- China

- /

- Metals and Mining

- /

- SHSE:688786

Top Global Growth Companies With High Insider Ownership In October 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of renewed U.S.-China trade tensions and the impact of a prolonged U.S. government shutdown, investors are increasingly focusing on companies with strong fundamentals and strategic growth potential. In this environment, growth companies with high insider ownership can offer unique advantages, as their leadership's vested interest often aligns with shareholder value creation, making them compelling considerations in uncertain times.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| KebNi (OM:KEBNI B) | 36.3% | 74% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 97.7% |

| CD Projekt (WSE:CDR) | 29.7% | 43.1% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Underneath we present a selection of stocks filtered out by our screen.

Rigol Technologies (SHSE:688337)

Simply Wall St Growth Rating: ★★★★☆☆

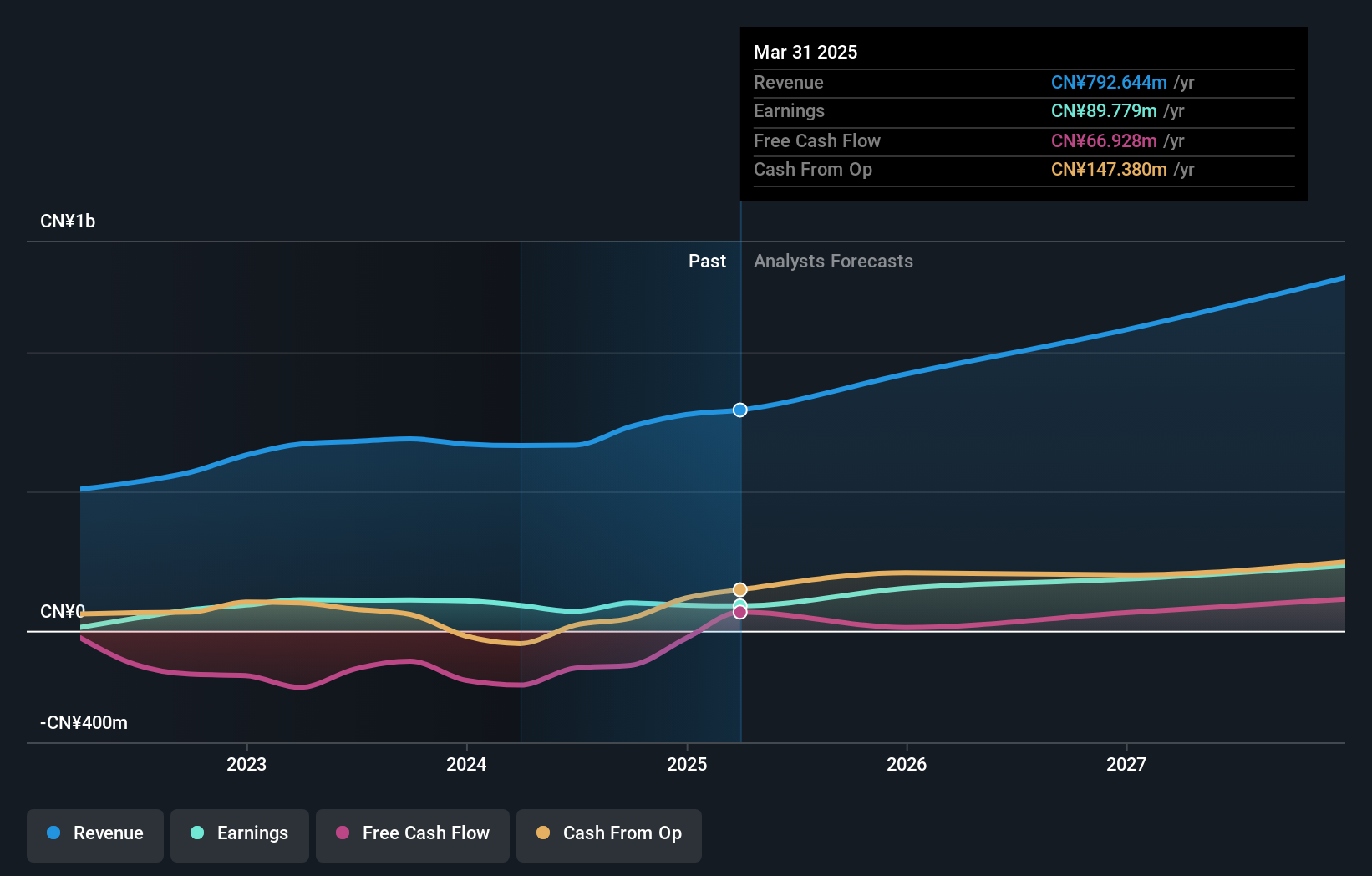

Overview: Rigol Technologies Co., Ltd. is a global manufacturer and seller of test and measurement instruments, with a market cap of CN¥7.91 billion.

Operations: The company generates revenue primarily from its Electronic Test & Measurement Instruments segment, amounting to CN¥823.65 million.

Insider Ownership: 23%

Revenue Growth Forecast: 17.2% p.a.

Rigol Technologies demonstrates robust growth potential with expected annual earnings growth of 29.63%, surpassing the market average. However, revenue is projected to increase at a slower rate of 17.2% per year. Recent financial results show significant improvement, with net income doubling compared to the previous year. Despite low return on equity forecasts and an unsustainable dividend yield, insider ownership remains stable without substantial trading activity recently noted. A recent share buyback reflects confidence in future prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Rigol Technologies.

- Upon reviewing our latest valuation report, Rigol Technologies' share price might be too optimistic.

Jiangxi Yuean Advanced MaterialsLtd (SHSE:688786)

Simply Wall St Growth Rating: ★★★★★☆

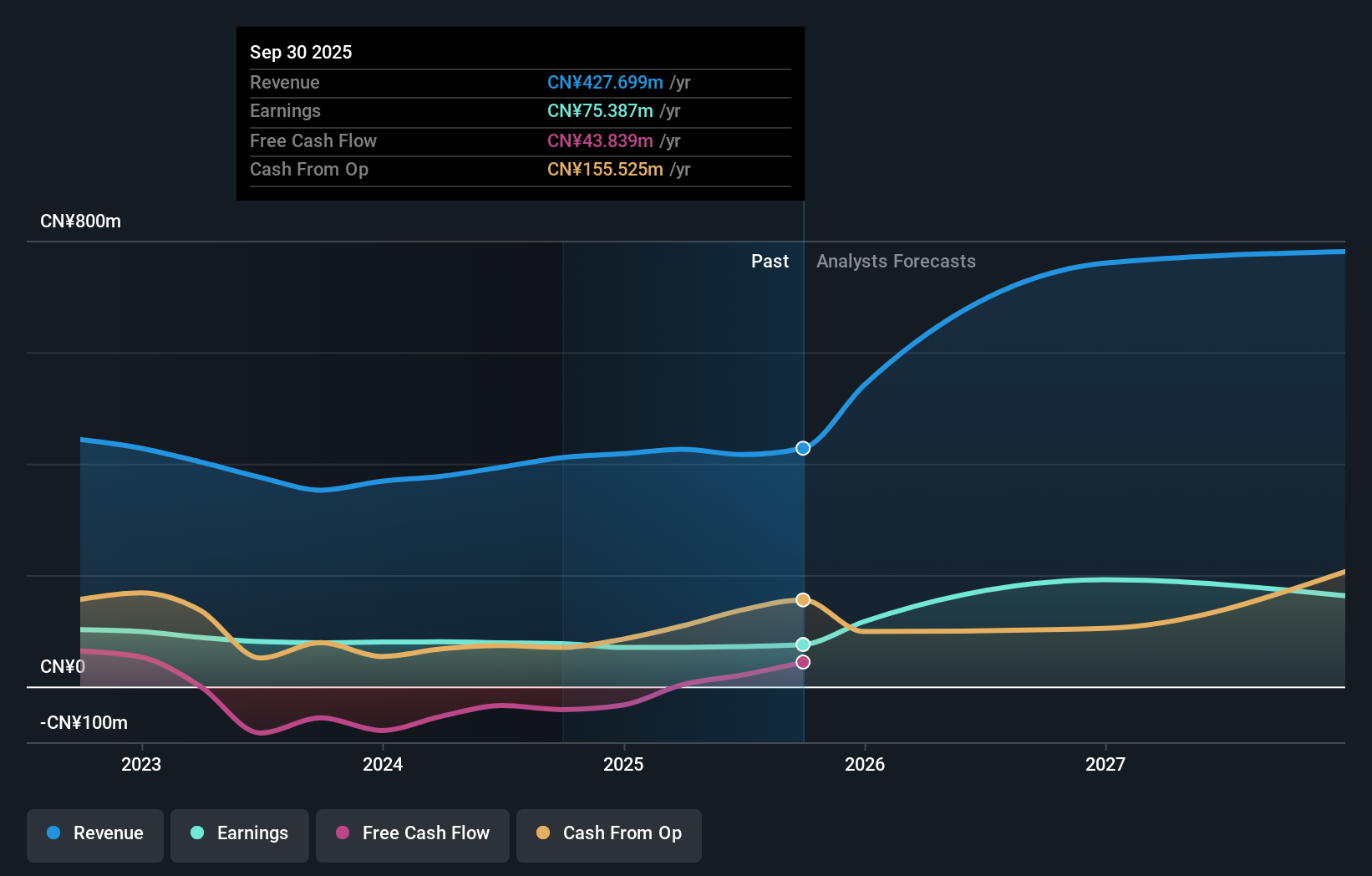

Overview: Jiangxi Yuean Advanced Materials Co., Ltd. (ticker: SHSE:688786) operates in the advanced materials sector with a market capitalization of approximately CN¥4.59 billion.

Operations: The company's revenue primarily comes from the production of residual iron powder, amounting to CN¥416.22 million.

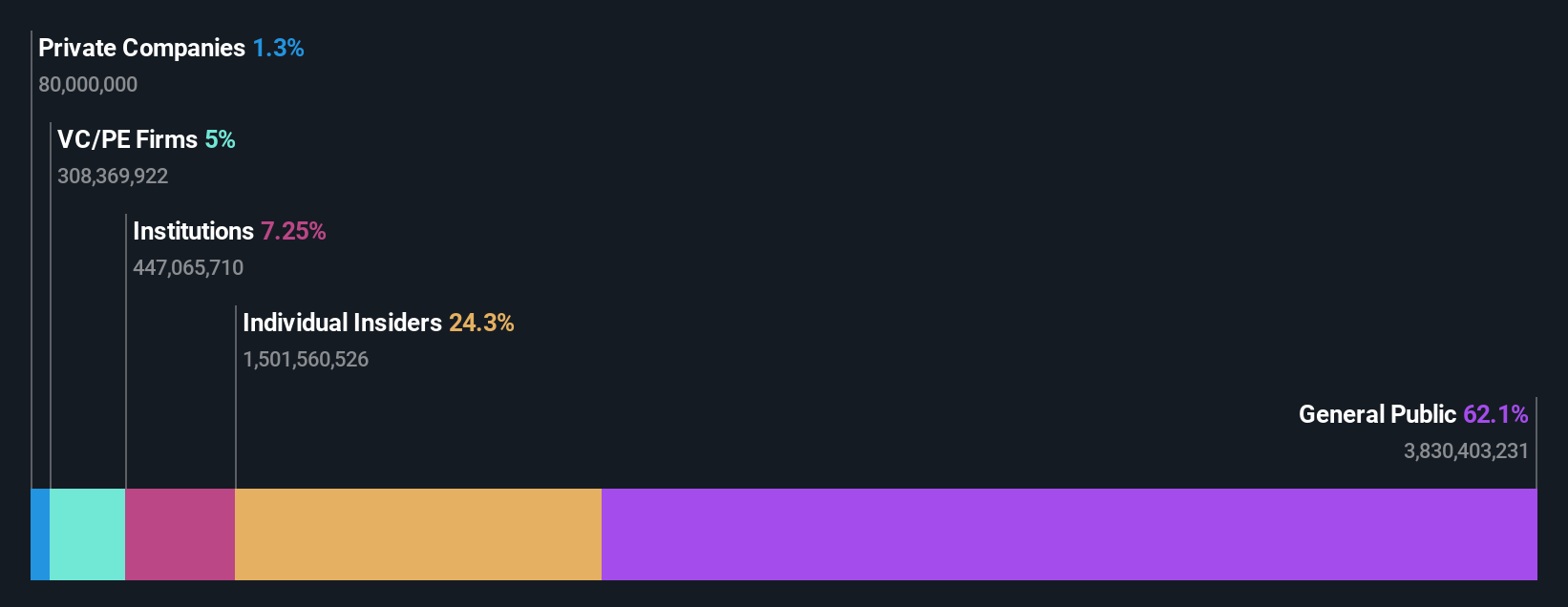

Insider Ownership: 37.2%

Revenue Growth Forecast: 26.4% p.a.

Jiangxi Yuean Advanced Materials Ltd. showcases promising growth with earnings projected to rise 34.22% annually, outpacing the CN market average. Revenue is also expected to grow significantly at 26.4% per year, surpassing market expectations. Recent financials show stable performance with slight increases in sales and net income compared to last year. Despite low return on equity forecasts and an unsustainable dividend yield, no significant insider trading activity has been reported recently, indicating steady insider confidence.

- Dive into the specifics of Jiangxi Yuean Advanced MaterialsLtd here with our thorough growth forecast report.

- Our valuation report unveils the possibility Jiangxi Yuean Advanced MaterialsLtd's shares may be trading at a premium.

Offcn Education Technology (SZSE:002607)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Offcn Education Technology Co., Ltd. operates as a multi-category vocational education institution in China with a market cap of CN¥17.39 billion.

Operations: The company's revenue primarily comes from its education and training segment, which generated CN¥2.27 billion.

Insider Ownership: 22.8%

Revenue Growth Forecast: 13.7% p.a.

Offcn Education Technology Co., Ltd. demonstrates potential with earnings forecasted to grow significantly at 50.1% annually, surpassing the CN market average of 26.5%. Despite a decline in recent financial performance, including net income dropping to CNY 61.78 million for the half-year ended June 30, 2025, the company trades at a substantial discount below its estimated fair value. However, revenue growth is expected to lag behind market trends and interest payments remain inadequately covered by earnings.

- Click here to discover the nuances of Offcn Education Technology with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Offcn Education Technology's current price could be inflated.

Next Steps

- Reveal the 811 hidden gems among our Fast Growing Global Companies With High Insider Ownership screener with a single click here.

- Looking For Alternative Opportunities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688786

Jiangxi Yuean Advanced MaterialsLtd

Jiangxi Yuean Advanced Materials Co.,Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.