- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3393

High Growth Tech Stocks To Watch Including Three Promising Picks

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by tariff uncertainties and mixed economic signals, with U.S. job growth falling short of expectations and manufacturing activity showing signs of recovery. Amid these fluctuations, investors are keenly observing high growth tech stocks that demonstrate resilience and potential for expansion in a dynamic market environment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 68.22% | 59.79% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1217 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the R&D, production, and sale of energy metering and efficiency management solutions for energy supply industries across various regions including China, Africa, the United States, Europe, and Asia; it has a market cap of approximately HK$8.04 billion.

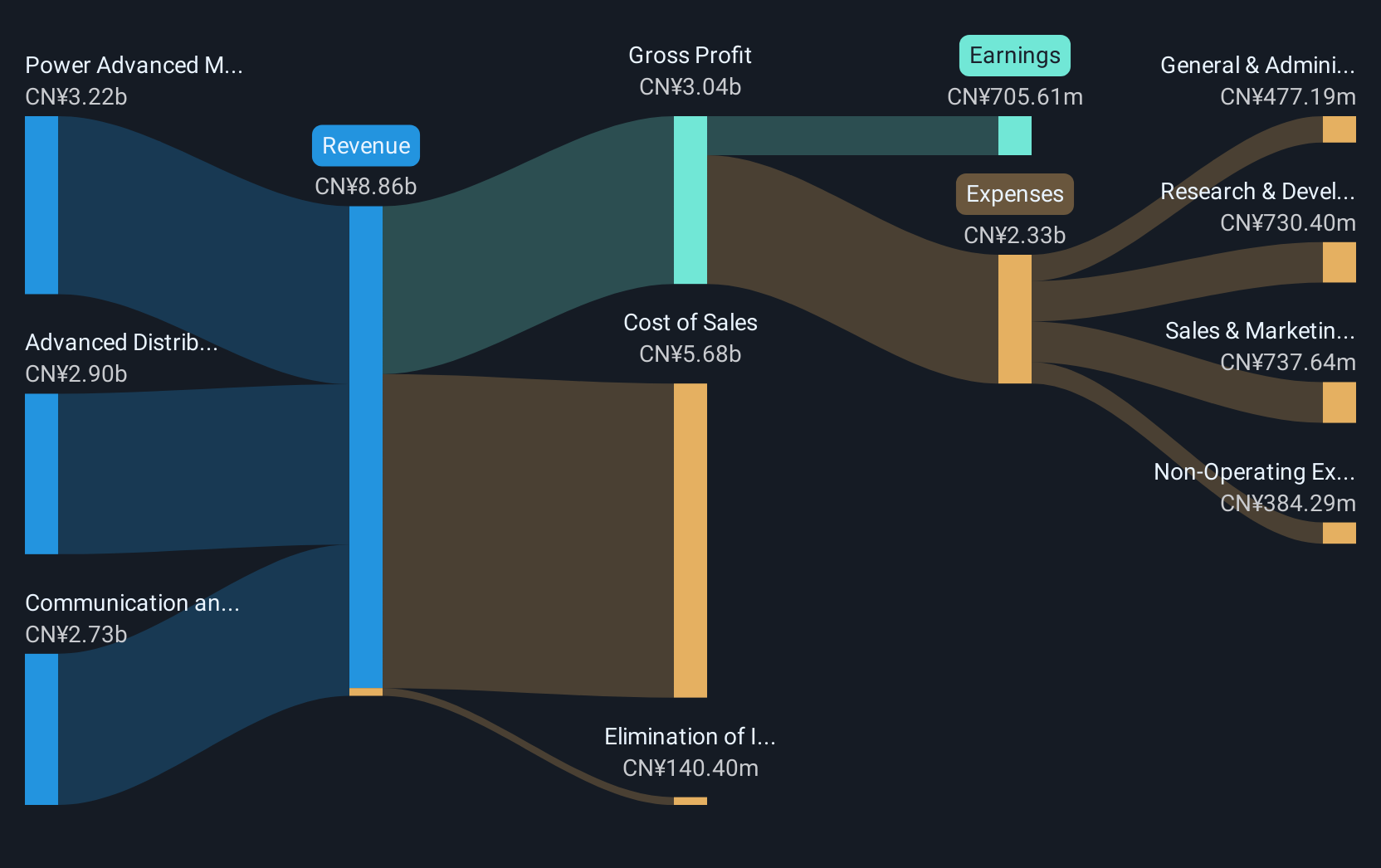

Operations: Wasion Holdings generates revenue primarily from three segments: Power Advanced Metering Infrastructure (CN¥2.99 billion), Advanced Distribution Operations (CN¥2.51 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion).

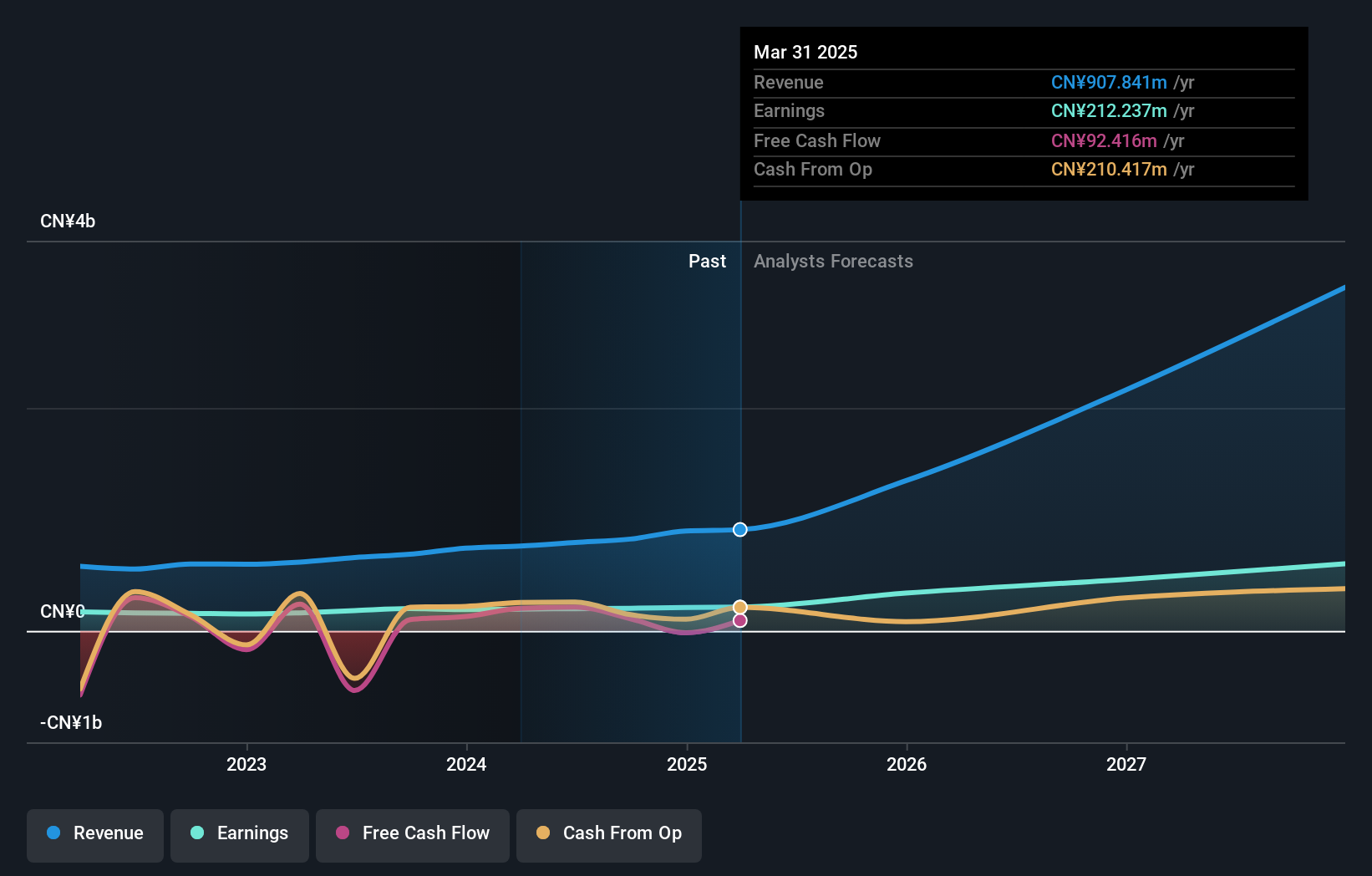

Wasion Holdings has demonstrated robust performance with a 61.9% surge in earnings over the past year, significantly outpacing the electronic industry's growth of 11.7%. This growth trajectory is supported by projections that see earnings increasing by 22.6% annually, exceeding Hong Kong's market average of 11.5%. Despite revenue forecasts growing at a slower rate than some high-growth benchmarks at 19.2%, they still surpass the local market forecast of 7.8%. The company maintains a positive free cash flow and is noted for its high-quality earnings, though its Return on Equity is expected to moderate to 15.4% in three years, suggesting potential challenges in sustaining higher profitability levels amidst aggressive expansion efforts.

- Unlock comprehensive insights into our analysis of Wasion Holdings stock in this health report.

Review our historical performance report to gain insights into Wasion Holdings''s past performance.

Jilin OLED Material Tech (SHSE:688378)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin OLED Material Tech Co., Ltd. focuses on the research and development, production, and sale of organic electroluminescent materials and equipment for China's new display industry, with a market cap of CN¥4.99 billion.

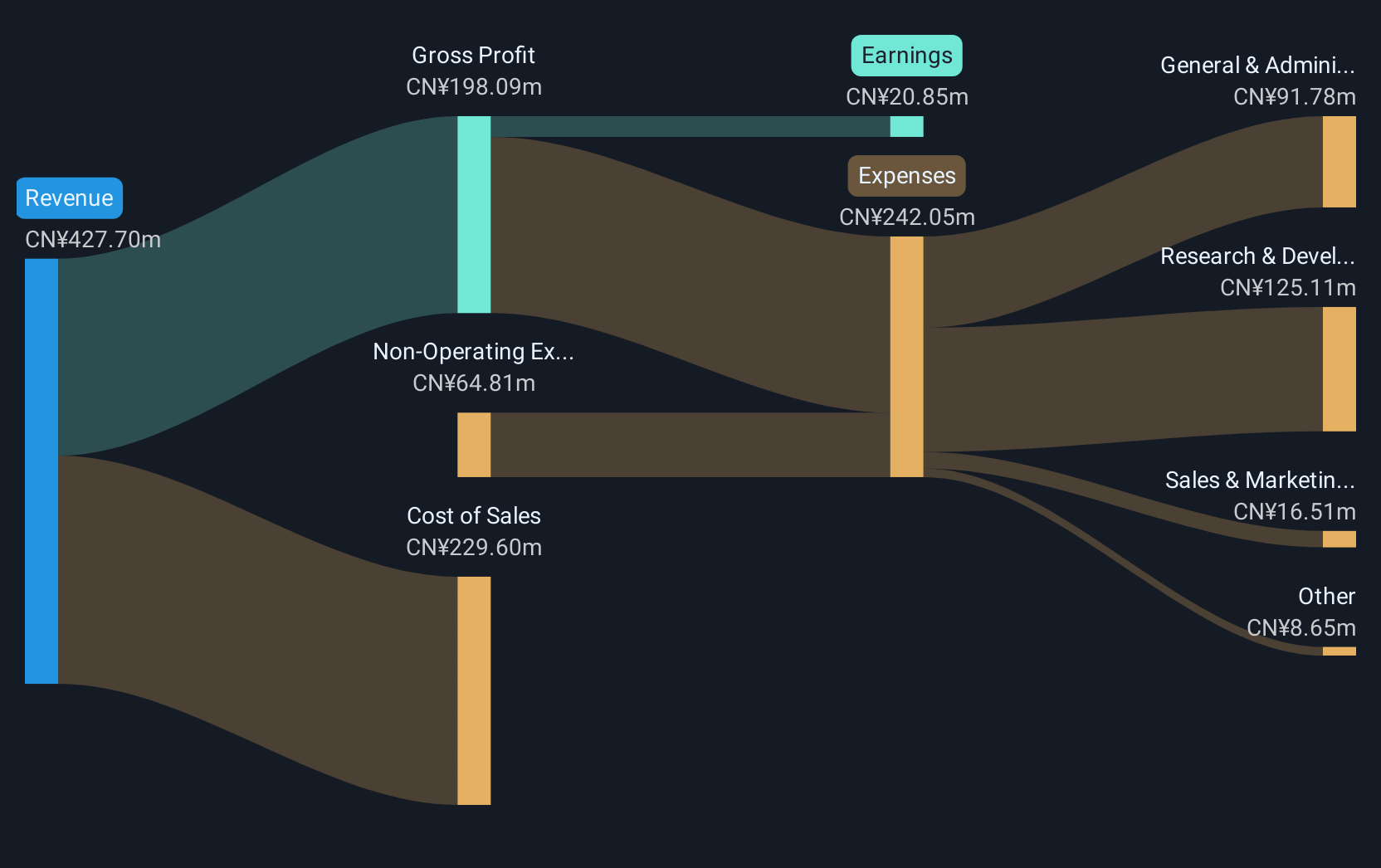

Operations: The company generates revenue primarily through the sale of organic electroluminescent materials and equipment tailored for the new display industry in China. Its business model is centered on leveraging advanced research and development capabilities to produce high-quality materials that cater to a growing market demand.

Jilin OLED Material Tech has shown remarkable growth, with earnings forecasted to increase by 51% annually and revenue expected to rise at 46.3% per year, significantly outpacing the Chinese market's average of 13.5%. This performance is underpinned by substantial R&D investments totaling CN¥75.7 million last year, emphasizing the company's commitment to innovation in OLED technology—a sector poised for rapid expansion due to increasing demand for advanced display materials. Moreover, the company recently announced a share repurchase program worth CNY 100 million, signaling confidence in its future prospects and dedication to enhancing shareholder value through strategic capital allocation.

- Take a closer look at Jilin OLED Material Tech's potential here in our health report.

Learn about Jilin OLED Material Tech's historical performance.

Jiangsu Tongxingbao Intelligent Transportation Technology (SZSE:301339)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. offers smart transportation platform solutions for highways, trunk roads, and urban transportation in China with a market cap of CN¥8.68 billion.

Operations: Tongxingbao focuses on providing intelligent transportation solutions, primarily catering to highways, trunk roads, and urban transit systems across China. The company leverages its expertise in smart platform technologies to enhance traffic management and infrastructure efficiency.

With a robust 22.1% annual revenue growth, Jiangsu Tongxingbao Intelligent Transportation Technology outpaces the broader Chinese market's average of 13.5%. This performance is bolstered by a notable increase in net income from CNY 190.96 million to CNY 210.56 million year-over-year, reflecting a solid earnings growth of 10.3%, which surpasses the electronic industry's average by over threefold. The company's commitment to innovation is evident in its strategic R&D investments, crucial for sustaining its competitive edge in the intelligent transportation sector—a field critical as urban mobility evolves rapidly due to technological advancements and increasing environmental concerns.

Summing It All Up

- Navigate through the entire inventory of 1217 High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wasion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3393

Wasion Holdings

An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives