- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6274

High Growth Tech Stocks in Asia for April 2025

Reviewed by Simply Wall St

As global trade tensions show signs of easing, the Asian markets have been buoyed by positive sentiment, with key indices like the Hang Seng Index experiencing notable gains. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience and adaptability in leveraging emerging technologies to navigate economic uncertainties.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.31% | 28.32% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 30.19% | 28.84% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Inspur Digital Enterprise Technology (SEHK:596)

Simply Wall St Growth Rating: ★★★★★☆

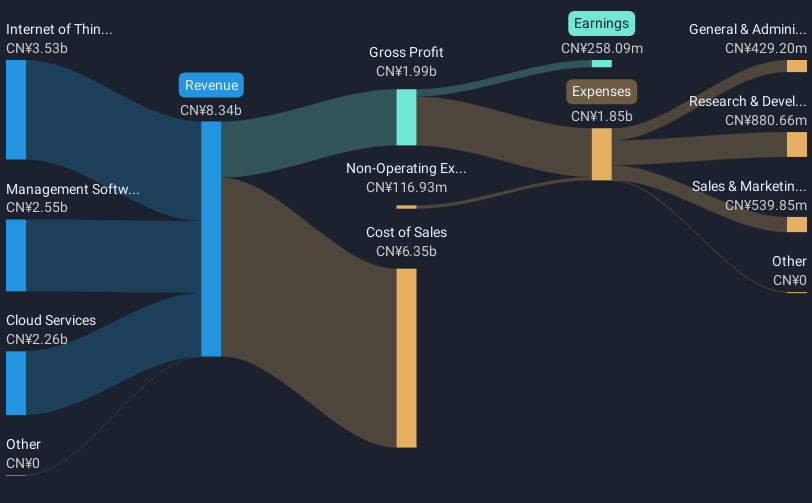

Overview: Inspur Digital Enterprise Technology Limited is an investment holding company that offers software development, other software services, and cloud services in the People’s Republic of China, with a market capitalization of approximately HK$8.96 billion.

Operations: Inspur Digital Enterprise Technology Limited generates revenue primarily from three segments: Cloud Services (CN¥2.76 billion), Management Software (CN¥2.56 billion), and Internet of Things (IoT) Solutions (CN¥2.88 billion). The company's operations focus on software development and cloud services within China, contributing to its market presence and financial performance.

Inspur Digital Enterprise Technology has demonstrated robust growth with a notable 90.8% increase in earnings over the past year, significantly outpacing the software industry's average of 2.2%. This surge is linked to aggressive R&D investments, which have catalyzed innovations and efficiencies within its cloud services segment. The company's commitment to R&D is evident from its recent financials, showing a substantial allocation towards these activities aimed at maintaining technological leadership and driving future revenue streams. Moreover, with an annual earnings growth forecast at 25.7%, Inspur is poised for continued expansion in Asia's competitive tech landscape, supported by a strong projected Return on Equity of 20.1% in three years' time.

Zhejiang Hechuan Technology (SHSE:688320)

Simply Wall St Growth Rating: ★★★★★☆

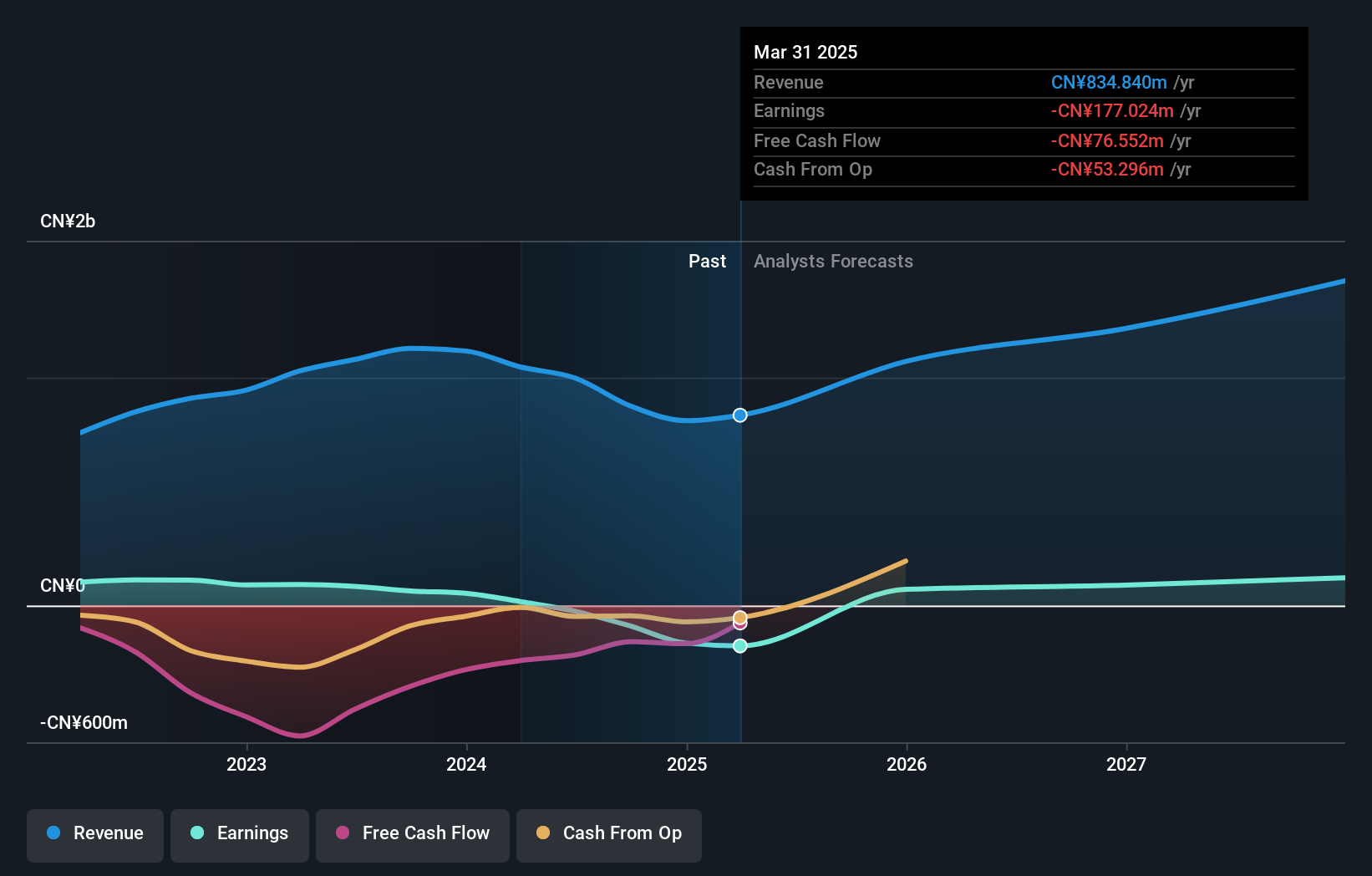

Overview: Zhejiang Hechuan Technology Co., Ltd. focuses on the research and development, manufacturing, sale, and application integration of industrial automation products with a market capitalization of CN¥6.59 billion.

Operations: Hechuan Technology specializes in industrial automation products, with its primary revenue derived from the sale and integration of these technologies. The company emphasizes R&D to enhance its product offerings.

Zhejiang Hechuan Technology's recent financial performance has been challenging, with a reported net loss of CNY 157.23 million for the year ended December 31, 2024, a stark contrast to the net income of CNY 53.56 million from the previous year. Despite these setbacks, the company's revenue growth forecast remains robust at 23.9% per year, outpacing the Chinese market average of 12.6%. This suggests potential for recovery and growth driven by strategic initiatives and market positioning. Additionally, Hechuan has completed a share repurchase program, buying back shares worth CNY 62.13 million, which could signal confidence in its future prospects from its management team.

- Click here to discover the nuances of Zhejiang Hechuan Technology with our detailed analytical health report.

Gain insights into Zhejiang Hechuan Technology's past trends and performance with our Past report.

Taiwan Union Technology (TPEX:6274)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Taiwan Union Technology Corporation specializes in producing and distributing copper foil substrates, adhesive sheets, and multi-layer laminated boards both domestically and internationally, with a market capitalization of NT$38.67 billion.

Operations: The company generates revenue primarily from two segments: foreign sales and manufacturing, which contribute NT$14.81 billion, and domestic sales and manufacturing, contributing NT$8.26 billion.

Taiwan Union Technology has demonstrated robust growth with a 216.3% increase in earnings over the past year, significantly outpacing the Electronic industry's growth of 26.1%. This performance is anchored by strategic presentations at key tech conferences and a substantial dividend payout of TWD 1.8 billion, signaling strong financial health and shareholder confidence. Additionally, their R&D focus is evident from recent amendments to company bylaws aimed at fostering innovation, ensuring Taiwan Union remains competitive in Asia’s high-tech landscape. With earnings projected to grow by 21.1% annually and revenue expected to rise at 15.3% per year, the company is well-positioned for sustained advancement in technology sectors.

Seize The Opportunity

- Explore the 486 names from our Asian High Growth Tech and AI Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Union Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6274

Taiwan Union Technology

Engages in the manufacture and sale of copper foil substrates, adhesive sheets, and multi-layer laminated boards in Taiwan and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives