- China

- /

- Electronic Equipment and Components

- /

- SHSE:688286

Global Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As global markets navigate a landscape marked by steady U.S. inflation and geopolitical uncertainties, investors are keenly observing the performance of small-cap stocks, which have recently outperformed larger indices like the S&P 500. In such an environment, growth companies with high insider ownership often attract attention for their potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 56.4% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 28.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 48.5% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CD Projekt (WSE:CDR) | 29.7% | 42.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.7% | 91.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Leader Harmonious Drive Systems (SHSE:688017)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Leader Harmonious Drive Systems Co., Ltd. operates in the field of advanced drive systems and components, with a market cap of CN¥27.75 billion.

Operations: Leader Harmonious Drive Systems Co., Ltd. generates revenue through its advanced drive systems and components, contributing to its market cap of CN¥27.75 billion.

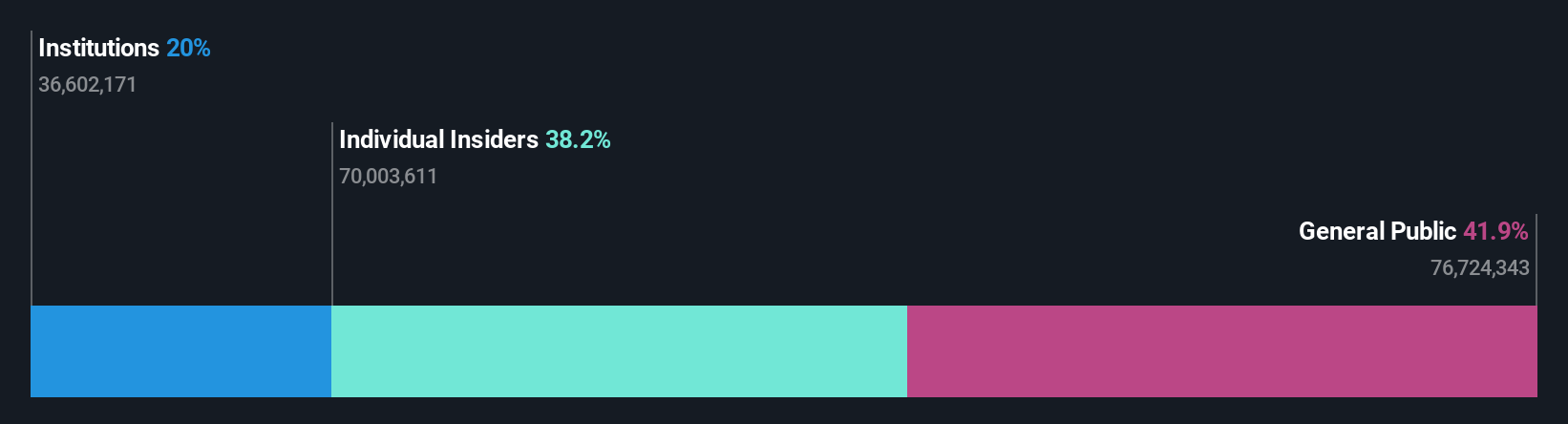

Insider Ownership: 39.6%

Leader Harmonious Drive Systems has demonstrated strong growth with recent earnings showing a net income increase to CNY 53.42 million, up from CNY 36.62 million the previous year. Revenue growth of CNY 251.41 million from CNY 172.41 million highlights its robust performance, supported by forecasts predicting revenue and earnings growth significantly above market averages at over 27% annually. Despite no substantial insider trading activity recently, its high insider ownership aligns with these promising growth prospects.

- Unlock comprehensive insights into our analysis of Leader Harmonious Drive Systems stock in this growth report.

- According our valuation report, there's an indication that Leader Harmonious Drive Systems' share price might be on the expensive side.

MEMSensing Microsystems (Suzhou China) (SHSE:688286)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MEMSensing Microsystems (Suzhou, China) Co., Ltd. operates in the field of micro-electromechanical systems and has a market cap of CN¥5.48 billion.

Operations: The company generates revenue primarily from the production and sale of MEMS sensor products, amounting to CN¥552.52 million.

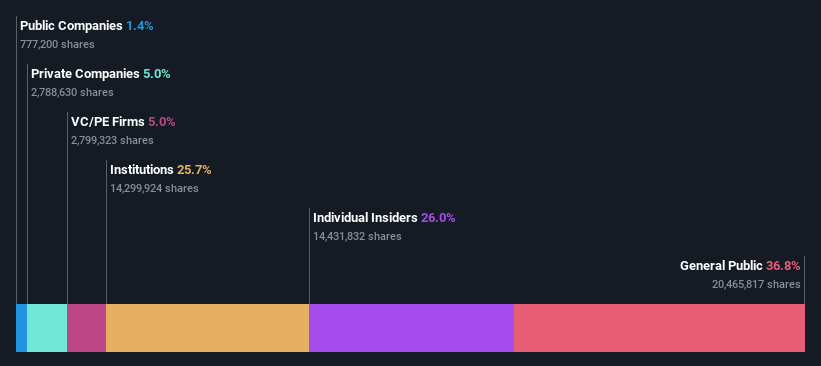

Insider Ownership: 26%

MEMSensing Microsystems is poised for significant growth, with revenue expected to rise 25% annually, outpacing the Chinese market average of 13.9%. Earnings are projected to grow at 86.32% per year, and the company is forecasted to achieve profitability within three years, surpassing market expectations. Despite a low return on equity forecast of 7.6%, high insider ownership suggests confidence in its growth trajectory without notable recent insider trading activity.

- Navigate through the intricacies of MEMSensing Microsystems (Suzhou China) with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report MEMSensing Microsystems (Suzhou China) implies its share price may be too high.

Ningbo Zhenyu Technology (SZSE:300953)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Zhenyu Technology Co., Ltd. specializes in the research, development, manufacturing, and sale of progressive lamination dies both in China and internationally, with a market cap of CN¥23.74 billion.

Operations: Ningbo Zhenyu Technology Co., Ltd.'s revenue is primarily derived from the research, development, manufacturing, and sales of progressive lamination dies in both domestic and international markets.

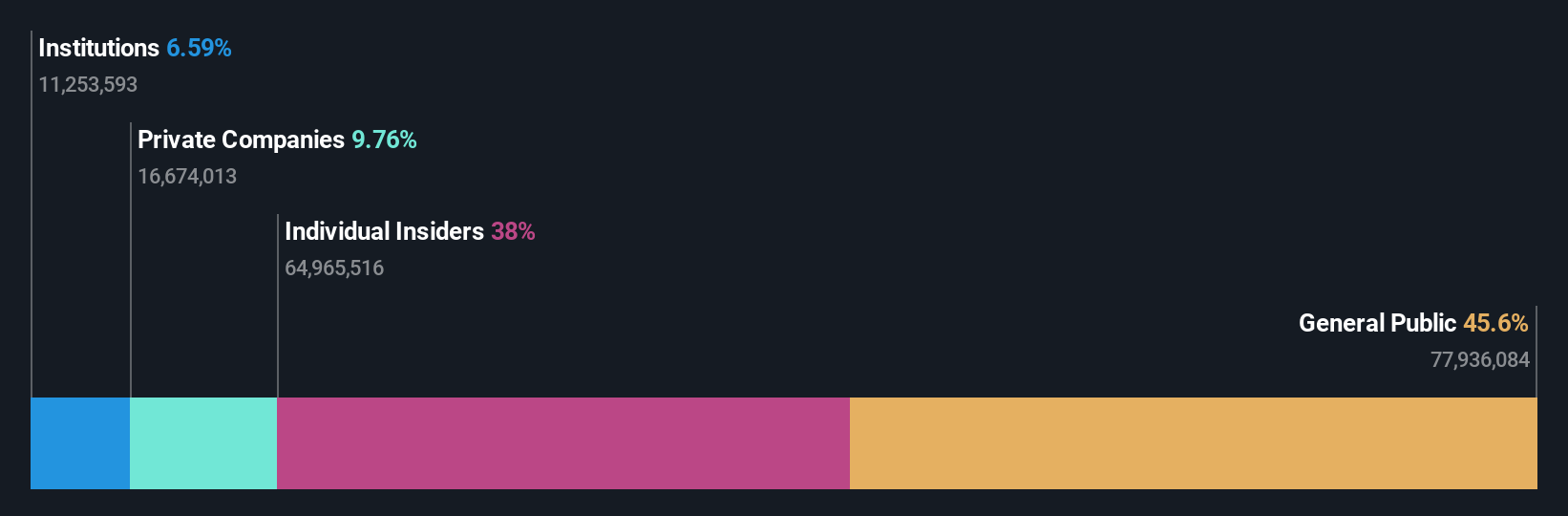

Insider Ownership: 38.3%

Ningbo Zhenyu Technology's earnings are projected to grow significantly at 26.3% annually, exceeding the Chinese market average of 26.1%, although revenue growth is slower at 16%. Recent earnings showed a substantial increase in net income to CNY 211.35 million from CNY 131.72 million a year ago, despite past shareholder dilution and high share price volatility. The company's return on equity is expected to remain low at 14.6% over three years, with no recent insider trading activity reported.

- Click here and access our complete growth analysis report to understand the dynamics of Ningbo Zhenyu Technology.

- Insights from our recent valuation report point to the potential overvaluation of Ningbo Zhenyu Technology shares in the market.

Key Takeaways

- Embark on your investment journey to our 832 Fast Growing Global Companies With High Insider Ownership selection here.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688286

MEMSensing Microsystems (Suzhou China)

MEMSensing Microsystems (Suzhou, China) Co., Ltd.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion