- China

- /

- Electronic Equipment and Components

- /

- SHSE:688188

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the global markets navigate a mixed landscape, with U.S. consumer confidence dipping and durable goods orders declining, major stock indexes like the Nasdaq Composite have shown resilience by posting gains despite some volatility during the holiday-shortened week. In this environment, identifying promising high-growth tech stocks involves looking for companies that can adapt to economic shifts and leverage innovation to sustain growth amidst fluctuating market sentiments.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1262 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Shanghai BOCHU Electronic Technology (SHSE:688188)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai BOCHU Electronic Technology Corporation Limited is a company focused on electronic technology operations with a market capitalization of CN¥39.91 billion.

Operations: Shanghai BOCHU Electronic Technology Corporation Limited operates within the electronic technology sector. The company is involved in various segments, though specific revenue streams and cost breakdowns are not detailed in the provided text.

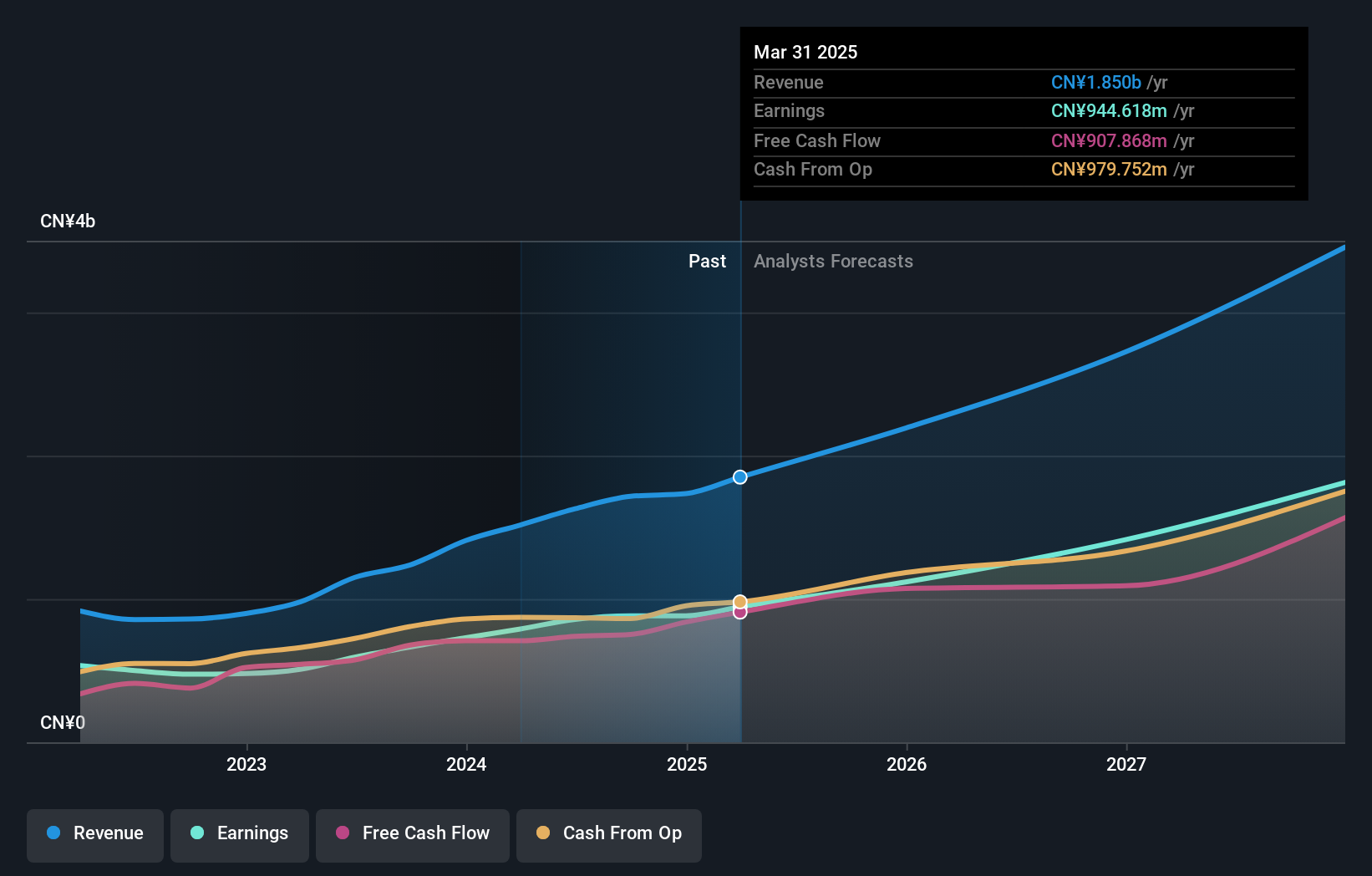

Shanghai BOCHU Electronic Technology has demonstrated robust financial performance with a notable increase in sales to CNY 1.3 billion, up from CNY 991.5 million the previous year, and a surge in net income to CNY 725.74 million. This growth is underpinned by an aggressive R&D strategy, as reflected in its earnings growth outpacing the industry average significantly at 32.7% compared to just 1.9%. The company’s commitment to innovation is evident from its projected annual earnings growth of nearly 29.8%, substantially above the Chinese market's average of 25.2%. This focus on research and development not only fuels current revenue streams but also positions Shanghai BOCHU well within the high-tech sector for continued expansion in emerging technologies. Recent strategic moves include significant investments in technology upgrades, which have bolstered their market position against competitors and enhanced product offerings critical for sustaining long-term growth in the tech industry’s fast-evolving landscape. With a forecasted return on equity of an impressive 22.2% and revenue expected to grow at an annual rate of 28.1%, Shanghai BOCHU is strategically aligning its operations towards sustainable profitability and market leadership in electronic technology innovations.

- Dive into the specifics of Shanghai BOCHU Electronic Technology here with our thorough health report.

Learn about Shanghai BOCHU Electronic Technology's historical performance.

Intsig Information (SHSE:688615)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IntSig Information Co., Ltd. offers optical character recognition solutions to corporate clients and individuals globally, with a market capitalization of CN¥20.24 billion.

Operations: IntSig Information Co., Ltd. specializes in optical character recognition solutions for both corporate clients and individuals on a global scale. The company generates its revenue through these technological services, focusing on enhancing document management and data extraction capabilities for its users.

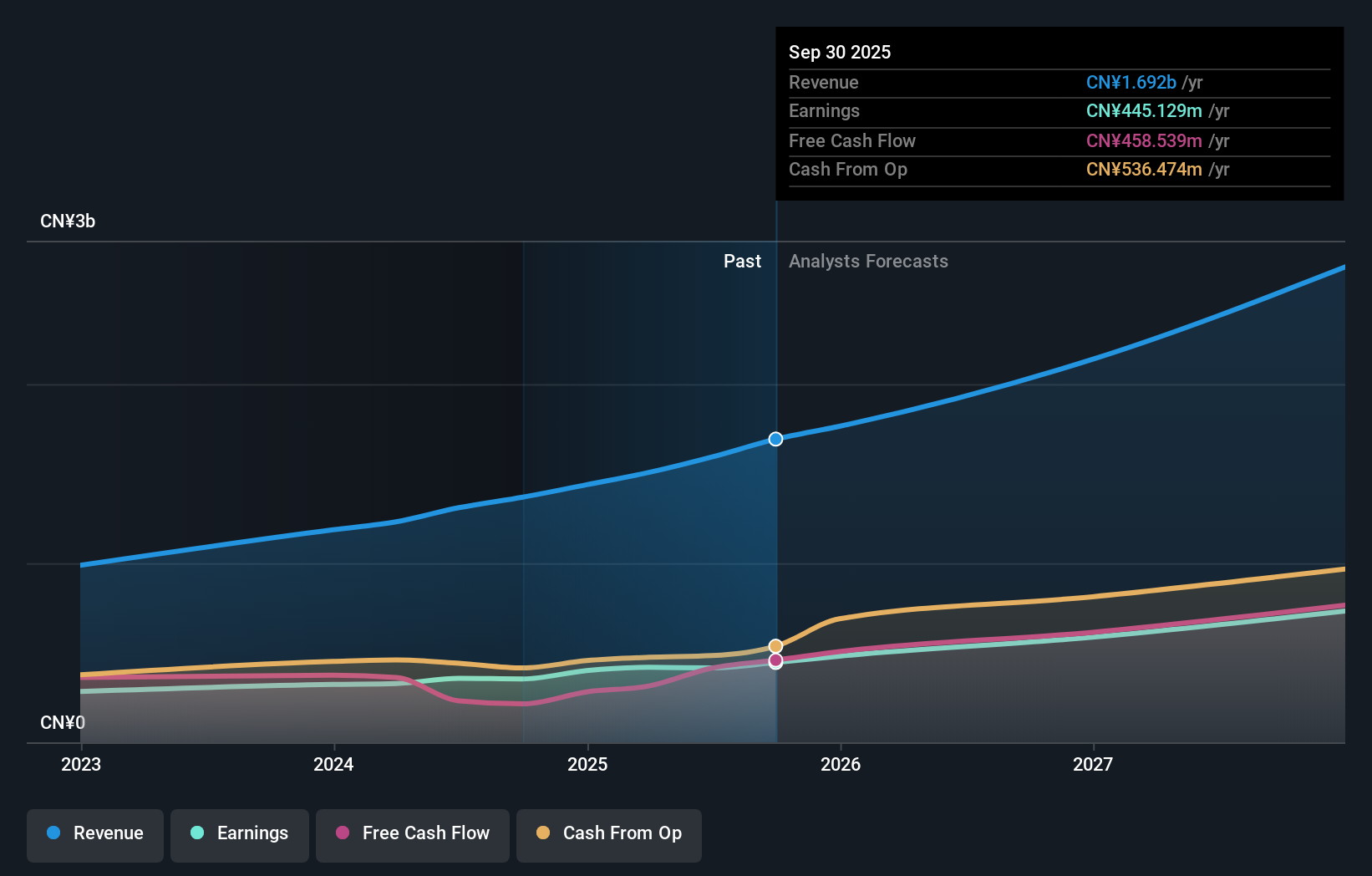

Intsig Information has demonstrated solid growth, with revenue climbing to CNY 1.05 billion from CNY 866.99 million in the previous year, and net income increasing to CNY 306.5 million from CNY 276.01 million. This financial uplift is supported by a notable annual revenue growth rate of 19.4% and earnings growth of 25.2%, both outpacing the broader Chinese market's averages of 13.6% and 25.2%, respectively. The company’s aggressive investment in R&D has propelled these gains, fostering innovation that keeps it competitive within the rapidly evolving tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Intsig Information.

Assess Intsig Information's past performance with our detailed historical performance reports.

Electric Connector Technology (SZSE:300679)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Electric Connector Technology Co., Ltd. specializes in the research, design, development, manufacture, sale, and marketing of electronic connectors and interconnection system products globally with a market cap of CN¥25.09 billion.

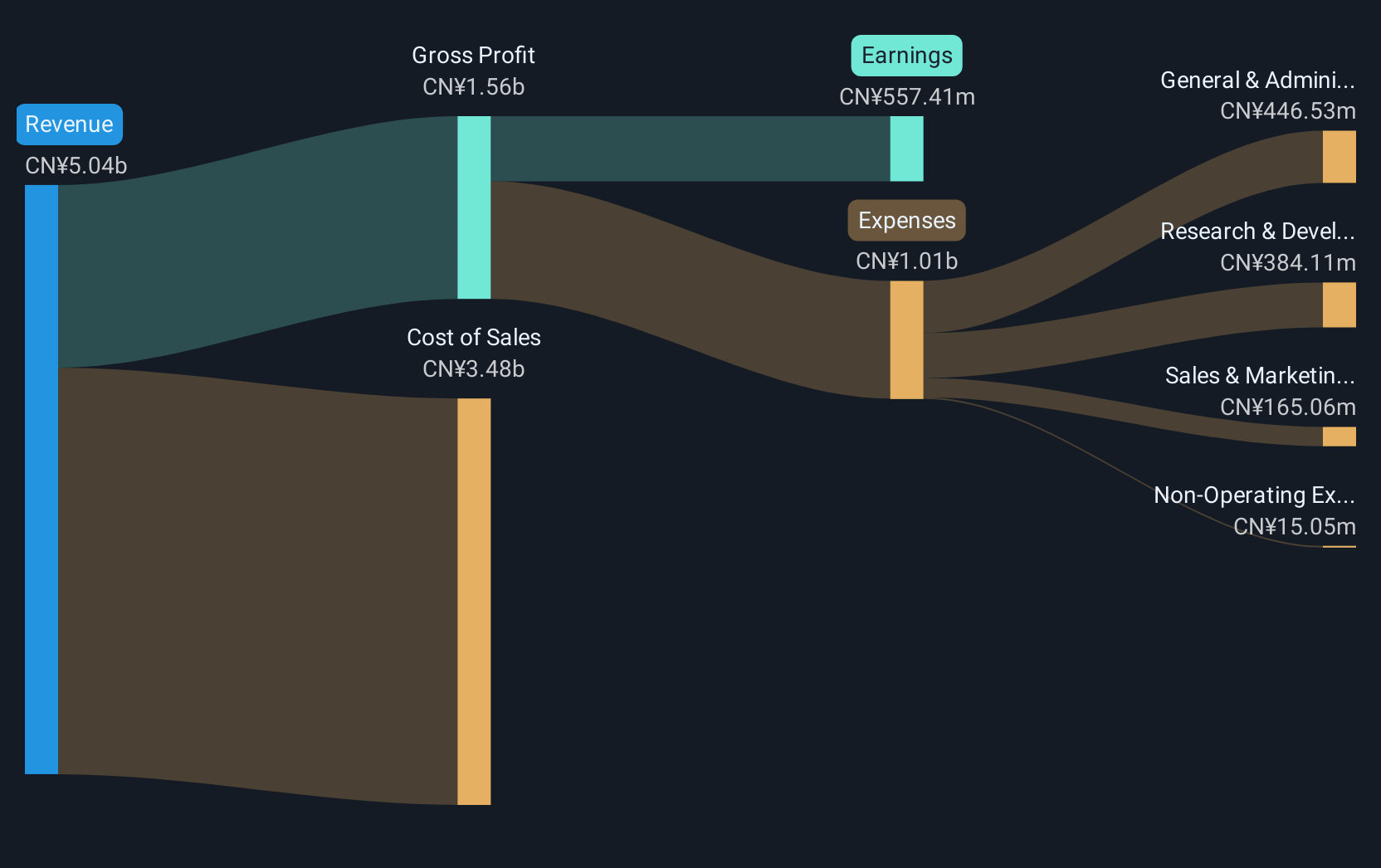

Operations: The company primarily generates revenue from the connector industry, contributing CN¥3.89 billion. It focuses on the technical aspects of electronic connectors and interconnection systems on a global scale.

Electric Connector Technology has demonstrated a robust financial performance, with a 51% surge in revenue to CNY 3.33 billion and earnings growth of 85.4%, reaching CNY 458.59 million over the past nine months. This growth is supported by an annualized revenue increase of 26.1% and earnings expansion at 28.4%, both outstripping the broader Chinese market's averages significantly. The company also actively repurchased shares, buying back over 2.78 million shares for CNY 100.28 million, reflecting confidence in its financial health and commitment to shareholder value.

- Navigate through the intricacies of Electric Connector Technology with our comprehensive health report here.

Understand Electric Connector Technology's track record by examining our Past report.

Key Takeaways

- Access the full spectrum of 1262 High Growth Tech and AI Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688188

Shanghai BOCHU Electronic Technology

Shanghai BOCHU Electronic Technology Corporation Limited.

Exceptional growth potential with flawless balance sheet.