- China

- /

- Electronic Equipment and Components

- /

- SHSE:688260

High Growth Tech Stocks To Watch This November 2024

Reviewed by Simply Wall St

Amid a busy earnings season and mixed economic signals, global markets have seen fluctuations, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before experiencing sharp declines. As small-cap stocks hold up better than their large-cap counterparts, investors are keenly observing high-growth tech stocks that demonstrate resilience and potential for innovation in this volatile environment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Pharma Mar | 26.94% | 55.09% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.50% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

izertis (BME:IZER)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Izertis, S.A. offers technological consultancy services both in Spain and internationally, with a market capitalization of €267.39 million.

Operations: The company generates revenue primarily from its Technologies and Information (IT) segment, amounting to €124.33 million.

Izertis, a player in the tech sector, has demonstrated robust growth dynamics, with its revenue surging by 24.6% annually, outpacing the broader Spanish market's average of 5%. This growth trajectory is complemented by an even more impressive forecast for earnings, expected to soar by 48.6% per year. Despite recent earnings reports showing a dip in net income from EUR 2.08 million to EUR 1.32 million and a decrease in EPS from EUR 0.09 to EUR 0.05 for the first half of 2024, the company's aggressive R&D investment aligns with its innovation-driven approach—critical for sustaining long-term competitiveness in technology sectors where rapid evolution is standard. The firm’s commitment to research and development not only fuels these high expectations but also positions it well against industry norms; however, challenges such as coverage of interest payments by earnings highlight areas needing strategic attention. With significant anticipated growth in both revenue and profits far exceeding market averages and backed by substantial R&D spending (exact figures not provided), Izertis appears poised for future advancements albeit mindful of financial prudence given its current leverage concerns.

- Click to explore a detailed breakdown of our findings in izertis' health report.

Explore historical data to track izertis' performance over time in our Past section.

Suzhou Gyz Electronic TechnologyLtd (SHSE:688260)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Gyz Electronic Technology Co., Ltd specializes in the research, development, design, and production of components across optical, automotive electronics, and optoelectronic semiconductor sectors in China with a market cap of CN¥2.04 billion.

Operations: The company focuses on producing components for optical, automotive electronics, and optoelectronic semiconductor sectors in China. With a market cap of CN¥2.04 billion, its operations span research, development, and design within these industries.

Suzhou Gyz Electronic Technology Co., Ltd, amidst a challenging financial landscape marked by a net loss widening from CNY 64.51 million to CNY 79.72 million in nine months, still shows promising revenue growth trends with an increase from CNY 384.53 million to CNY 414.01 million year-on-year. This growth is significantly above the CN market average forecast of 14% per year, demonstrating a robust expansion rate of 54.5%. Despite current unprofitability, the company's aggressive pursuit of innovation through R&D investments—which have not only fueled this revenue surge but are also expected to pivot the company towards profitability with earnings projected to grow by an impressive 184% annually—positions Suzhou Gyz as a potential turnaround story in the tech sector if it can streamline operations and manage costs effectively.

- Dive into the specifics of Suzhou Gyz Electronic TechnologyLtd here with our thorough health report.

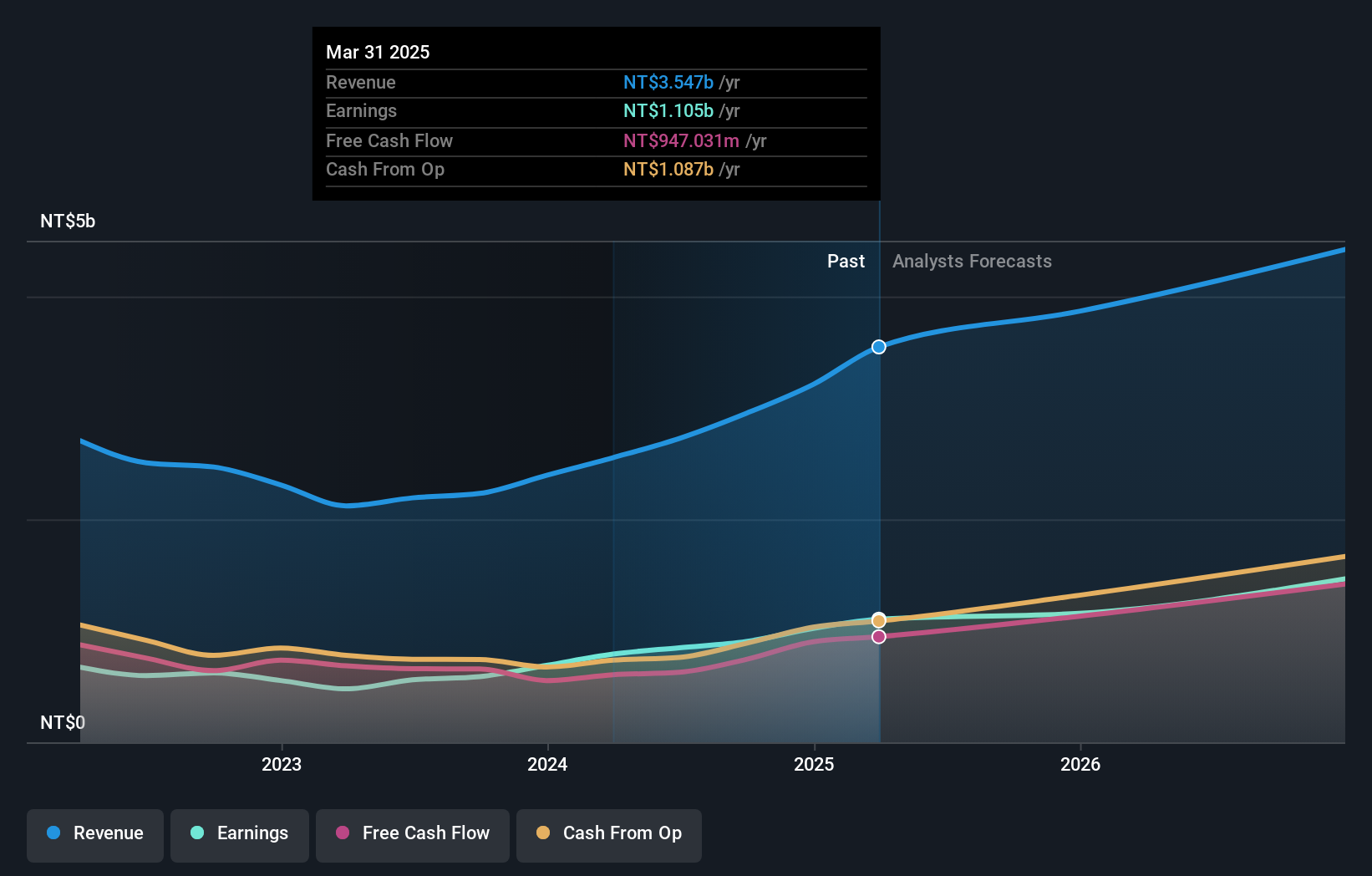

Alltop Technology (TPEX:3526)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alltop Technology Co., Ltd. specializes in the design, manufacture, and sale of electrical connectors globally, with a market capitalization of NT$16.62 billion.

Operations: The company generates revenue primarily from its electronic coupling segment, amounting to NT$2.73 billion. It focuses on the global market for electrical connectors, leveraging its expertise in design and manufacturing.

Alltop Technology has demonstrated robust growth with a revenue increase of 20.5% per year, outpacing the TW market average of 12.3%. This performance is bolstered by significant R&D investment, which not only drives innovation but also supports a projected earnings growth of 22.4% annually—higher than the market forecast of 19.1%. Recent earnings reports for the first half of 2024 reflect this positive trajectory, showing a surge in sales to TWD 1.36 billion from TWD 1.03 billion and net income rising to TWD 438.84 million from TWD 280.29 million year-on-year, underscoring Alltop’s potential in leveraging its technological advancements for sustained financial success.

Key Takeaways

- Access the full spectrum of 1291 High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688260

Suzhou Gyz Electronic TechnologyLtd

Designs and produces electronic components in China.

Low and slightly overvalued.

Market Insights

Community Narratives