- China

- /

- Electronic Equipment and Components

- /

- SHSE:688195

High Growth Tech Stocks in Asia to Watch for Potential Opportunities

Reviewed by Simply Wall St

As global markets experience shifts in sentiment due to fluctuating economic indicators, the Asian tech sector remains a focal point for investors seeking growth opportunities. With smaller-cap stocks showing sensitivity to interest rate movements and broader market dynamics, identifying promising tech companies involves assessing their resilience and potential for innovation amid these evolving conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Giant Network Group | 31.77% | 35.00% | ★★★★★★ |

| Fositek | 33.62% | 43.82% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Zhongji Innolight | 26.47% | 27.39% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Foxconn Industrial Internet | 28.07% | 27.29% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 55.36% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

ROBOTIS (KOSDAQ:A108490)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ROBOTIS Co., Ltd. offers robotic solutions in South Korea and has a market capitalization of ₩1.29 trillion.

Operations: ROBOTIS Co., Ltd. generates revenue primarily from developing, manufacturing, and selling personal robots, with this segment contributing ₩31.71 billion.

ROBOTIS, a burgeoning force in Asia's tech sector, recently pivoted to profitability with an impressive 83.3% annual earnings growth forecast, outpacing the broader Korean market's 23.4%. This turnaround is underscored by a robust revenue surge at 42.4% annually, significantly ahead of the regional average of 7%. The company’s strategic emphasis on R&D has fostered innovation and competitiveness; last year alone, R&D expenditures were notably high at ₩50 million, accounting for approximately 15% of total revenues. Recently, ROBOTIS bolstered its financial structure through a ₩100 billion follow-on equity offering aimed at fueling further expansion and solidifying its market position amidst volatile trading conditions. These moves highlight ROBOTIS' agile adaptation to market demands and its upward trajectory in the high-stakes tech landscape.

- Get an in-depth perspective on ROBOTIS' performance by reading our health report here.

Examine ROBOTIS' past performance report to understand how it has performed in the past.

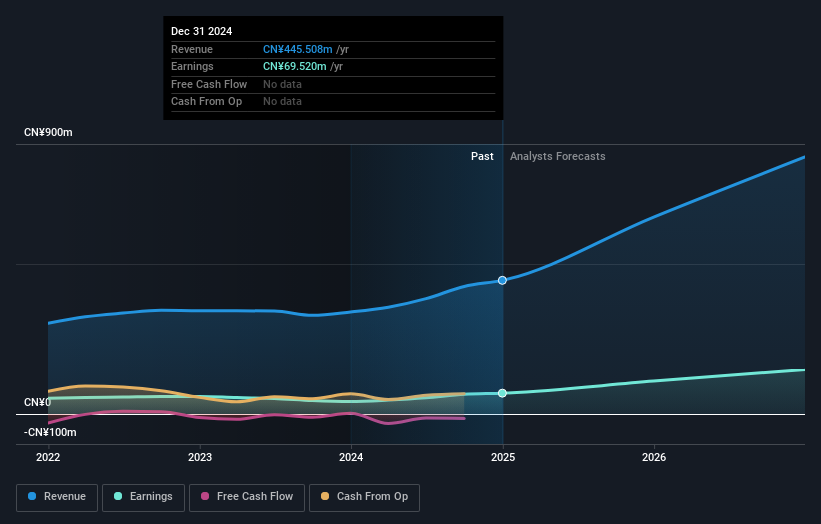

Optowide Technologies (SHSE:688195)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Optowide Technologies Co., Ltd. focuses on the research, development, production, and sale of precision optics and fiber components globally with a market cap of CN¥11.96 billion.

Operations: Optowide Technologies specializes in precision optics and fiber components, serving both domestic and international markets.

Optowide Technologies, amidst Asia's tech surge, has demonstrated robust growth with a 29% annual revenue increase outstripping the CN market's 13.7%. This momentum is mirrored in its earnings, which have climbed by 35.2% over the past year—significantly higher than the industry average of 3.8%. The company's strategic focus on R&D is evident from its allocation of substantial resources to innovation; last year, R&D expenses accounted for a notable portion of total revenues. Despite some volatility in share price recently, Optowide’s aggressive growth strategy and recent earnings results from H1 2025 suggest it remains a dynamic component of Asia’s high-tech landscape.

- Click to explore a detailed breakdown of our findings in Optowide Technologies' health report.

Explore historical data to track Optowide Technologies' performance over time in our Past section.

I'LL (TSE:3854)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: I'LL Inc. is a Japanese company specializing in system solutions, with a market cap of ¥70.99 billion.

Operations: I'LL Inc. focuses on providing system solutions in Japan. The company generates revenue through its specialized services in this sector, contributing to its market presence.

I'LL Inc. stands out in the Asian tech sector with its strategic positioning and robust financial performance. Over the past year, the company has seen a 20.8% surge in earnings, surpassing the software industry's average growth of 14.9%. This growth trajectory is supported by an aggressive R&D focus, with expenditures significantly contributing to its innovative edge—evidence of their commitment to maintaining competitive superiority in rapidly evolving markets. Moreover, I'LL's recent board meeting highlighted plans for dividend distribution and a comprehensive Mid-Term Management Plan aimed at sustaining this momentum, signaling strong future prospects amidst challenging market dynamics.

- Click here to discover the nuances of I'LL with our detailed analytical health report.

Review our historical performance report to gain insights into I'LL's's past performance.

Taking Advantage

- Click through to start exploring the rest of the 182 Asian High Growth Tech and AI Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688195

Optowide Technologies

Engages in the research, development, production, and sale of precision optics and fiber components in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives