- United Arab Emirates

- /

- Real Estate

- /

- DFM:DEYAAR

Undiscovered Gems To Explore This January 2025

Reviewed by Simply Wall St

As global markets navigate a period of easing inflation and robust bank earnings, major U.S. stock indexes have rebounded, with small-cap indices like the S&P MidCap 400 and Russell 2000 showing notable gains. In this environment, identifying undiscovered gems involves seeking stocks that can capitalize on current economic trends such as value outperforming growth and sectors benefiting from sector-specific tailwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Deyaar Development PJSC (DFM:DEYAAR)

Simply Wall St Value Rating: ★★★★★★

Overview: Deyaar Development PJSC is a company that offers property investment, development, and management services both in the United Arab Emirates and internationally, with a market capitalization of AED4.05 billion.

Operations: Deyaar generates revenue primarily from property development activities (AED1.09 billion), followed by properties and facilities management (AED157.25 million) and hospitality (AED110.65 million).

Deyaar Development, a notable player in the real estate sector, has shown impressive financial health with its debt to equity ratio dropping from 22.2% to 10.1% over five years and earnings surging by 90.9% last year, outpacing the industry average of 46.8%. The company's EBIT covers interest payments 17 times over, indicating robust financial management. Recent reports reveal a net income of AED139 million for Q3 2024 compared to AED119 million in the previous year, alongside sales growth from AED311 million to AED376 million in the same period, demonstrating strong operational performance amidst industry challenges.

Beijing Haohan Data TechnologyLtd (SHSE:688292)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Haohan Data Technology Co., Ltd specializes in network intelligence, information security protection, network security protection, and big data application products in China with a market capitalization of CN¥3.01 billion.

Operations: Haohan Data Technology generates its revenue primarily from the communications equipment segment, amounting to CN¥563.83 million.

Beijing Haohan Data Technology, a smaller player in the tech space, has shown impressive earnings growth of 41% over the past year, outpacing its industry peers. Despite this, recent earnings reports for the nine months ending September 2024 indicate a revenue dip to CNY 316.76 million from CNY 368.5 million previously, and net income fell to CNY 36.9 million from CNY 51.49 million last year. The company trades at a significant discount of about 77% below its estimated fair value and remains debt-free with high-quality earnings; however, share price volatility is notable in recent months.

Token (TSE:1766)

Simply Wall St Value Rating: ★★★★★★

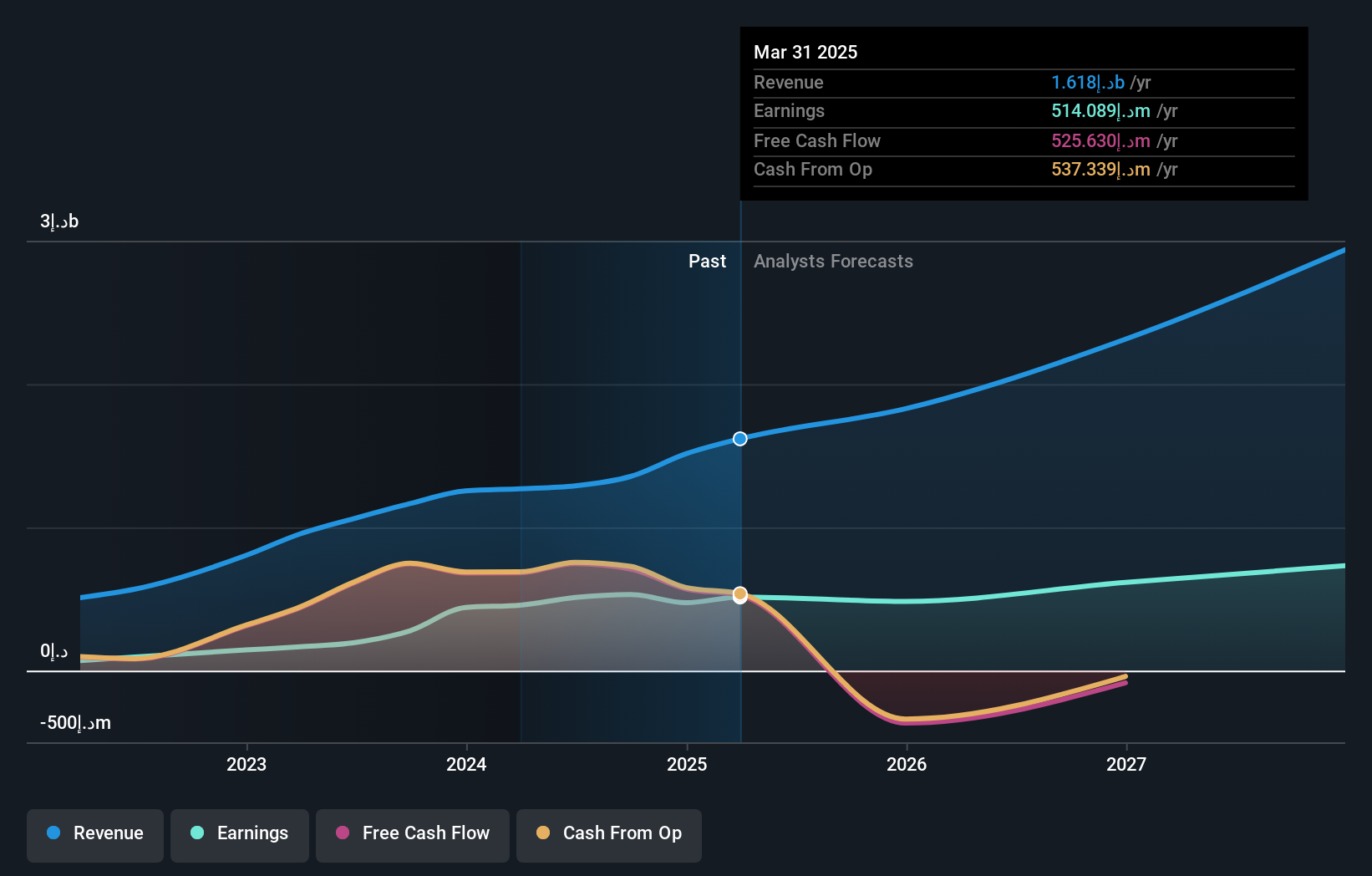

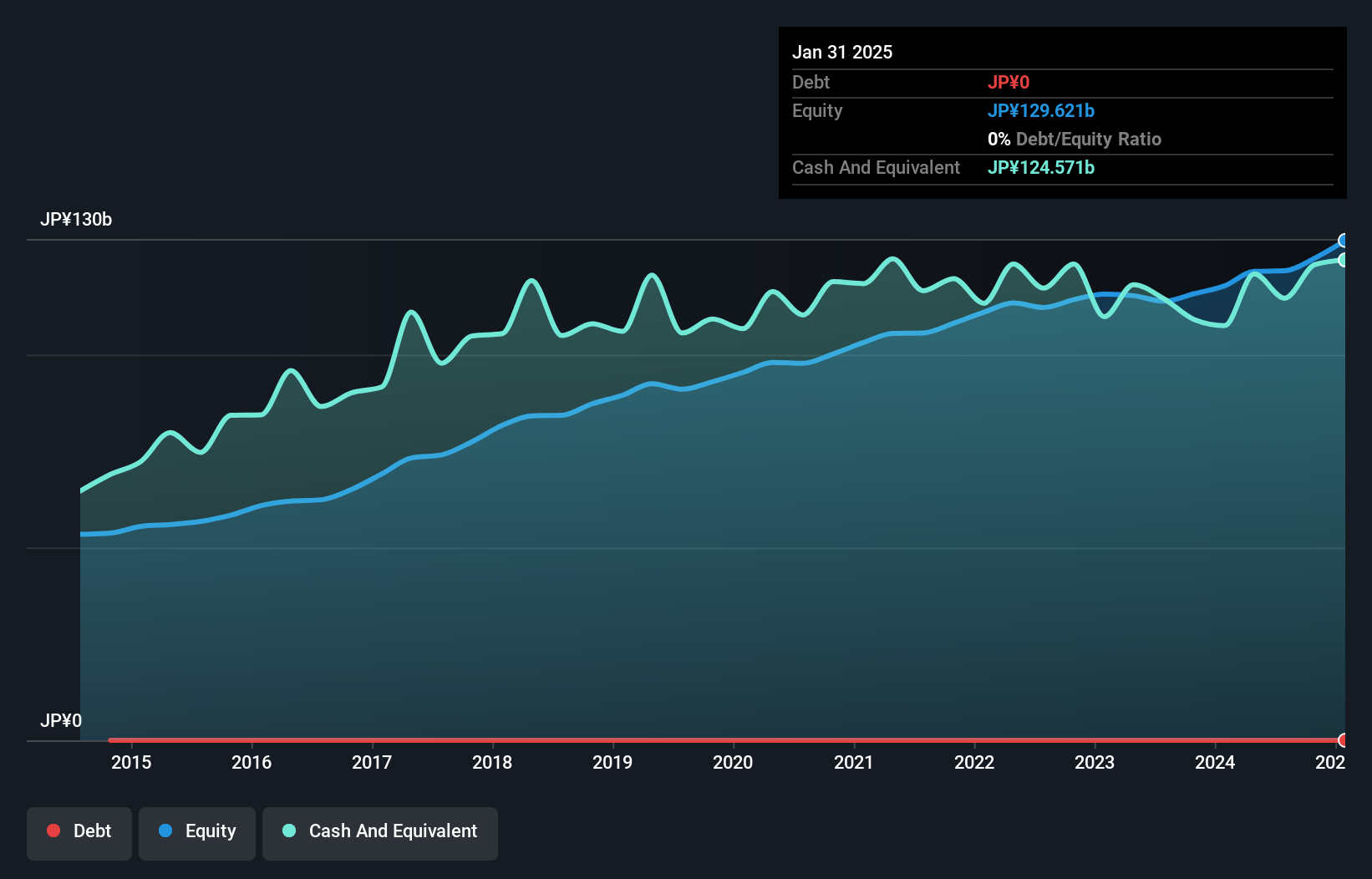

Overview: Token Corporation is a Japanese construction company with a market capitalization of approximately ¥160.79 billion.

Operations: The company generates revenue primarily from its construction business and real estate rental business, with the latter contributing ¥210.93 billion. The construction segment adds ¥141.07 billion to the total revenue.

Token has shown impressive growth, with earnings surging by 145% over the past year, outpacing the Consumer Durables industry's modest 0.6% rise. Trading at a significant discount of 78.1% below its fair value estimate, it appears undervalued in its sector. The company is debt-free and boasts high-quality earnings, indicating robust financial health without concerns about interest payments or cash runway issues. Looking ahead, Token forecasts net sales of JPY 364 billion and an operating profit of JPY 19 billion for fiscal year ending April 2025, alongside a notable dividend increase to ¥330 per share from ¥250 last year.

Taking Advantage

- Click here to access our complete index of 4656 Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DEYAAR

Deyaar Development PJSC

Provides property investment, development, leasing, and management services in the United Arab Emirates and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives