- China

- /

- Electronic Equipment and Components

- /

- SHSE:688188

High Growth Tech Stocks to Watch in June 2025

Reviewed by Simply Wall St

In recent weeks, global markets have been heavily influenced by trade policy developments, with U.S. stocks experiencing a rebound despite ongoing tariff uncertainties and smaller-cap indexes posting positive returns. Amidst these fluctuations, investors are keenly observing high-growth tech stocks that have the potential to thrive in an environment characterized by easing inflation and evolving consumer confidence.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| Rakovina Therapeutics | 40.75% | 16.49% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

We'll examine a selection from our screener results.

Shanghai BOCHU Electronic Technology (SHSE:688188)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai BOCHU Electronic Technology Corporation Limited operates in the electronic technology sector and has a market capitalization of CN¥40.99 billion.

Operations: Shanghai BOCHU Electronic Technology focuses on the electronic technology sector, generating revenue primarily through its diverse range of products and services. The company experiences fluctuations in its net profit margin, which reflects varying cost efficiencies and market conditions.

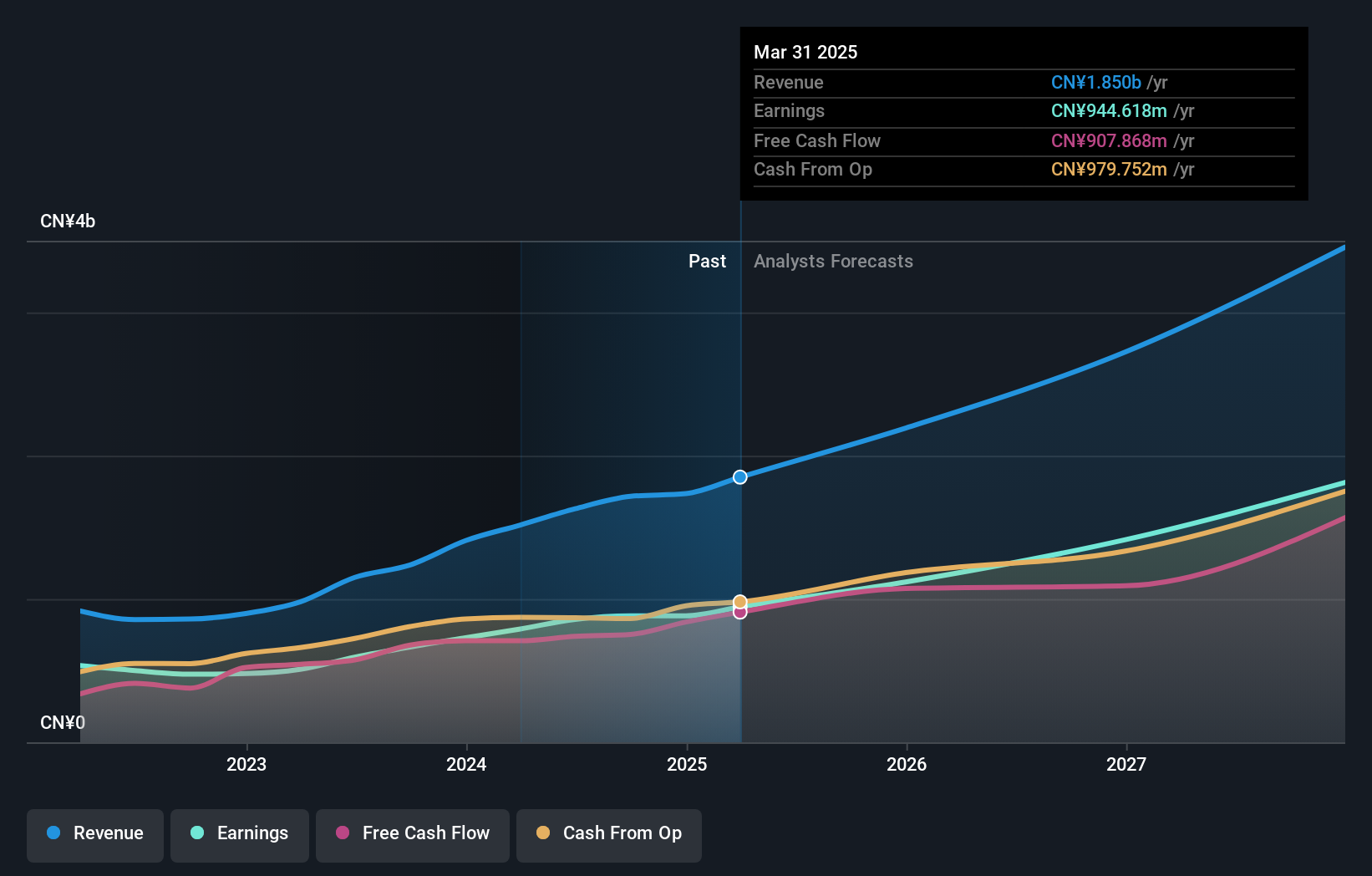

Shanghai BOCHU Electronic Technology has demonstrated robust financial performance, with revenue and earnings growth outpacing the broader Chinese market. The company's revenue surged by 22.4% annually, significantly higher than the market's 12.5%, while its earnings are projected to grow by 23.5% per year, slightly ahead of the national average of 23.4%. This growth trajectory is supported by substantial R&D investments that have positioned it well for sustained innovation in electronic technologies; last quarter alone saw a remarkable increase in net income to CNY 255.46 million from CNY 193.55 million year-over-year, highlighting efficient operational execution and strong market demand for its offerings. Recent strategic decisions underscore Shanghai BOCHU's commitment to maintaining its competitive edge and expanding its market share. The company recently reported a first-quarter revenue jump to CNY 495.84 million from CNY 381.06 million in the previous year during their latest earnings announcement on April 21, reflecting not only increased sales but also effective adaptation to dynamic market conditions—a testament to their proactive management and forward-thinking strategies in technology development.

Beijing Shiji Information Technology (SZSE:002153)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Shiji Information Technology Co., Ltd. operates as a technology company providing software solutions and services primarily for the hospitality, retail, and entertainment industries, with a market cap of CN¥22.35 billion.

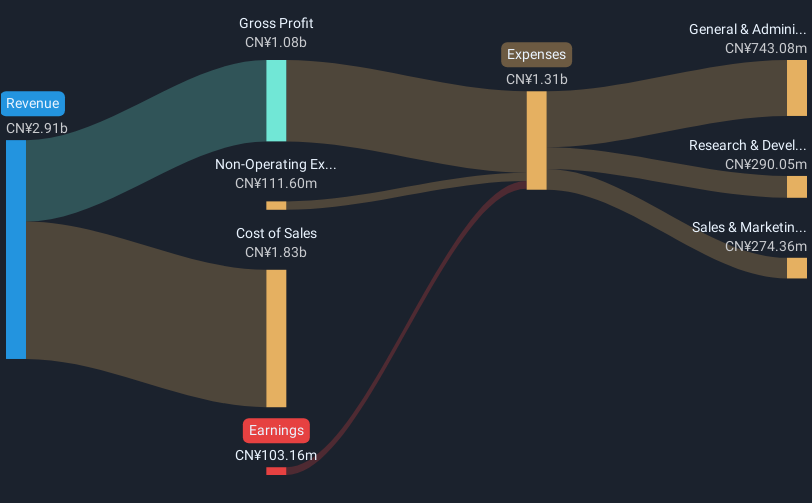

Operations: The company generates revenue by offering software solutions and services tailored to the hospitality, retail, and entertainment sectors. Its business model focuses on leveraging technology to enhance operational efficiency for clients in these industries.

Beijing Shiji Information Technology, despite recent fluctuations, shows promise with a strategic focus on expanding its technological offerings. In the last year, the company's revenue grew by 15.1%, outpacing the broader Chinese market growth of 12.5%. This growth is underpinned by an aggressive R&D strategy that saw expenses rise significantly to fuel innovation in its software solutions. Notably, the firm has navigated market challenges as evidenced in its latest quarterly earnings where net income nearly doubled from CNY 11.39 million to CNY 21.11 million year-over-year, underscoring potential for future profitability and stability within a competitive tech landscape.

Range Intelligent Computing Technology Group (SZSE:300442)

Simply Wall St Growth Rating: ★★★★★★

Overview: Range Intelligent Computing Technology Group Company Limited offers server hosting services to internet companies and large cloud vendors in China, with a market capitalization of CN¥77.11 billion.

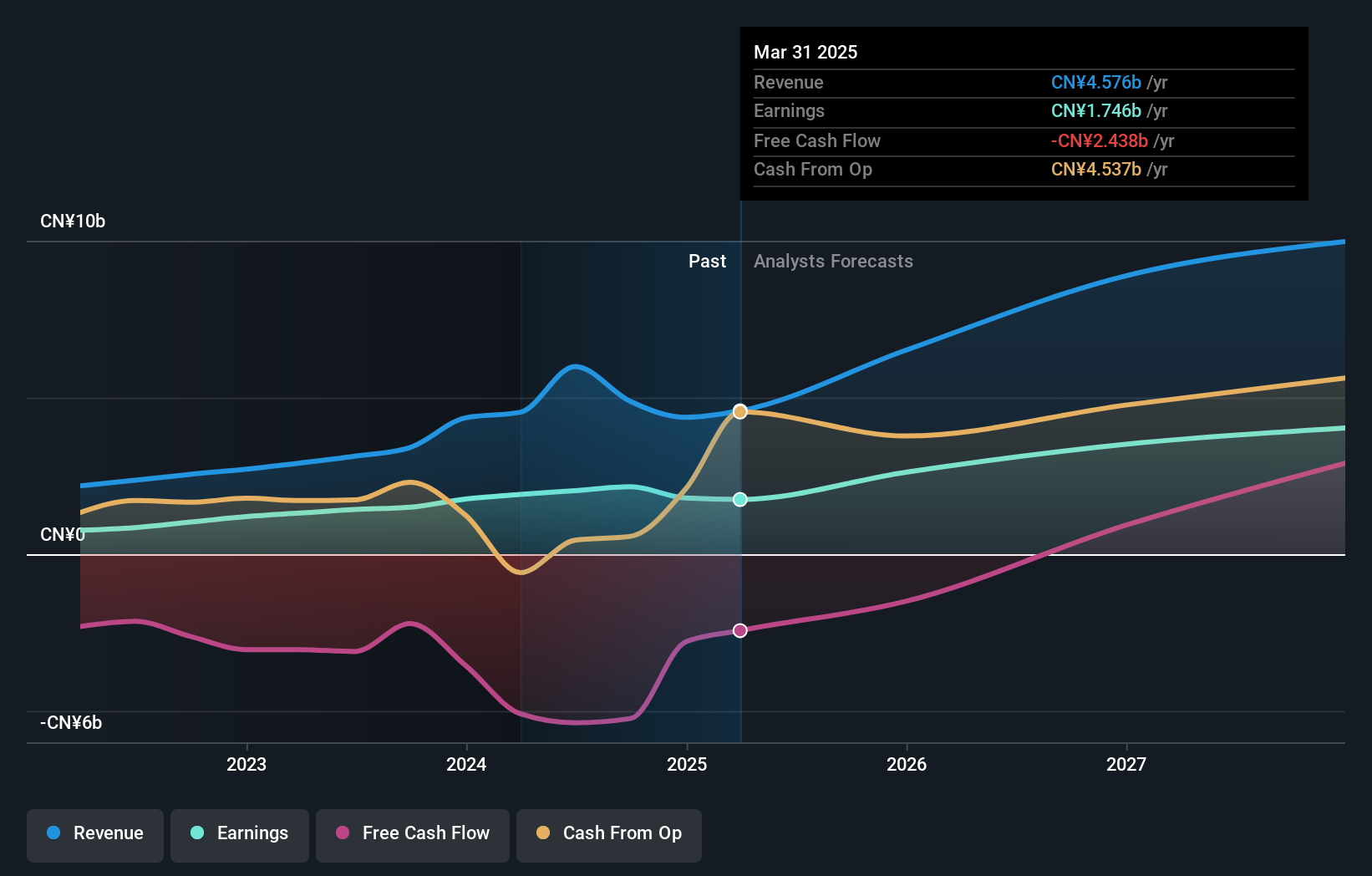

Operations: The company generates revenue primarily through its IDC services, amounting to CN¥4.58 billion.

Range Intelligent Computing Technology Group has demonstrated robust financial performance with a reported annual revenue growth of 27.3% and earnings growth of 28.6%. This growth trajectory is supported by significant R&D investments, which are evident from the recent increase in R&D expenses to enhance their technological capabilities further. The company's strategic initiatives, including a recent share buyback program valued at CNY 1 billion and dividend increases, reflect its commitment to shareholder value and confidence in sustained profitability. These moves, coupled with innovative expansions in AI and software solutions, position Range Intelligent Computing well within the competitive tech landscape.

Turning Ideas Into Actions

- Unlock more gems! Our Global High Growth Tech and AI Stocks screener has unearthed 741 more companies for you to explore.Click here to unveil our expertly curated list of 744 Global High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688188

Shanghai BOCHU Electronic Technology

Shanghai BOCHU Electronic Technology Corporation Limited.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives