As global markets navigate a landscape marked by political developments and economic indicators, major U.S. indices have recently reached new highs, buoyed by optimism around softer tariffs and advancements in artificial intelligence. In this context of growth stocks outperforming their value counterparts, identifying high-growth tech stocks like Neusoft becomes increasingly relevant for investors looking to capitalize on technological innovation and market momentum.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Neusoft (SHSE:600718)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Neusoft Corporation is a global provider of software and information technology solutions and services, with a market capitalization of CN¥11.37 billion.

Operations: Neusoft Corporation generates revenue primarily through its software and IT solutions, serving a global market. The company's operations are supported by its substantial market capitalization of CN¥11.37 billion.

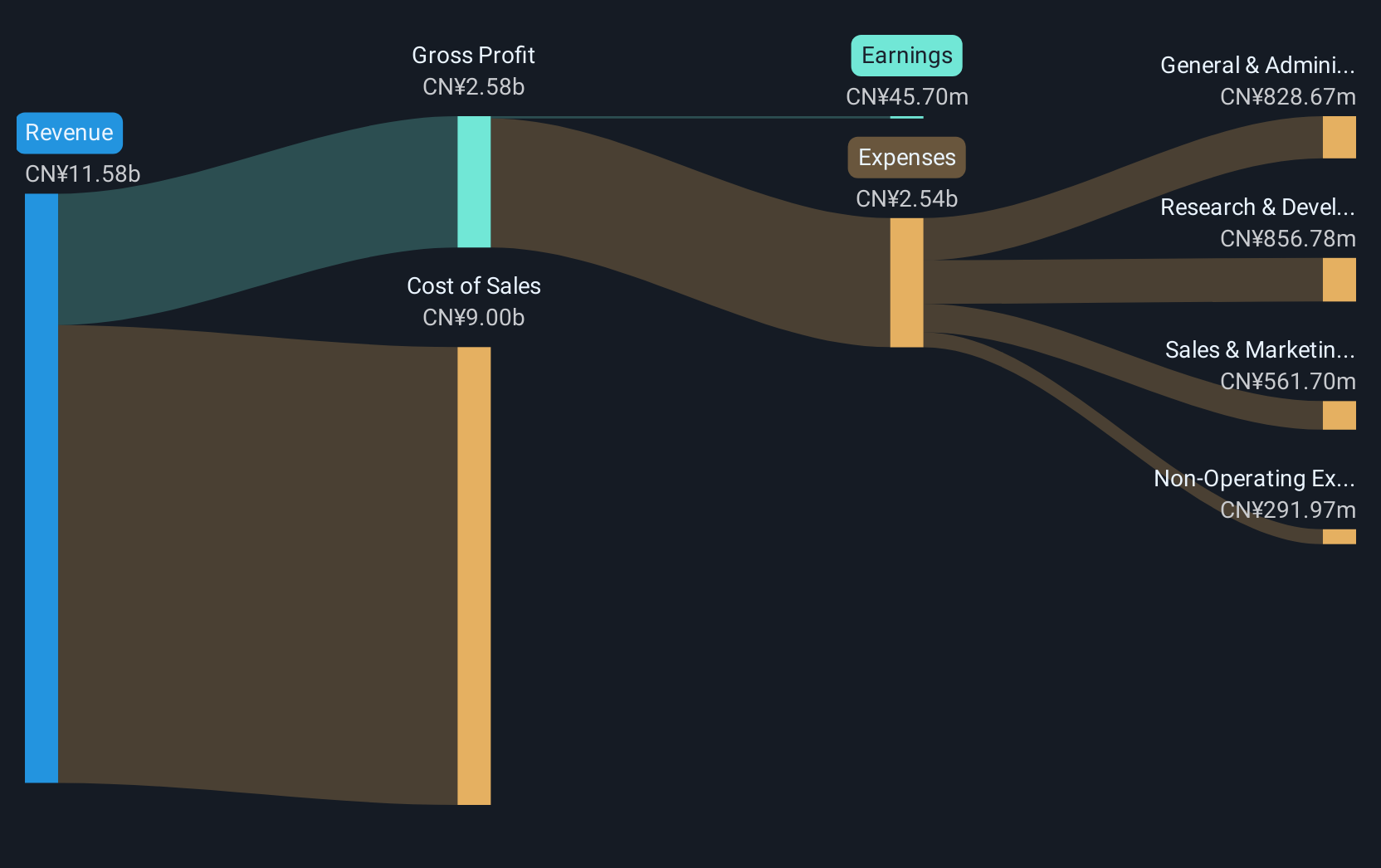

Neusoft Corporation, with its recent showcase at CES 2025, demonstrated robust integration of AI in automotive solutions, highlighting its strategic pivot towards intelligent technologies. This move aligns with a broader industry trend where tech firms are leveraging AI to enhance user experiences and operational efficiencies. Financially, Neusoft has shown promising growth metrics: a significant annual revenue increase at 15.6%, and an even more impressive earnings growth forecast of 55.9% per year. These figures underscore Neusoft's potential in both market expansion and profitability in the burgeoning field of intelligent mobility solutions. Moreover, the company’s commitment to R&D is evident from its recent private placement aimed at funding these innovations, ensuring sustained investment in technology that drives future growth.

- Click to explore a detailed breakdown of our findings in Neusoft's health report.

Gain insights into Neusoft's historical performance by reviewing our past performance report.

Rigol Technologies (SHSE:688337)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rigol Technologies Co., Ltd. is a global manufacturer and seller of test and measurement instruments with a market capitalization of CN¥7.18 billion.

Operations: Rigol Technologies generates revenue primarily from its electronic test and measurement instruments, amounting to CN¥732.68 million. The company's market capitalization is CN¥7.18 billion, reflecting its global presence in the industry.

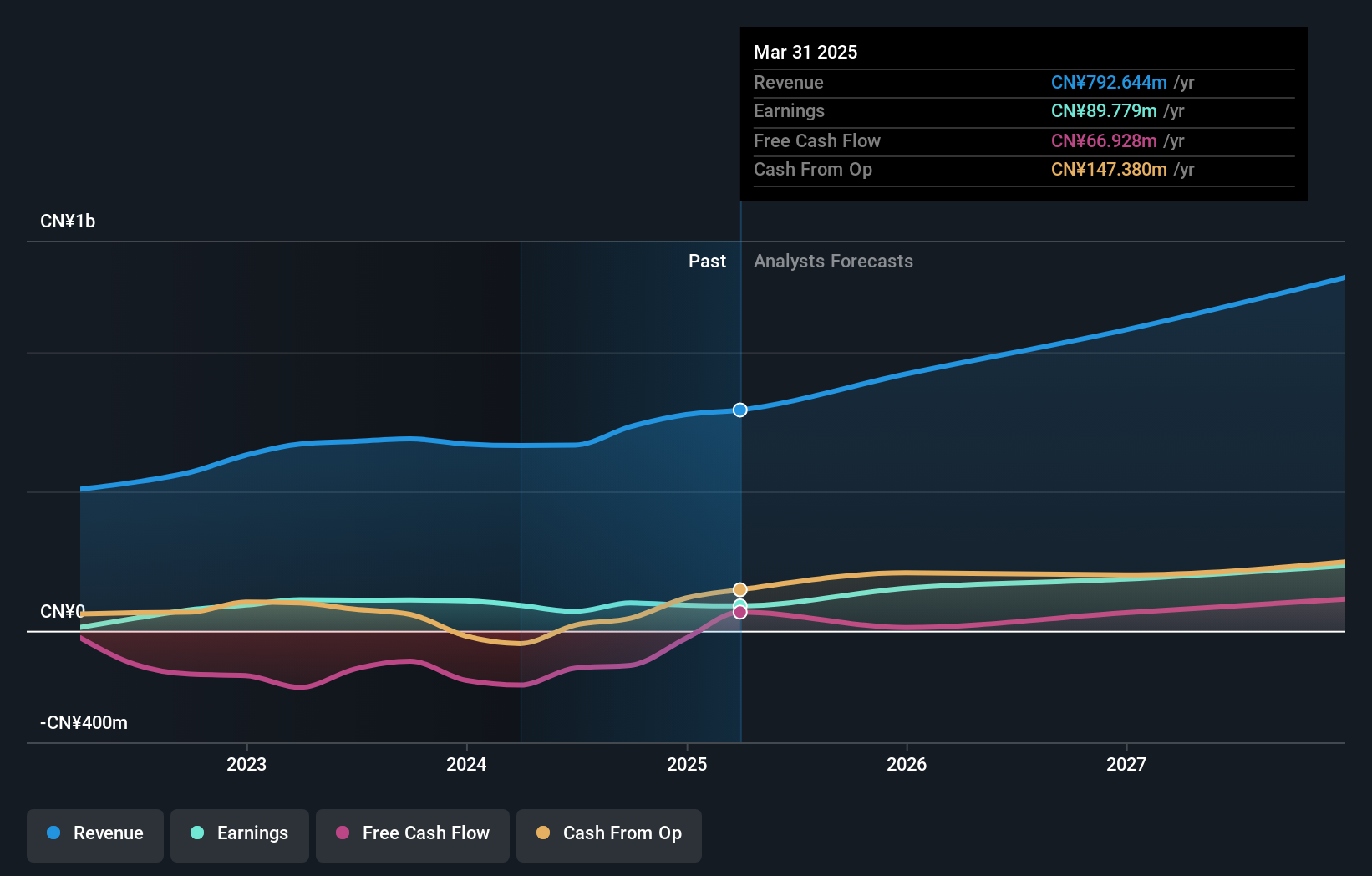

Rigol Technologies has been making significant strides in the tech industry, particularly with its recent product launches that underscore its commitment to innovation. The introduction of the DHO/MHO5000 Series High-Resolution Oscilloscopes and DG5000 Pro Series Arbitrary Waveform Generators not only enhances its product line but also meets the sophisticated demands of modern electronics testing. Financially, Rigol reported a revenue growth to CNY 534.89 million from CNY 472.75 million year-over-year, although net income slightly decreased to CNY 60.13 million from CNY 68.06 million, reflecting substantial reinvestment in R&D and new product development which is crucial for sustaining long-term growth in the highly competitive tech sector.

- Delve into the full analysis health report here for a deeper understanding of Rigol Technologies.

Gain insights into Rigol Technologies' past trends and performance with our Past report.

Shenzhen Genvict Technologies (SZSE:002869)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Genvict Technologies Co., Ltd. and its subsidiaries focus on the research, development, and industrialization of smart transportation technology in China, with a market capitalization of CN¥4.55 billion.

Operations: Genvict Technologies generates revenue primarily from the intelligent traffic industry, amounting to CN¥514.77 million. The company's operations are centered around smart transportation technology within China.

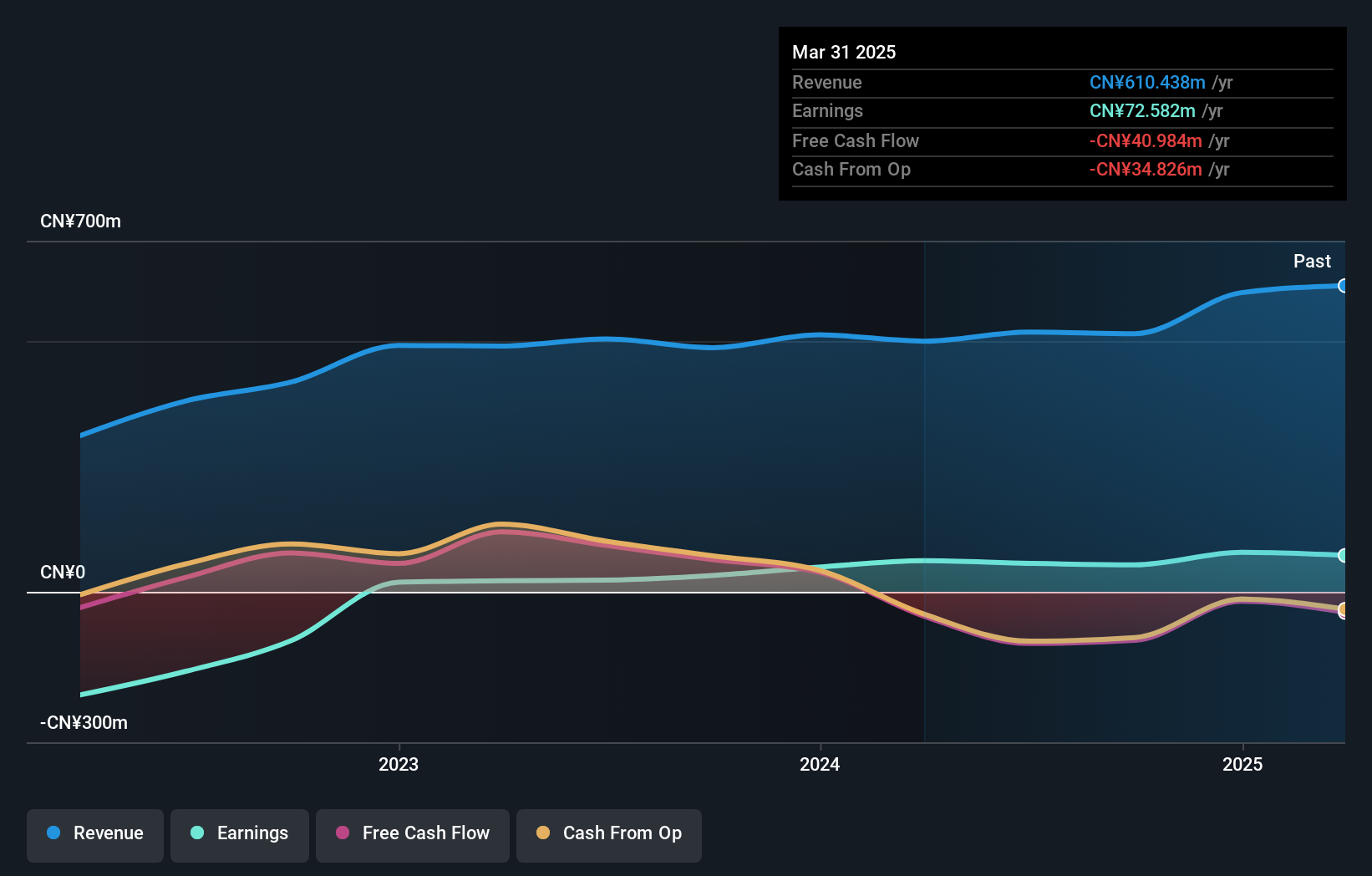

Shenzhen Genvict Technologies has demonstrated robust growth, with revenue increasing to CNY 352.44 million from CNY 350.07 million year-over-year and net income rising to CNY 31.09 million from CNY 26.48 million, reflecting a significant earnings growth of 40.2% annually. This performance is bolstered by innovative strategies in intelligent transportation solutions, positioning them well above industry averages where earnings have surged by 65% compared to the electronic sector's modest 2.3%. Moreover, their commitment to R&D is evident with a substantial investment leading to enhanced product capabilities, ensuring they stay at the forefront of technological advances despite a forecasted low return on equity of just 5.7% in three years' time.

Turning Ideas Into Actions

- Gain an insight into the universe of 1226 High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neusoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600718

Neusoft

Provides software and information technology solutions and services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives