- China

- /

- Electronic Equipment and Components

- /

- SZSE:002913

Exploring High Growth Tech Stocks For A Dynamic Portfolio

Reviewed by Simply Wall St

As global markets experience a surge with major U.S. indices like the S&P 500 and Nasdaq Composite hitting record highs, smaller-cap indexes such as the S&P MidCap 400 and Russell 2000 have also shown robust performance, reflecting an optimistic market sentiment despite mixed economic signals. In this dynamic environment, identifying high growth tech stocks that align with resilient job growth and evolving trade conditions can be pivotal for building a portfolio that capitalizes on technological advancements and market opportunities.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.26% | 44.76% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Shengyi Electronics (SHSE:688183)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shengyi Electronics Co., Ltd. is involved in the research, development, production, and sales of printed circuit boards in China with a market capitalization of CN¥40.73 billion.

Operations: The company focuses on the research, development, production, and sales of printed circuit boards in China. It operates with a market capitalization of CN¥40.73 billion.

Shengyi Electronics has demonstrated a remarkable growth trajectory, with its earnings skyrocketing by 9156.8% over the past year, significantly outpacing the electronic industry's average of 2.9%. This surge is underpinned by a robust annual revenue growth rate of 23%, which is nearly double the Chinese market forecast of 12.4%. Notably, Shengyi's strategic focus on R&D has fostered innovation, aligning with its recent earnings announcement where Q1 sales jumped to CNY 1.58 billion from CNY 884.61 million year-over-year. Additionally, the company's commitment to enhancing shareholder value is evident from its recent share repurchase program, aimed at boosting equity incentives and stabilizing its highly volatile share price. Looking ahead, Shengyi is poised for sustained growth with projected annual earnings increases of 35.2%, outstripping the broader Chinese market's expectation of 23.4%. The firm’s forward-looking strategies are further reflected in its anticipated high Return on Equity (RoE) of 21.4% in three years’ time and a positive free cash flow status that supports ongoing and future operational needs.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a company engaged in the research, development, and commercialization of innovative pharmaceutical products, with a market cap of approximately CN¥30.72 billion.

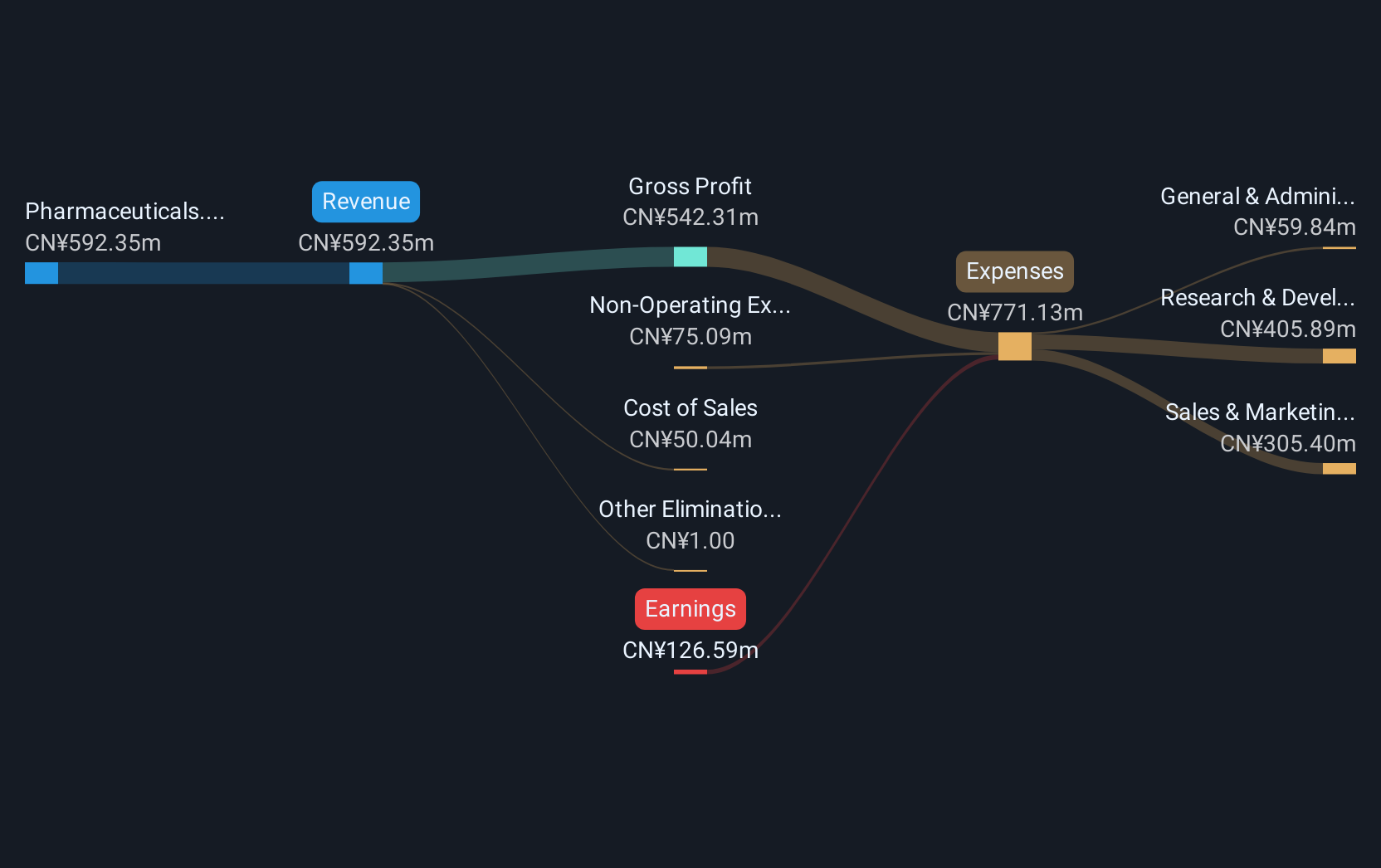

Operations: Zelgen focuses on developing and commercializing pharmaceutical products, generating revenue primarily from its pharmaceuticals segment, which amounts to approximately CN¥592.35 million.

Suzhou Zelgen Biopharmaceuticals has recently been added to the Shanghai Stock Exchange Health Care Sector Index, signaling a positive market acknowledgment. Despite its current unprofitable status, the company's revenue surged by 45.4% year-over-year to CNY 167.64 million in Q1 2025, reflecting robust growth potential. The firm's strategic R&D investment is set to bolster its pipeline, with earnings projected to grow by an impressive 101.5% annually. This focus on innovation and recent financial performance underscore Zelgen’s potential in a rapidly evolving biotech landscape, even as it navigates challenges like a highly volatile share price and ongoing losses.

Aoshikang Technology (SZSE:002913)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aoshikang Technology Co., Ltd. focuses on the research, development, production, and sale of printed circuit boards with a market capitalization of CN¥10.04 billion.

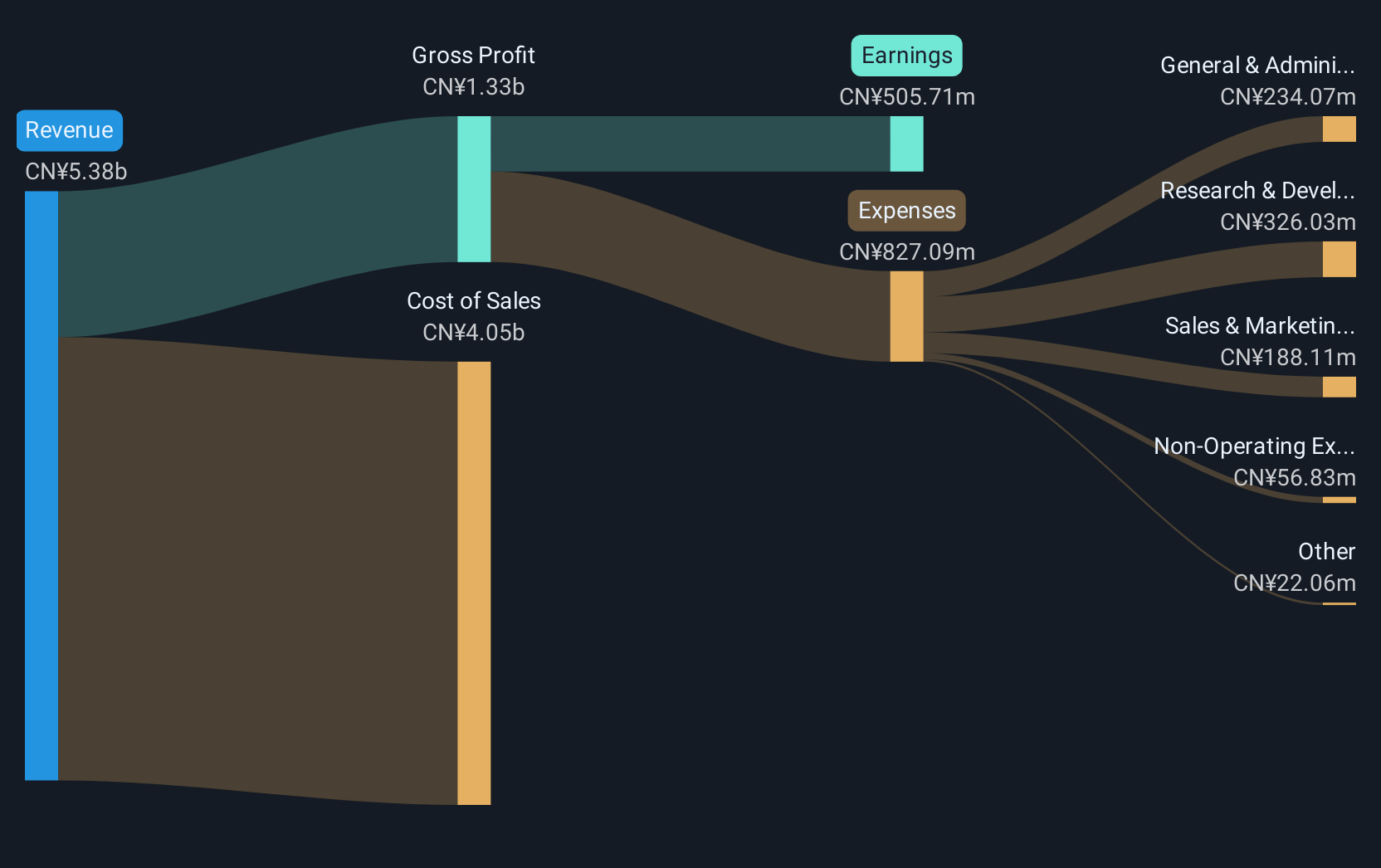

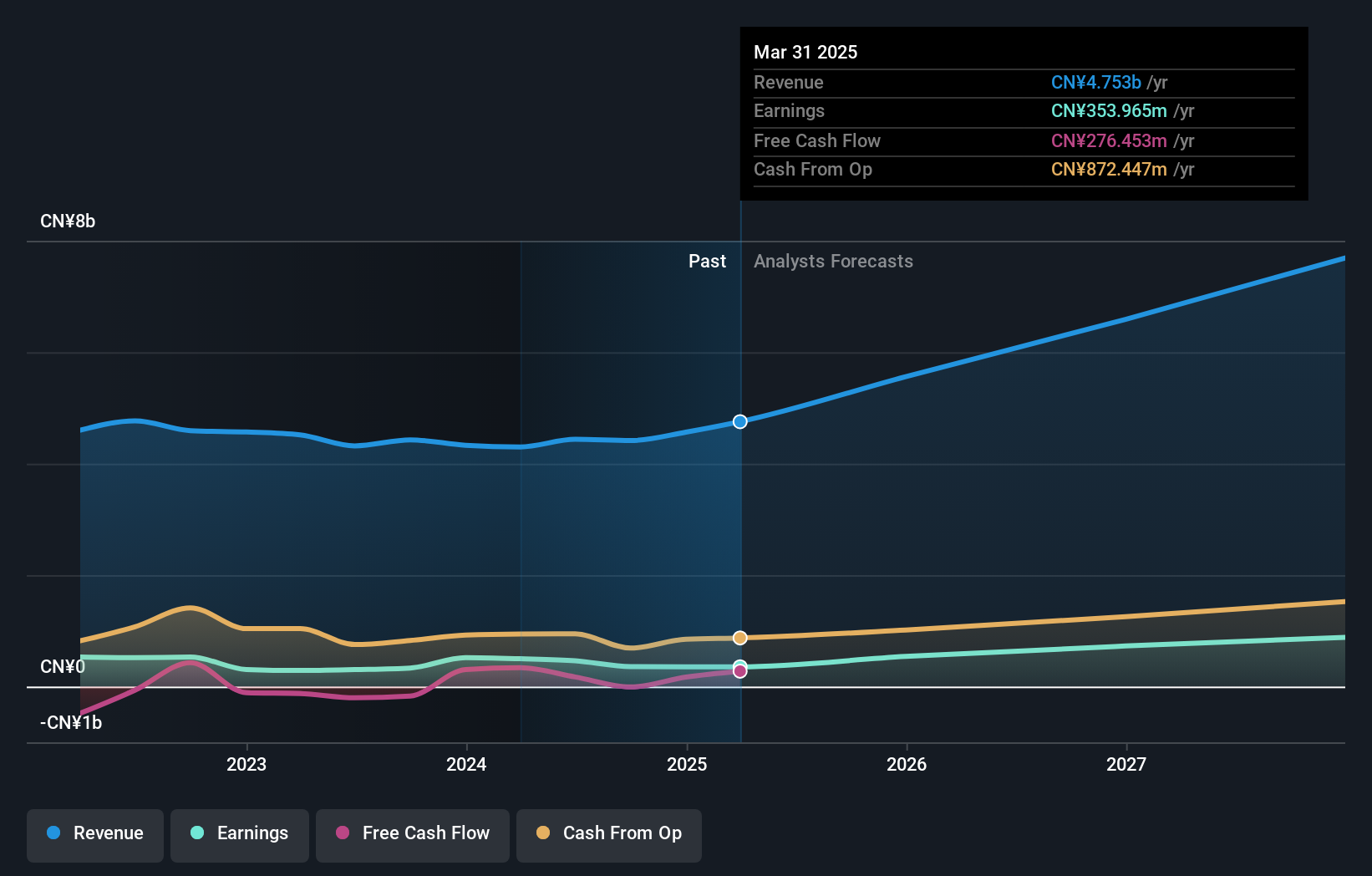

Operations: The company generates revenue primarily from its printed circuit boards segment, amounting to CN¥4.75 billion.

Aoshikang Technology, amidst a dynamic tech landscape, has shown commendable financial agility with a 17.3% annual revenue growth and an impressive 30.5% projected increase in earnings per year. Recent strategic moves include a robust share repurchase plan valued at CNY 180 million and consistent dividend payouts, signaling strong shareholder confidence. Despite facing challenges like a profit margin reduction to 7.4% from last year's 11.6%, the company's commitment to R&D and innovation positions it well for sustained growth within the competitive electronics sector.

Make It Happen

- Gain an insight into the universe of 742 Global High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002913

Aoshikang Technology

Engages in the research, development, production, and sale of printed circuit boards.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives