- China

- /

- Electronic Equipment and Components

- /

- SHSE:688286

High Growth Tech Stocks to Watch in January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with key indices like the S&P 500 and Nasdaq Composite closing out 2024 with strong annual gains despite recent volatility, investors are keeping a keen eye on economic indicators such as the Chicago PMI and GDP forecasts. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience amid fluctuating market conditions and have robust fundamentals to capitalize on technological advancements.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Beijing Tricolor Technology (SHSE:603516)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Tricolor Technology Co., Ltd specializes in the manufacturing and sale of professional audio and video products globally, with a market capitalization of approximately CN¥9.46 billion.

Operations: Tricolor Technology generates revenue primarily from the display control industry, amounting to CN¥484.76 million. The company focuses on producing professional audio and video products for a global market.

Beijing Tricolor Technology has demonstrated robust financial performance with a significant 188.4% earnings growth over the past year, outpacing the electronic industry's average of 1.9%. This trend is expected to continue, with projected annual earnings growth of 49.2%, well above China's market average of 25%. Despite a slight drop in revenue from CNY 337.34 million to CNY 326.52 million year-over-year, the company managed an impressive increase in net income from CNY 11.59 million to CNY 51.51 million, reflecting high-quality earnings and effective cost management strategies. The company's commitment to innovation is evident in its R&D investments, crucial for sustaining its rapid growth trajectory in a competitive tech landscape. With revenue growing at an anticipated rate of 32.3% annually—twice as fast as the broader Chinese market—Beijing Tricolor is strategically positioning itself as a dynamic player within the tech sector, leveraging advanced technologies and expanding market presence to potentially enhance future profitability and shareholder value.

- Click here and access our complete health analysis report to understand the dynamics of Beijing Tricolor Technology.

Understand Beijing Tricolor Technology's track record by examining our Past report.

MEMSensing Microsystems (Suzhou China) (SHSE:688286)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MEMSensing Microsystems (Suzhou, China) Co., Ltd. is a company with a market cap of CN¥3.13 billion, specializing in the development and production of micro-electromechanical systems (MEMS) technology.

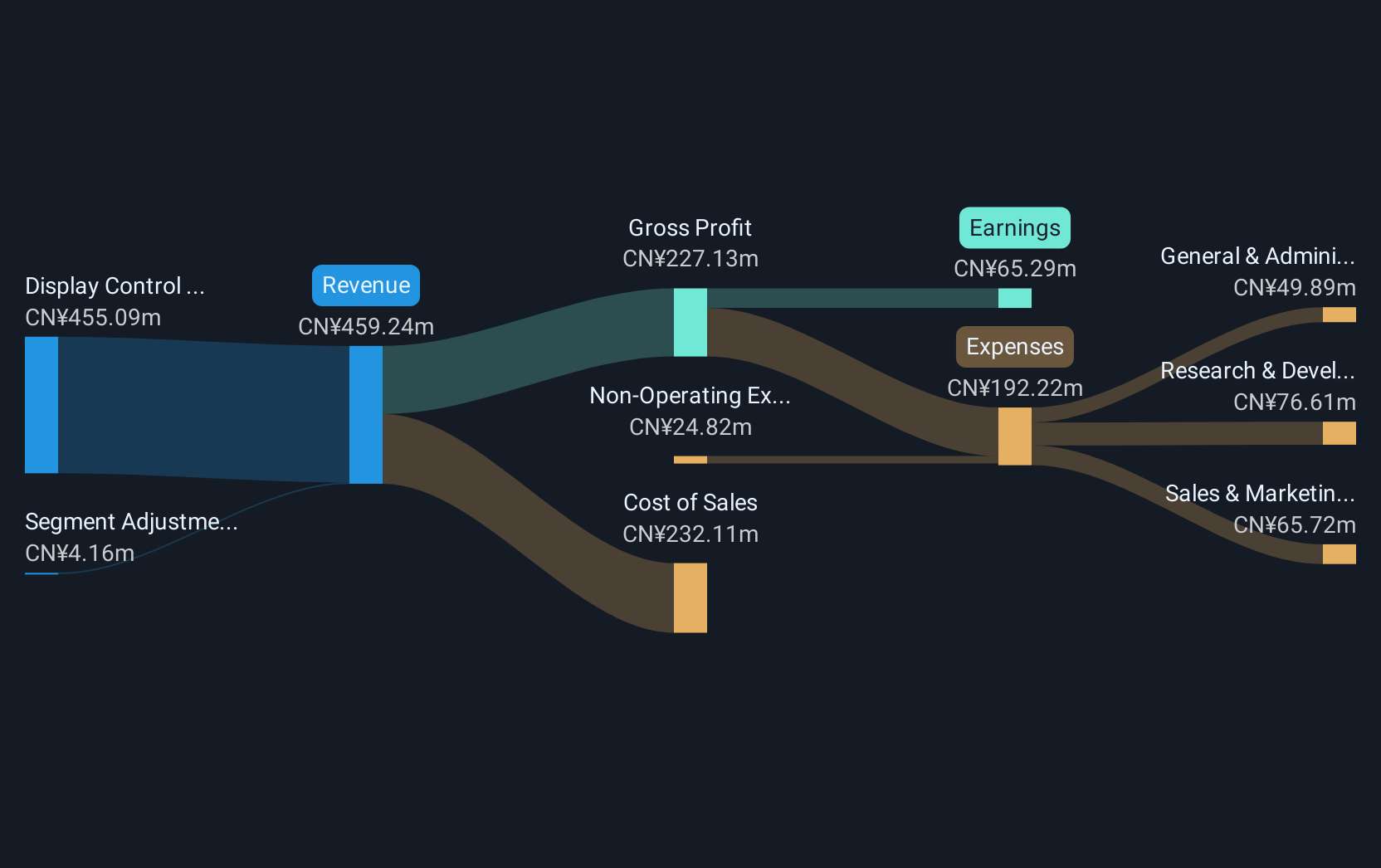

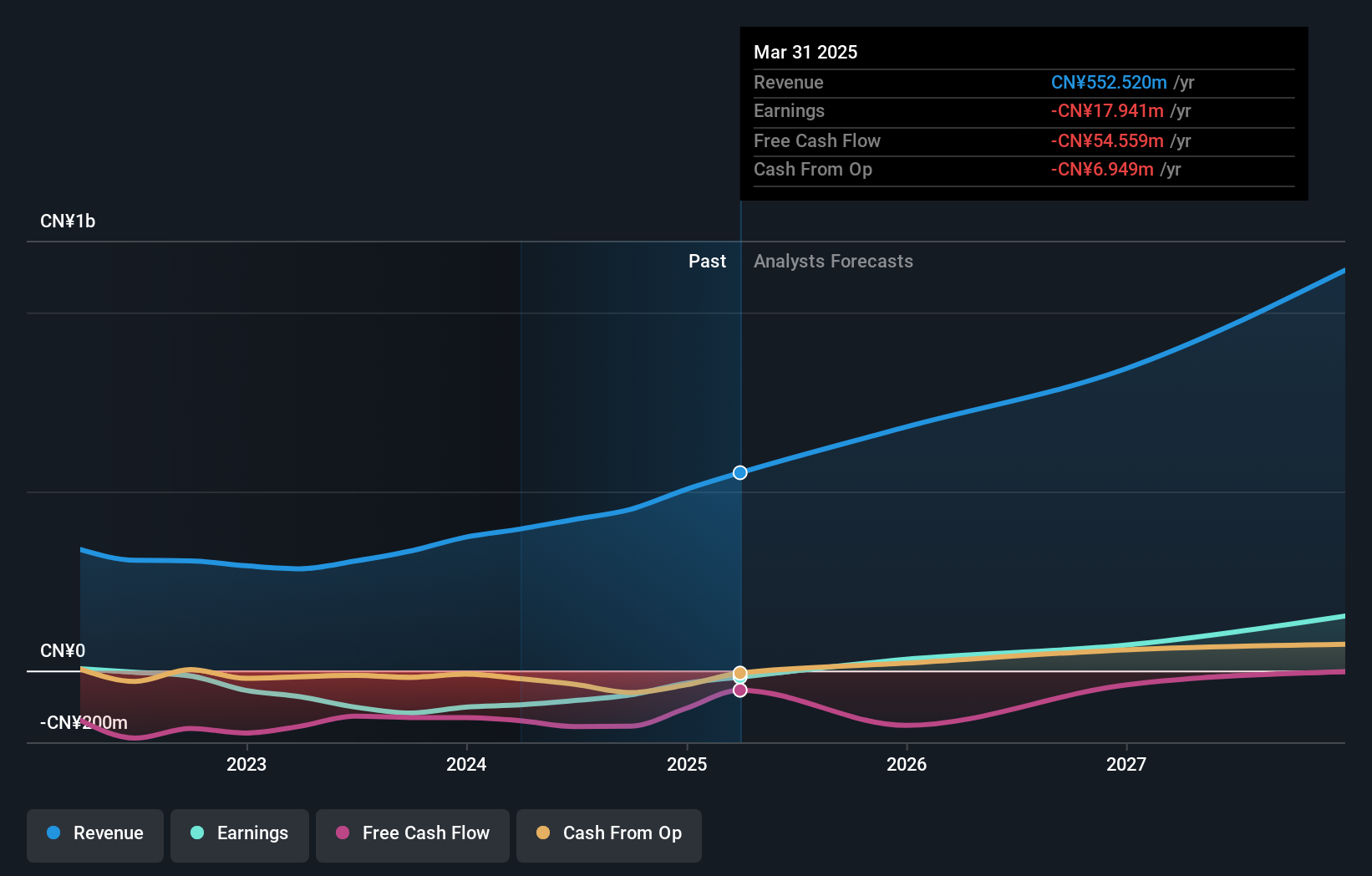

Operations: The company generates its revenue primarily from the integrated circuit segment, contributing CN¥450.24 million. With a focus on micro-electromechanical systems technology, it operates in a niche market within the semiconductor industry.

Despite a challenging year, MEMSensing Microsystems (Suzhou, China) has shown resilience with a notable revenue increase from CNY 259.07 million to CNY 336.65 million, marking an annual growth of 27.1%. This growth is significantly above the Chinese market average of 13.5%. The company's commitment to innovation is underscored by its R&D investments, which are crucial for its competitiveness in the tech sector. Although currently unprofitable with a net loss reduction from CNY 82.32 million to CNY 48.09 million, MEMSensing's strategic focus on technological advancements and market expansion suggests potential for future profitability, especially as it navigates towards positive earnings forecasted to grow at an impressive rate of 119.8% annually.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company focused on designing, developing, and producing mask products in China with a market capitalization of CN¥4.72 billion.

Operations: Shenzhen Newway Photomask Making generates revenue primarily through its electronic components and parts segment, contributing CN¥793.19 million. The company operates within the lithography industry in China, focusing on mask product development and production.

Shenzhen Newway Photomask Making has demonstrated robust financial health, with a notable annual revenue growth of 26.3% and earnings growth of 31.9%. This performance is significantly ahead of the broader Chinese market's averages. The company's aggressive R&D investment strategy not only underscores its commitment to maintaining technological leadership but also positions it well for sustained future growth within the tech sector. Recent shareholder meetings and a completed share buyback program reflect active management engagement and confidence in the company’s strategic direction, further solidifying its standing in high-growth tech circles.

Summing It All Up

- Reveal the 1267 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688286

MEMSensing Microsystems (Suzhou China)

MEMSensing Microsystems (Suzhou, China) Co., Ltd.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion