Global markets have been experiencing fluctuations, with U.S. stocks ending the week lower amid tariff uncertainties and mixed economic indicators such as a cooling labor market and expanding manufacturing activity for the first time in over two years. In this environment, identifying high growth tech stocks with potential involves looking for companies that can navigate these challenges while demonstrating resilience through strong earnings growth and innovative capabilities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1216 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★★

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on the research, development, production, and commercialization of bio-active principles for oncology across various international markets with a market cap of €1.62 billion.

Operations: The company generates revenue primarily from its oncology segment, amounting to €154.75 million. It operates in Spain, Italy, Germany, Ireland, France, the rest of the European Union, and the United States.

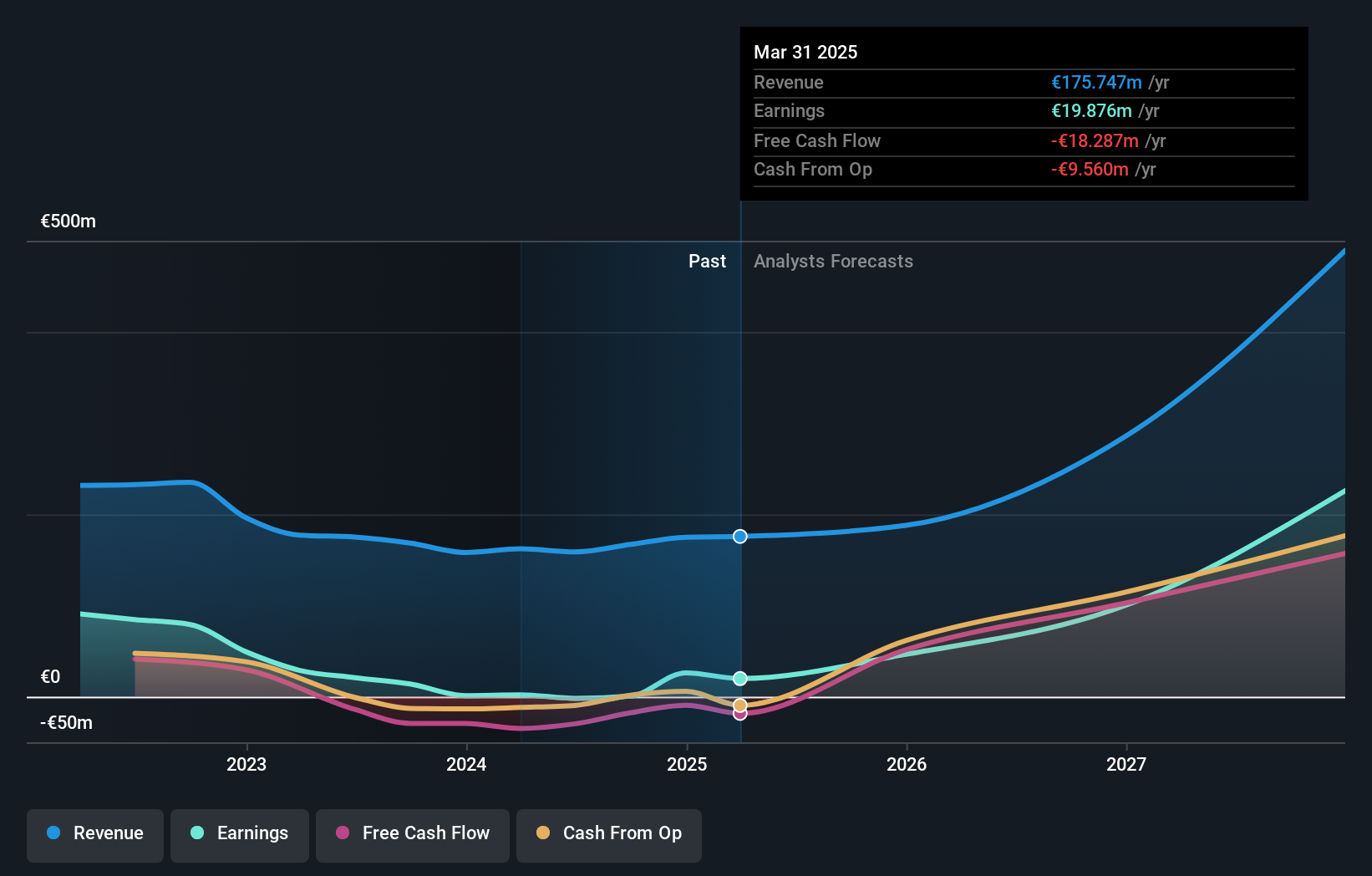

Pharma Mar, amidst a challenging year with a 95.5% dip in earnings, still shows promise with forecasts suggesting robust growth. The company's revenue is expected to surge by 23.2% annually, outpacing the Spanish market's 5.2%. Additionally, its earnings are projected to grow significantly at 44.7% per year, well above the local market average of 7.5%. Despite current profit margins being low at 0.4%, down from last year’s 8.3%, Pharma Mar’s R&D commitment and strategic presence at key industry events like the J.P Morgan Healthcare Conference highlight its potential for recovery and future growth in the high-stakes biotech sector.

- Click here to discover the nuances of Pharma Mar with our detailed analytical health report.

Review our historical performance report to gain insights into Pharma Mar's's past performance.

Suzhou Gyz Electronic TechnologyLtd (SHSE:688260)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Gyz Electronic Technology Co., Ltd designs and produces electronic components in China, with a market cap of CN¥1.91 billion.

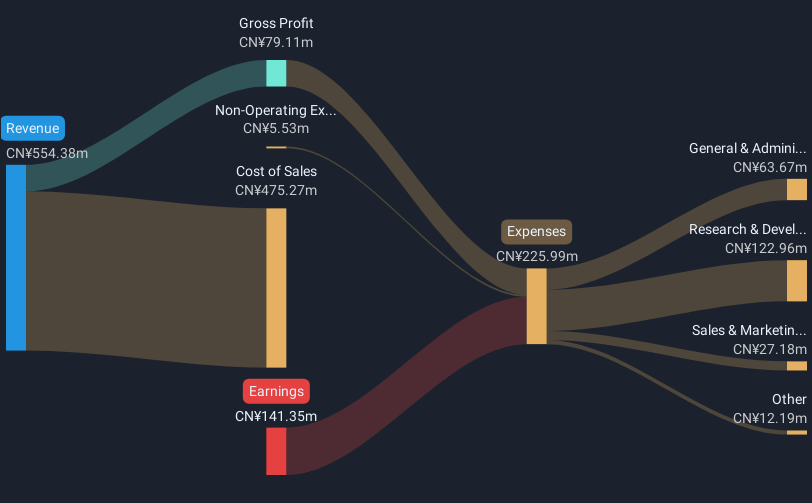

Operations: The company focuses on designing and manufacturing electronic components. It generates revenue primarily through the sale of these components within China.

Suzhou Gyz Electronic TechnologyLtd is poised for significant growth, with revenue expected to surge at an annual rate of 54.5%, outstripping the Chinese market's growth of 13.6%. Despite currently being unprofitable, forecasts predict profitability within three years, a testament to its strategic direction and market positioning. The company’s commitment is further underscored by its substantial R&D expenditures, which are crucial for maintaining competitive advantage in the fast-evolving tech landscape. This focus on innovation could be a key driver in transitioning from current financial positions into future profitability and market leadership.

Suzhou UIGreen Micro&Nano TechnologiesLtd (SHSE:688661)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou UIGreen Micro&Nano Technologies Co., Ltd specializes in the research, development, production, and sale of micro-electromechanical (MEMS) fine components and semiconductor test probe products both in China and internationally, with a market capitalization of CN¥4.75 billion.

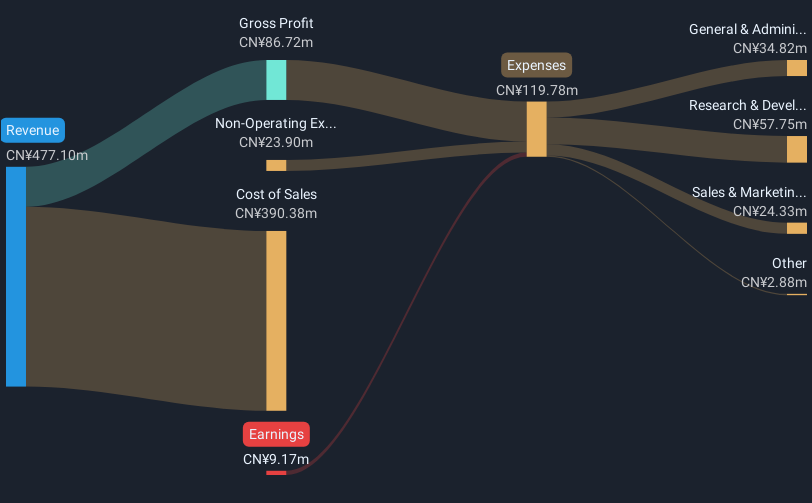

Operations: UIGreen focuses on the development and sale of MEMS fine components and semiconductor test probe products, catering to both domestic and international markets. The company's operations are centered around these key product areas, contributing significantly to its revenue streams.

Suzhou UIGreen Micro&Nano TechnologiesLtd is navigating a transformative phase, with projected revenue growth of 47.1% annually, significantly outpacing the broader Chinese market's growth rate of 13.6%. This robust expansion is underpinned by an aggressive R&D strategy, where investments have been pivotal in driving innovation and maintaining competitiveness in the high-tech sector. With earnings expected to surge by 148.6% annually, the company is on a clear trajectory towards profitability within three years despite current unprofitability. These financial dynamics are crucial for Suzhou UIGreen's potential to capture greater market share and solidify its standing in technology advancements.

- Dive into the specifics of Suzhou UIGreen Micro&Nano TechnologiesLtd here with our thorough health report.

Learn about Suzhou UIGreen Micro&Nano TechnologiesLtd's historical performance.

Summing It All Up

- Gain an insight into the universe of 1216 High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PHM

Pharma Mar

A biopharmaceutical company, engages in the research, development, production, and commercialization of bio-active principles for the use in oncology in Spain, Italy, Germany, Ireland, France, rest of the European Union, the United States, and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives