- China

- /

- Electronic Equipment and Components

- /

- SHSE:688205

High Growth Tech Stocks To Watch For Potential Opportunities

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic indicators signal varying degrees of growth and contraction, the tech sector continues to present intriguing opportunities for investors. In this dynamic environment, identifying high growth potential stocks involves assessing companies that can innovate and adapt amidst shifting market conditions, making them worth watching for potential investment opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1253 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. operates in the optoelectronics industry and has a market capitalization of approximately CN¥10.42 billion.

Operations: Wuxi Taclink Optoelectronics Technology Co., Ltd. focuses on the optoelectronics sector, generating revenue primarily through its diverse range of photonic products and solutions. The company's cost structure involves significant investment in research and development to innovate within this high-tech field. Gross profit margin trends indicate fluctuations, reflecting changes in production costs and market pricing dynamics over time.

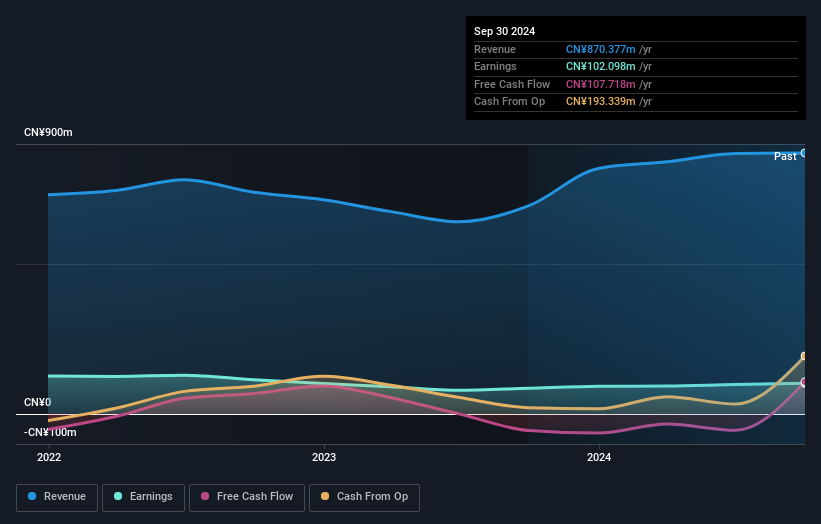

Wuxi Taclink Optoelectronics Technology has demonstrated robust financial performance, with revenue climbing to CNY 600.68 million and net income reaching CNY 76.29 million, marking year-over-year increases of 9.45% and 15%, respectively. This growth trajectory is underscored by an impressive annualized earnings growth forecast of 33.7%, significantly outpacing the broader Chinese market's projection of 25.1%. The company's commitment to innovation is evident in its R&D investments, aligning with industry trends towards advanced optoelectronic applications which are critical in sectors like telecommunications and healthcare. Despite a highly volatile share price in recent months, Wuxi Taclink's substantial investment in R&D and strategic focus on high-demand tech segments suggest promising prospects for sustained growth.

Asiainfo Security TechnologiesLtd (SHSE:688225)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Asiainfo Security Technologies Co., Ltd. specializes in offering network security software solutions both within China and internationally, with a market capitalization of CN¥6.36 billion.

Operations: The company generates revenue through the provision of network security software solutions across domestic and international markets. Its business model focuses on delivering specialized cybersecurity products and services, catering to various sectors that require robust digital protection.

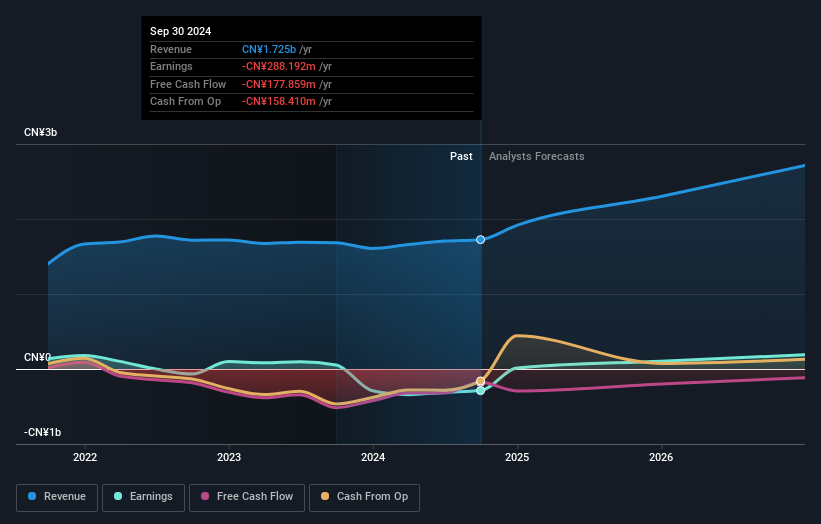

Asiainfo Security TechnologiesLtd. is navigating a complex landscape with a revenue growth forecast of 19.6% annually, outpacing the broader Chinese market's average of 13.6%. Despite currently being unprofitable, the company is projected to see an explosive earnings growth of 115.2% per year, positioning it for potential profitability within three years. This growth is supported by substantial R&D investments which are crucial as the firm aligns with evolving technological demands in security software solutions. The recent financial results highlight challenges, such as a net loss reduction from CNY 211.23 million to CNY 208.34 million year-over-year; however, these figures also reflect resilience and an adaptation strategy that could steer the company towards future stability and market relevance.

Beijing SuperMap Software (SZSE:300036)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing SuperMap Software Co., Ltd. provides geographic information system (GIS) and geospatial intelligence software products and services both in China and internationally, with a market capitalization of CN¥7.68 billion.

Operations: SuperMap Software specializes in GIS and geospatial intelligence solutions, generating revenue primarily through software sales and services. The company's operations extend beyond China, tapping into international markets for growth opportunities.

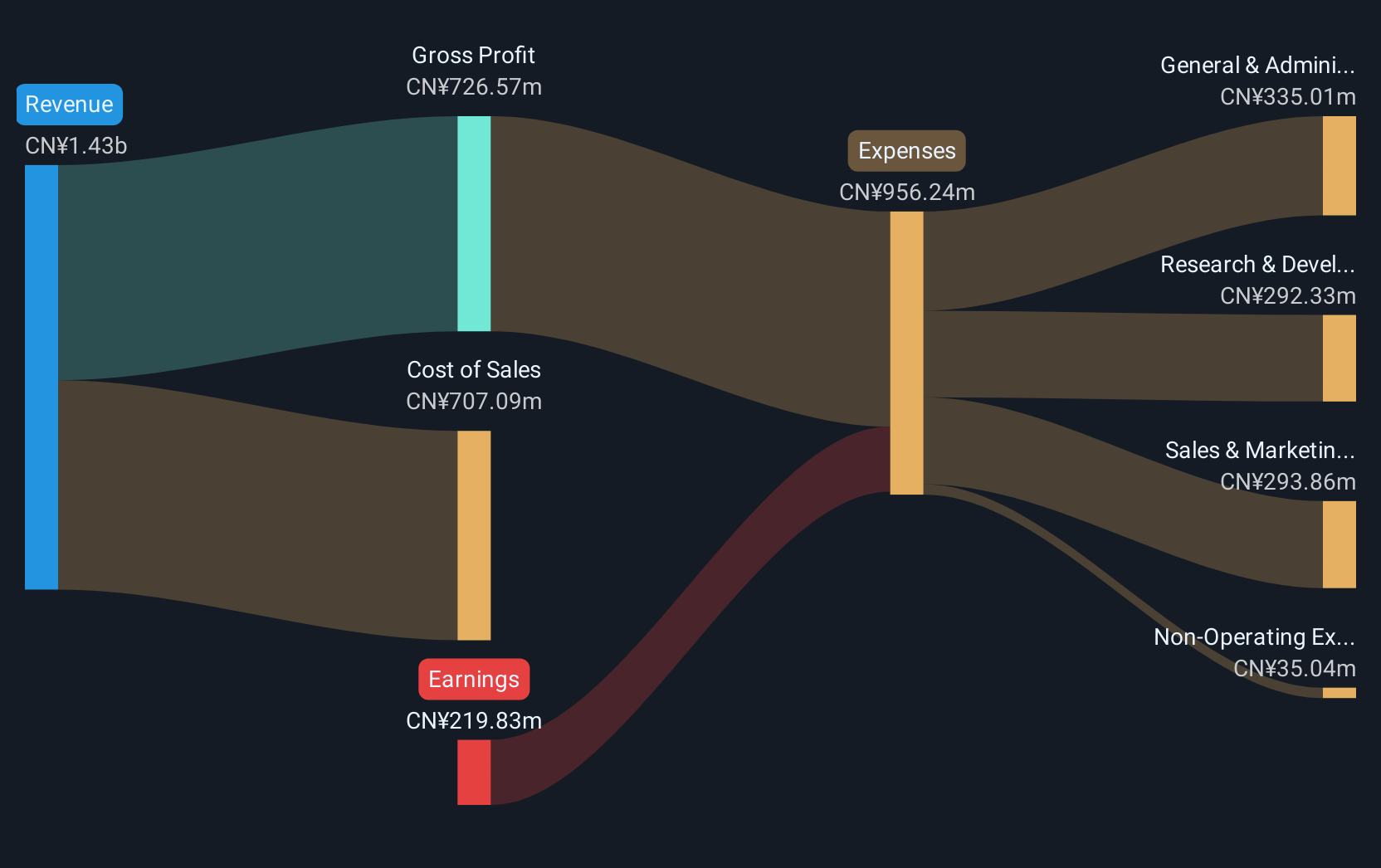

Beijing SuperMap Software, amidst a challenging fiscal period marked by a significant revenue drop to CNY 948.51 million from CNY 1,270.55 million year-over-year, still managed to report a net income of CNY 26.31 million. Despite these financial hurdles, the company's commitment to innovation is evident in its R&D spending and strategic buybacks—repurchasing 9,959,652 shares for CNY 140.21 million—highlighting confidence in its future trajectory within the tech landscape. This approach could bolster its standing as it navigates market fluctuations and aligns with broader industry shifts towards advanced software solutions.

- Dive into the specifics of Beijing SuperMap Software here with our thorough health report.

Gain insights into Beijing SuperMap Software's past trends and performance with our Past report.

Key Takeaways

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1250 more companies for you to explore.Click here to unveil our expertly curated list of 1253 High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Taclink Optoelectronics Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688205

Wuxi Taclink Optoelectronics Technology

Wuxi Taclink Optoelectronics Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives