- China

- /

- Electronic Equipment and Components

- /

- SHSE:688322

High Growth Tech Stocks In Asia For July 2025

Reviewed by Simply Wall St

Amidst a backdrop of muted market reactions to new U.S. tariffs and mixed economic signals, Asian markets have shown resilience with China's indices rising on hopes for further stimulus measures. In this environment, identifying high-growth tech stocks involves looking for companies that can leverage regional economic trends and technological innovation to drive performance despite global uncertainties.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.19% | 29.63% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Fositek | 29.16% | 36.17% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| PharmaResearch | 26.95% | 29.93% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Bonree Data Technology (SHSE:688229)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bonree Data Technology Co., Ltd offers application performance management services to enterprises in China and has a market cap of CN¥3.07 billion.

Operations: Bonree Data Technology Co., Ltd specializes in providing application performance management services for enterprises in China. The company focuses on optimizing and monitoring software applications to enhance business operations.

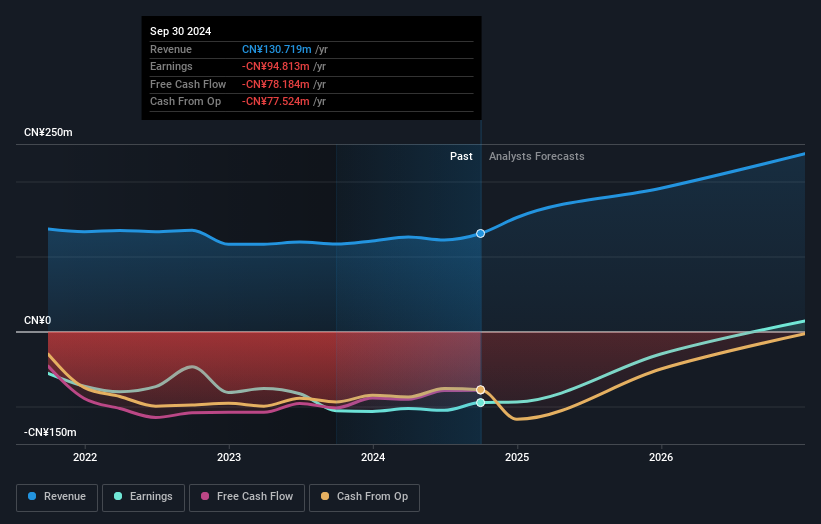

Bonree Data Technology, despite its current unprofitability, is poised for significant growth with revenue forecasted to increase by 27.5% annually. This growth rate outpaces the broader CN market's average of 12.4%, highlighting its potential in a competitive landscape. The company's recent reduction in net loss from CNY 14 million to CNY 9.21 million year-over-year suggests improving operational efficiency. Furthermore, with R&D expenses strategically allocated, Bonree is investing in innovation to secure a foothold in the high-growth tech sector of Asia, setting a robust foundation for future profitability projected within three years.

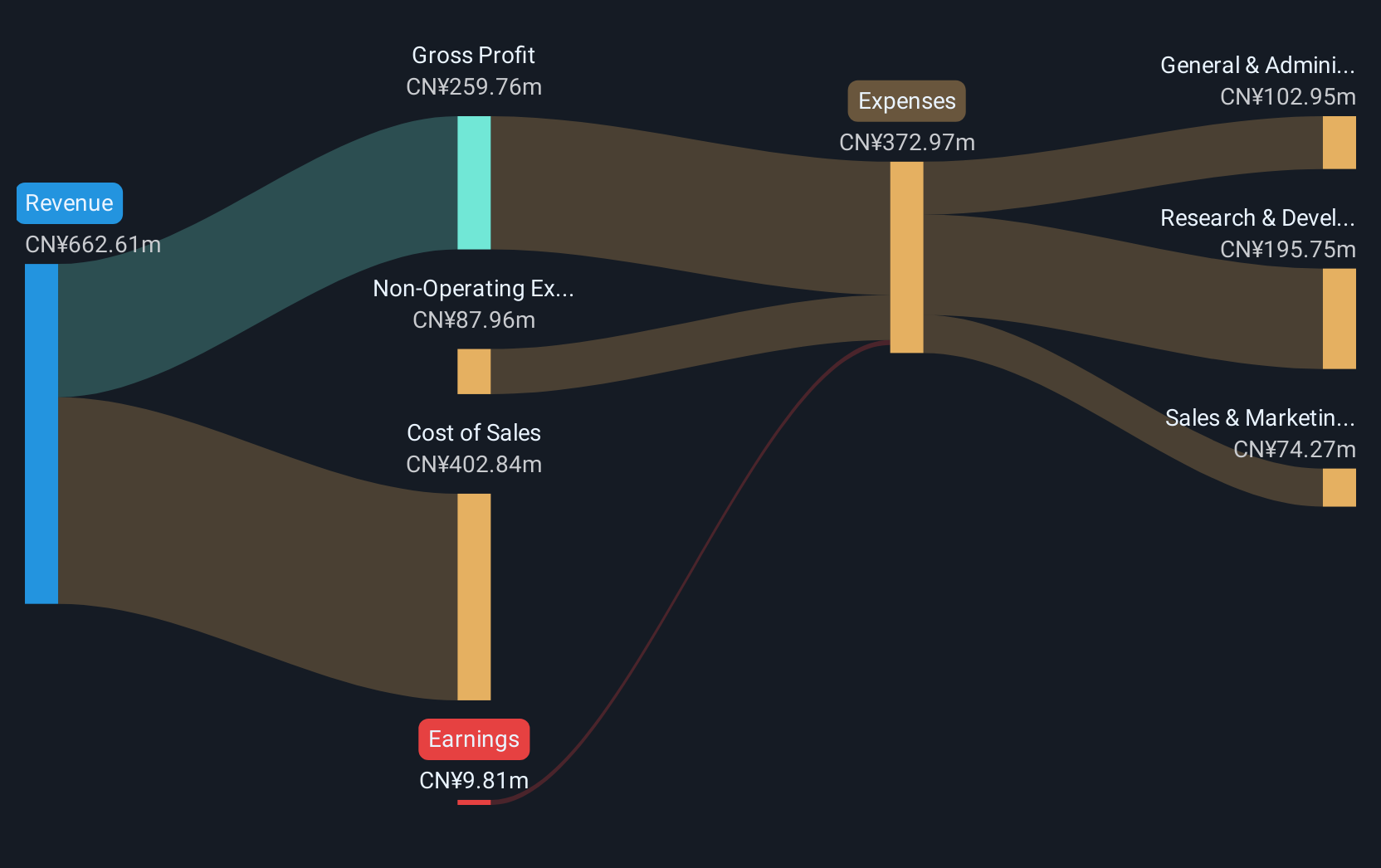

Orbbec (SHSE:688322)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orbbec Inc. specializes in designing, manufacturing, and selling 3D vision sensors with a market capitalization of CN¥26.66 billion.

Operations: Orbbec Inc. generates revenue through the design, manufacturing, and sale of 3D vision sensors.

Orbbec's recent surge in profitability and revenue underscores its potential within Asia's high-tech sector. In Q1 2025, the company flipped a net loss of CNY 28.78 million to a net profit of CNY 24.32 million year-over-year, with revenue doubling to CNY 191.06 million from CNY 92.91 million, reflecting an annual growth rate of 34.3%. This performance is bolstered by strategic R&D investments, aligning with industry trends towards enhanced technological capabilities and innovation in AI and software development sectors. The successful private placement raising over CNY 2 billion further solidifies Orbbec’s financial base for future expansions, promising robust growth prospects amidst competitive market dynamics.

- Delve into the full analysis health report here for a deeper understanding of Orbbec.

Examine Orbbec's past performance report to understand how it has performed in the past.

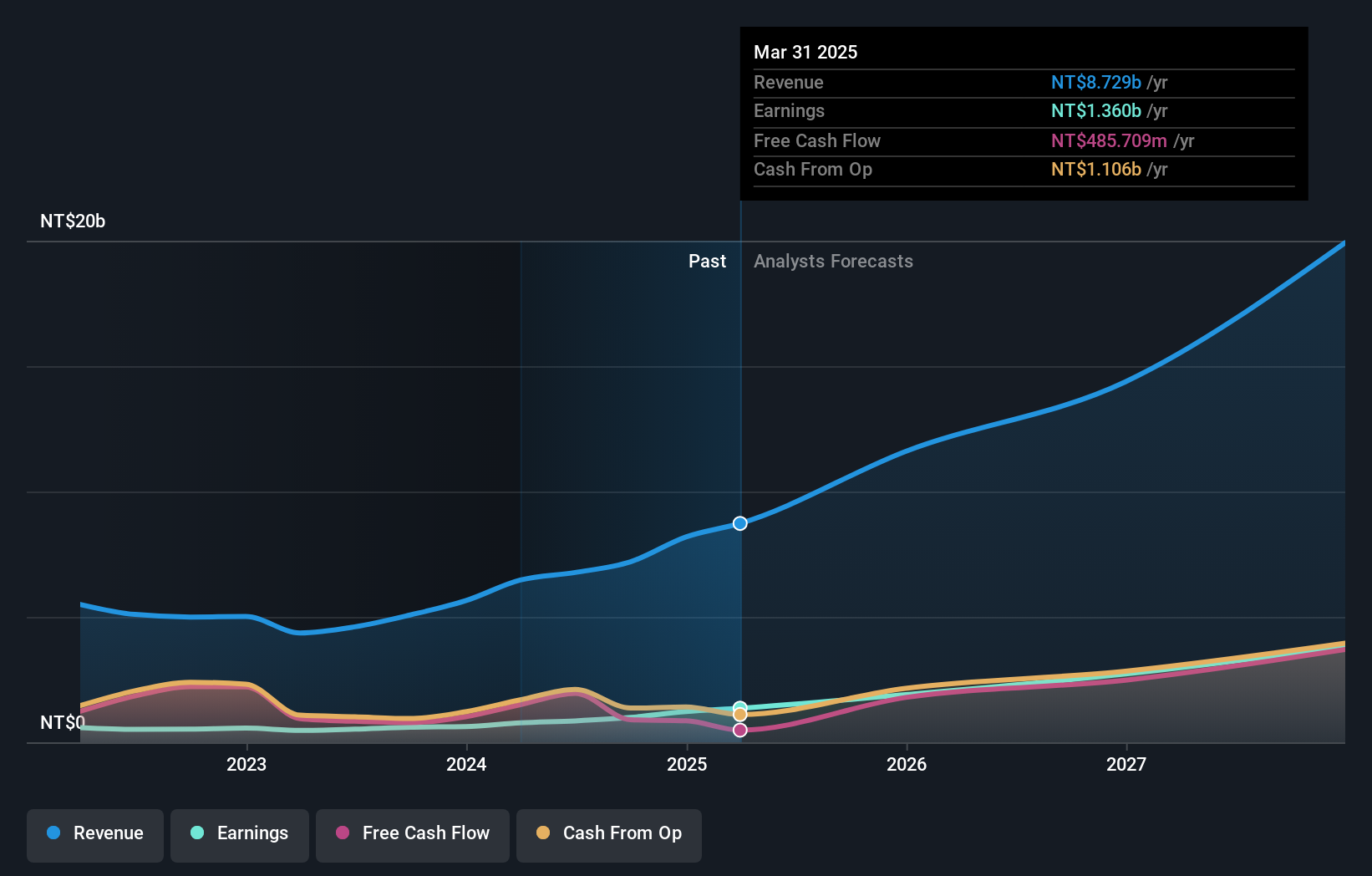

Fositek (TWSE:6805)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fositek Corp. is involved in the manufacture and wholesale of electronic materials and components, with a market cap of NT$57.99 billion.

Operations: Fositek Corp. primarily generates revenue through the sale of electronic components and parts, amounting to NT$8.73 billion.

Fositek's recent strategic board reshuffles and bylaw amendments underscore its adaptive corporate governance, aligning with its robust financial growth. In Q1 2025, the company reported a significant revenue jump to TWD 2.25 billion from TWD 1.71 billion year-over-year, alongside a net income increase to TWD 356.5 million from TWD 223.95 million, reflecting an earnings growth of 75.3%. This performance surpasses the electronic industry's average and is supported by Fositek’s aggressive R&D investment strategy, which is crucial for maintaining technological leadership in a competitive market landscape.

- Click here to discover the nuances of Fositek with our detailed analytical health report.

Explore historical data to track Fositek's performance over time in our Past section.

Summing It All Up

- Delve into our full catalog of 474 Asian High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688322

High growth potential with adequate balance sheet.

Market Insights

Community Narratives