- China

- /

- Electronic Equipment and Components

- /

- SHSE:688003

Asian Stocks With High Insider Ownership Expecting Up To 97% Growth

Reviewed by Simply Wall St

As global trade tensions show signs of easing, Asian markets are experiencing a cautious optimism, with Chinese indices advancing amid expectations of government stimulus to counteract U.S. tariffs. In this context, growth companies in Asia with high insider ownership can be particularly attractive due to their potential for significant expansion and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| M31 Technology (TPEX:6643) | 27.2% | 69.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 61.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 16.4% | 121.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Here's a peek at a few of the choices from the screener.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in China, with a market capitalization of approximately HK$20 billion.

Operations: The company's revenue is primarily derived from its Sage AI Platform at CN¥3.68 billion, followed by Shift Intelligent Solutions at CN¥1.02 billion, and Sagegpt Aigs Services at CN¥562.50 million.

Insider Ownership: 21.5%

Earnings Growth Forecast: 97.2% p.a.

Beijing Fourth Paradigm Technology has demonstrated strong revenue growth, increasing from CNY 4.20 billion to CNY 5.26 billion over the past year, while reducing net losses significantly. Analysts expect earnings to grow at a robust rate of 97.24% annually, with revenue growth outpacing the Hong Kong market average. Despite recent volatility in share prices and low forecasted return on equity, the company is expected to become profitable within three years, suggesting potential for substantial future growth. Recent board changes aim to enhance corporate governance practices further supporting its long-term strategy.

- Navigate through the intricacies of Beijing Fourth Paradigm Technology with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Beijing Fourth Paradigm Technology's share price might be on the cheaper side.

Suzhou TZTEK Technology (SHSE:688003)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou TZTEK Technology Co., Ltd specializes in designing, developing, assembling, and debugging industrial vision equipment in China with a market cap of CN¥10.22 billion.

Operations: Revenue Segments (in millions of CN¥):

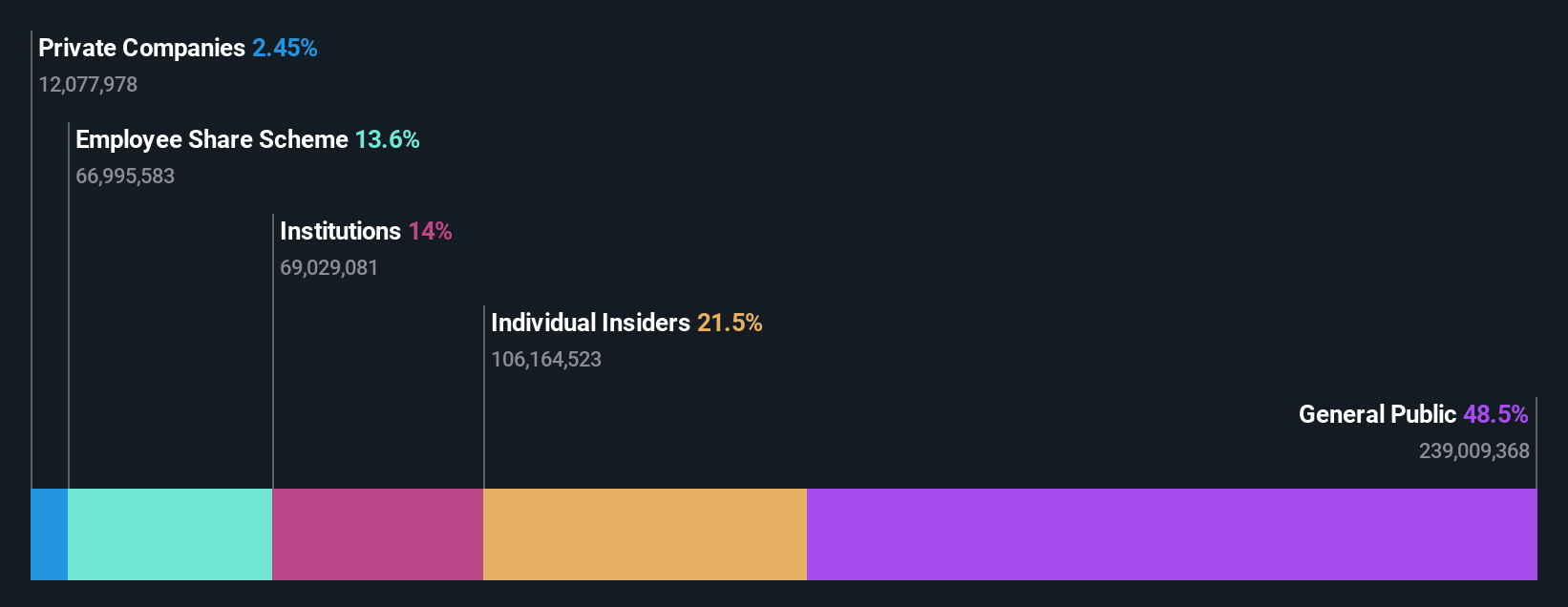

Insider Ownership: 15.3%

Earnings Growth Forecast: 51% p.a.

Suzhou TZTEK Technology is poised for significant growth, with earnings projected to increase by 51% annually, outpacing the CN market. Despite a volatile share price and declining profit margins from 12.7% to 8%, revenue is expected to grow at 24.1% per year, surpassing market averages. The company reported a Q1 net loss of CNY 32.3 million but improved from last year's loss of CNY 38 million, indicating potential recovery amidst high insider ownership levels.

- Click here to discover the nuances of Suzhou TZTEK Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report Suzhou TZTEK Technology implies its share price may be too high.

Lucky Harvest (SZSE:002965)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lucky Harvest Co., Ltd. operates in China, focusing on the research, development, production, and sale of precision stamping dies and structural metal parts, with a market cap of CN¥11 billion.

Operations: The company generates revenue through its activities in the research, development, production, and sale of precision stamping dies and structural metal parts within China.

Insider Ownership: 33.1%

Earnings Growth Forecast: 27% p.a.

Lucky Harvest's earnings are expected to grow significantly at 27% annually, outpacing the CN market. Despite revenue growth of 13.4% per year being slower than 20%, it exceeds the market average. Recent earnings reports show a decline in net income and profit margins compared to last year, with Q1 net income at CNY 85.9 million down from CNY 121.24 million. The stock trades well below estimated fair value but has an unstable dividend history and volatile share price.

- Delve into the full analysis future growth report here for a deeper understanding of Lucky Harvest.

- Insights from our recent valuation report point to the potential undervaluation of Lucky Harvest shares in the market.

Key Takeaways

- Discover the full array of 627 Fast Growing Asian Companies With High Insider Ownership right here.

- Ready For A Different Approach? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Suzhou TZTEK Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688003

Suzhou TZTEK Technology

Engages in the design, development, assembly, and debugging of the industrial vision equipment in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives