- China

- /

- Electronic Equipment and Components

- /

- SHSE:688003

High Growth Tech Stocks in Asia Including Suzhou TZTEK Technology

Reviewed by Simply Wall St

As global trade tensions show signs of easing, Asian markets are experiencing a positive shift in sentiment, with major indices like the Hang Seng Index and Japan's Nikkei 225 posting gains. In this environment, high-growth tech stocks in Asia, such as those from Suzhou TZTEK Technology, are drawing attention for their potential to leverage technological advancements and government support to navigate economic uncertainties effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.94% | 28.01% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 31.75% | 32.37% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Suzhou TZTEK Technology (SHSE:688003)

Simply Wall St Growth Rating: ★★★★★☆

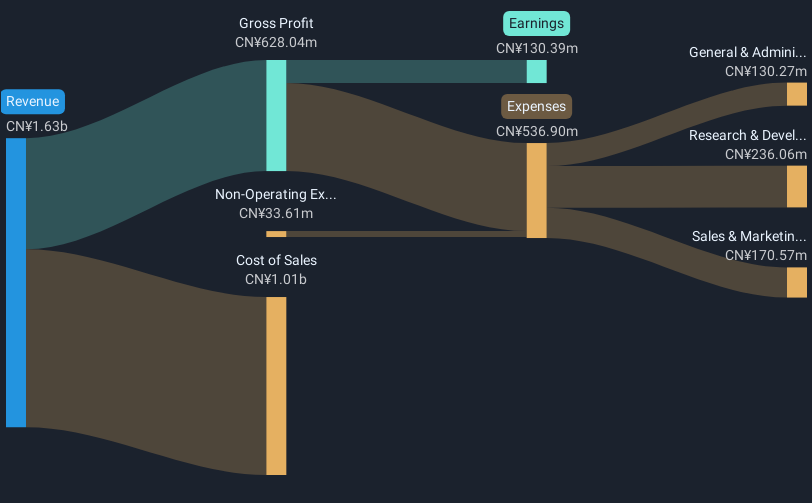

Overview: Suzhou TZTEK Technology Co., Ltd specializes in designing, developing, assembling, and debugging industrial vision equipment in China, with a market cap of CN¥10.22 billion.

Operations: The company focuses on industrial vision equipment, generating revenue primarily through the design, development, assembly, and debugging of these products.

Despite a challenging year with a net earnings decline of 38.1%, Suzhou TZTEK Technology is poised for recovery, projecting an impressive annual earnings growth rate of 51%. This forecast significantly outpaces the broader Chinese market's expected growth. The company's commitment to innovation is evident from its R&D spending, which remains robust in support of its technological advancements in the electronics sector. Recent financials show a revenue increase to CNY 218.63 million in Q1 2025 from CNY 193.24 million the previous year, although profit margins have dipped from 12.7% to 8%. Looking ahead, TZTEK's strategic focus on expanding its tech portfolio and improving operational efficiencies could enhance its market position and attract further investor interest.

- Click here and access our complete health analysis report to understand the dynamics of Suzhou TZTEK Technology.

Understand Suzhou TZTEK Technology's track record by examining our Past report.

Suzhou Dongshan Precision Manufacturing (SZSE:002384)

Simply Wall St Growth Rating: ★★★★☆☆

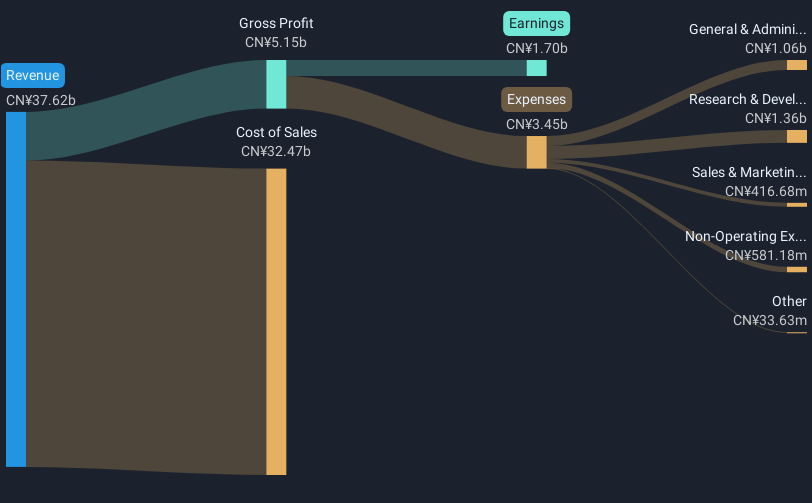

Overview: Suzhou Dongshan Precision Manufacturing Co., Ltd. operates as a company specializing in precision manufacturing, with a market cap of CN¥43.92 billion.

Operations: Dongshan Precision Manufacturing focuses on precision manufacturing, generating revenue primarily from its core operations in this sector. The company has a market cap of CN¥43.92 billion, reflecting its significant presence in the industry.

Suzhou Dongshan Precision Manufacturing has shown a robust performance with first-quarter sales rising to CNY 8.6 billion, up from CNY 7.74 billion year-over-year, and net income increasing significantly to CNY 455.86 million from CNY 289.35 million. This growth trajectory is underscored by an aggressive share repurchase program announced recently, aimed at buying back shares worth up to CNY 200 million at a price cap of CNY 48.78 each, reflecting confidence in its financial health and commitment to shareholder value. Additionally, the company's earnings are projected to grow by an impressive 41.4% annually, outpacing the broader Chinese market's growth rate of approximately 23.9%, positioning it favorably within the high-tech sector in Asia despite its past challenges with earnings volatility and competitive pressures in the electronics industry.

- Take a closer look at Suzhou Dongshan Precision Manufacturing's potential here in our health report.

Guangzhou Sie Consulting (SZSE:300687)

Simply Wall St Growth Rating: ★★★★☆☆

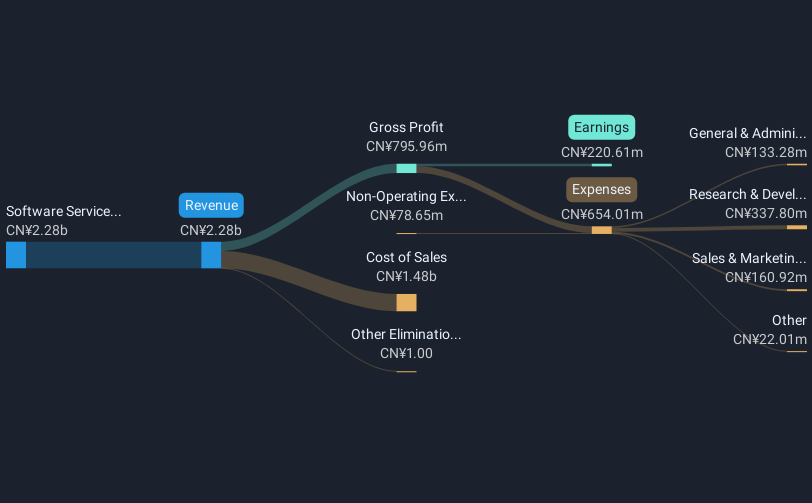

Overview: Guangzhou Sie Consulting Co., Ltd. is a solution provider specializing in industrial Internet, intelligent manufacturing, core ERP, and business operation centers in China with a market cap of CN¥13 billion.

Operations: The company generates revenue primarily from software services, amounting to CN¥2.40 billion.

Guangzhou Sie Consulting has demonstrated resilience with a year-over-year revenue increase from CNY 2,248.14 million to CNY 2,388.41 million, despite a notable drop in net income from CNY 254.4 million to CNY 139.38 million. The company's aggressive share repurchase strategy, completing the buyback of nearly 0.66% of its shares for CNY 42.39 million, signals confidence in its financial stability and commitment to enhancing shareholder value. Moreover, with an expected annual earnings growth rate of 49.6%, Guangzhou Sie Consulting is poised for rapid expansion in the tech sector, outpacing the broader Chinese market's growth forecast of approximately 23%. This robust projection is underpinned by a strategic focus on innovative software solutions that cater to evolving industry needs.

Key Takeaways

- Discover the full array of 484 Asian High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688003

Suzhou TZTEK Technology

Engages in the design, development, assembly, and debugging of the industrial vision equipment in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives