- China

- /

- Electronic Equipment and Components

- /

- SHSE:688010

There's Reason For Concern Over Fujian Forecam Optics Co., Ltd.'s (SHSE:688010) Massive 117% Price Jump

Despite an already strong run, Fujian Forecam Optics Co., Ltd. (SHSE:688010) shares have been powering on, with a gain of 117% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

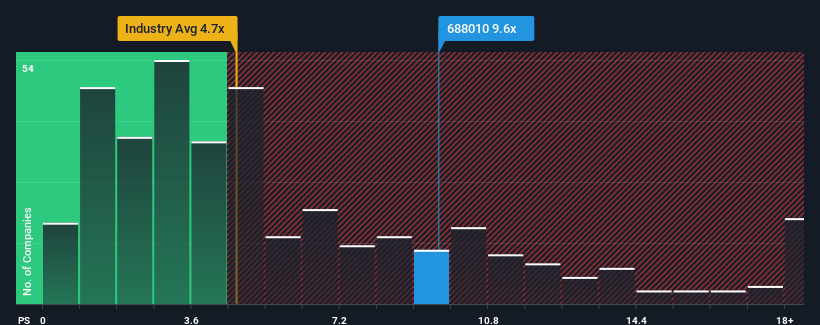

Since its price has surged higher, Fujian Forecam Optics may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 9.6x, when you consider almost half of the companies in the Electronic industry in China have P/S ratios under 4.7x and even P/S lower than 2x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Fujian Forecam Optics

How Has Fujian Forecam Optics Performed Recently?

For instance, Fujian Forecam Optics' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Fujian Forecam Optics, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Fujian Forecam Optics?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Fujian Forecam Optics' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. As a result, revenue from three years ago have also fallen 14% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 27% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Fujian Forecam Optics is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Fujian Forecam Optics' P/S

Fujian Forecam Optics' P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Fujian Forecam Optics revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Fujian Forecam Optics has 2 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688010

Fujian Forecam Optics

Researches, manufactures, and sells special and civilian optical lenses in the People's Republic of China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives