- China

- /

- Electronic Equipment and Components

- /

- SHSE:605118

Undiscovered Gems To Explore On None Exchange This October 2024

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and a cautious economic outlook, small-cap stocks have struggled to keep pace with their larger counterparts, as evidenced by recent declines in indices like the Russell 2000. In this environment, identifying undiscovered gems—stocks that offer potential growth despite broader market headwinds—requires a keen focus on companies with strong fundamentals and resilience to economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

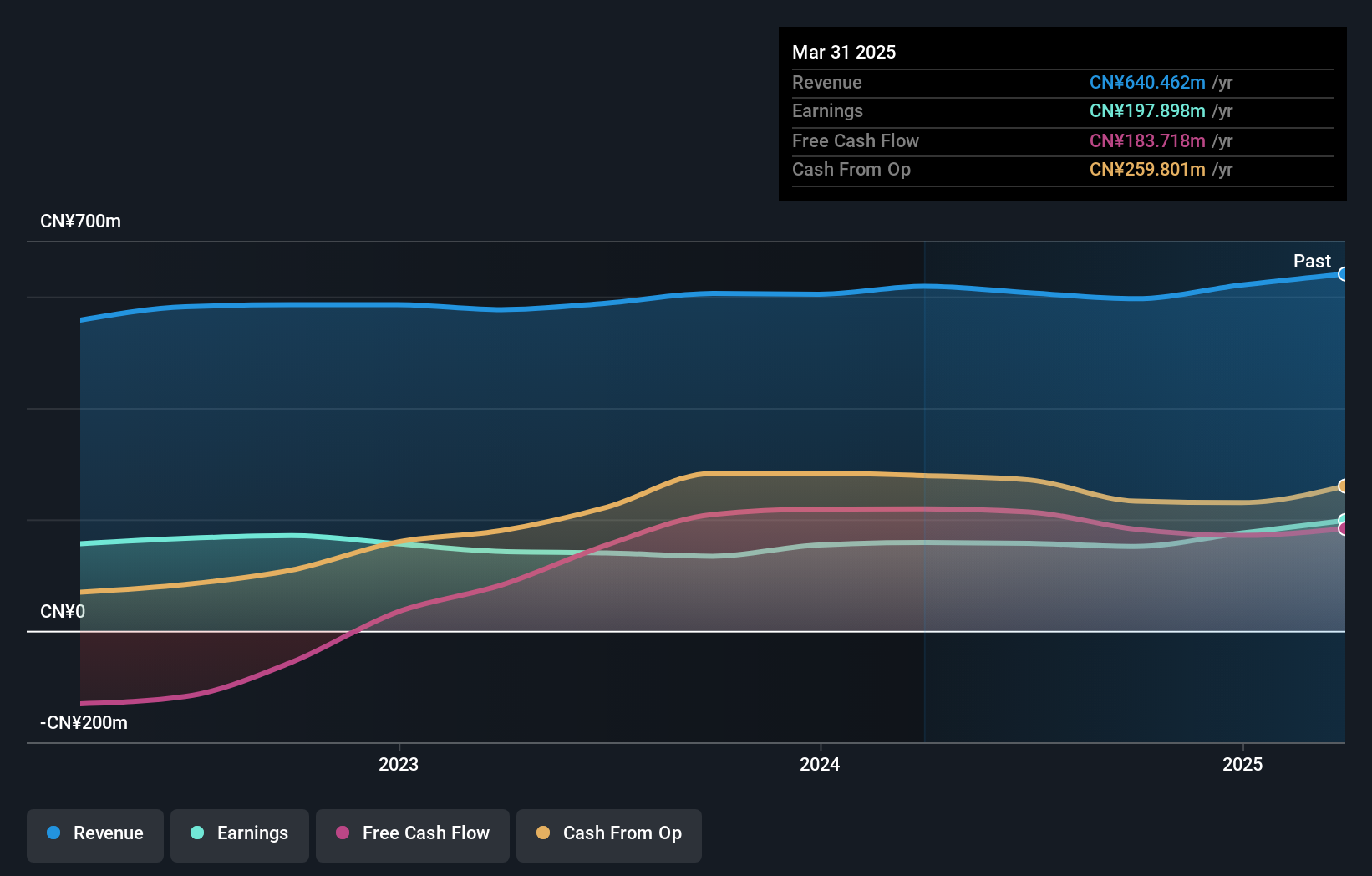

Xiamen Leading Optics (SHSE:605118)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Leading Optics Co., Ltd. offers optical solutions globally and has a market capitalization of CN¥7.25 billion.

Operations: The company generates revenue primarily through its optical solutions business. It has a market capitalization of CN¥7.25 billion.

Xiamen Leading Optics, a nimble player in the optics industry, showcases robust financial health with high-quality earnings and an impressive debt-to-equity ratio improvement from 10.8% to 6.9% over five years. Despite a slight dip in sales to CNY 455.07 million for the first nine months of 2024 compared to last year, net income remains strong at CNY 115.72 million. The company's earnings per share have seen minor adjustments but remain stable around CNY 0.28 per share, reflecting resilience amid challenges and positioning it as a promising contender within its sector for potential growth opportunities ahead.

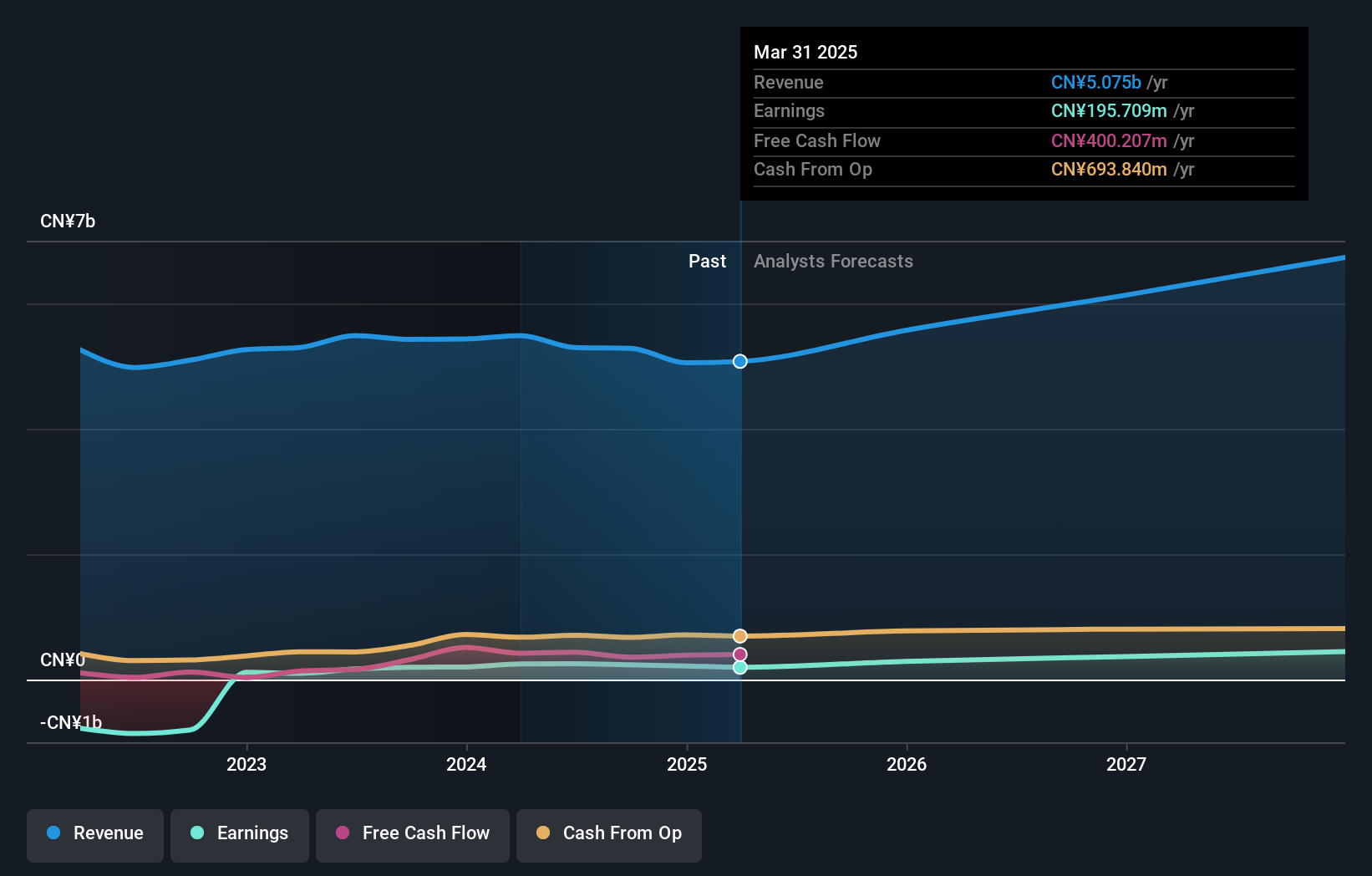

Nanfang Zhongjin Environment (SZSE:300145)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nanfang Zhongjin Environment Co., Ltd., with a market cap of CN¥6.32 billion, operates in the general equipment manufacturing sector through its subsidiaries.

Operations: Nanfang Zhongjin Environment generates revenue primarily from its general equipment manufacturing activities. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

Nanfang Zhongjin Environment, a relatively lesser-known player in the industry, has shown promising financial metrics. Despite a dip in sales from CNY 3.73 billion to CNY 3.59 billion over nine months, net income rose to CNY 251.88 million from CNY 215.97 million, indicating improved profitability with basic earnings per share climbing to CNY 0.133 from CNY 0.114. The company appears undervalued by about 54% compared to its fair value estimate and boasts a healthy free cash flow position alongside satisfactory debt levels with a net debt-to-equity ratio of around 39%. Earnings growth of nearly 20% outpaced the broader machinery sector's performance last year.

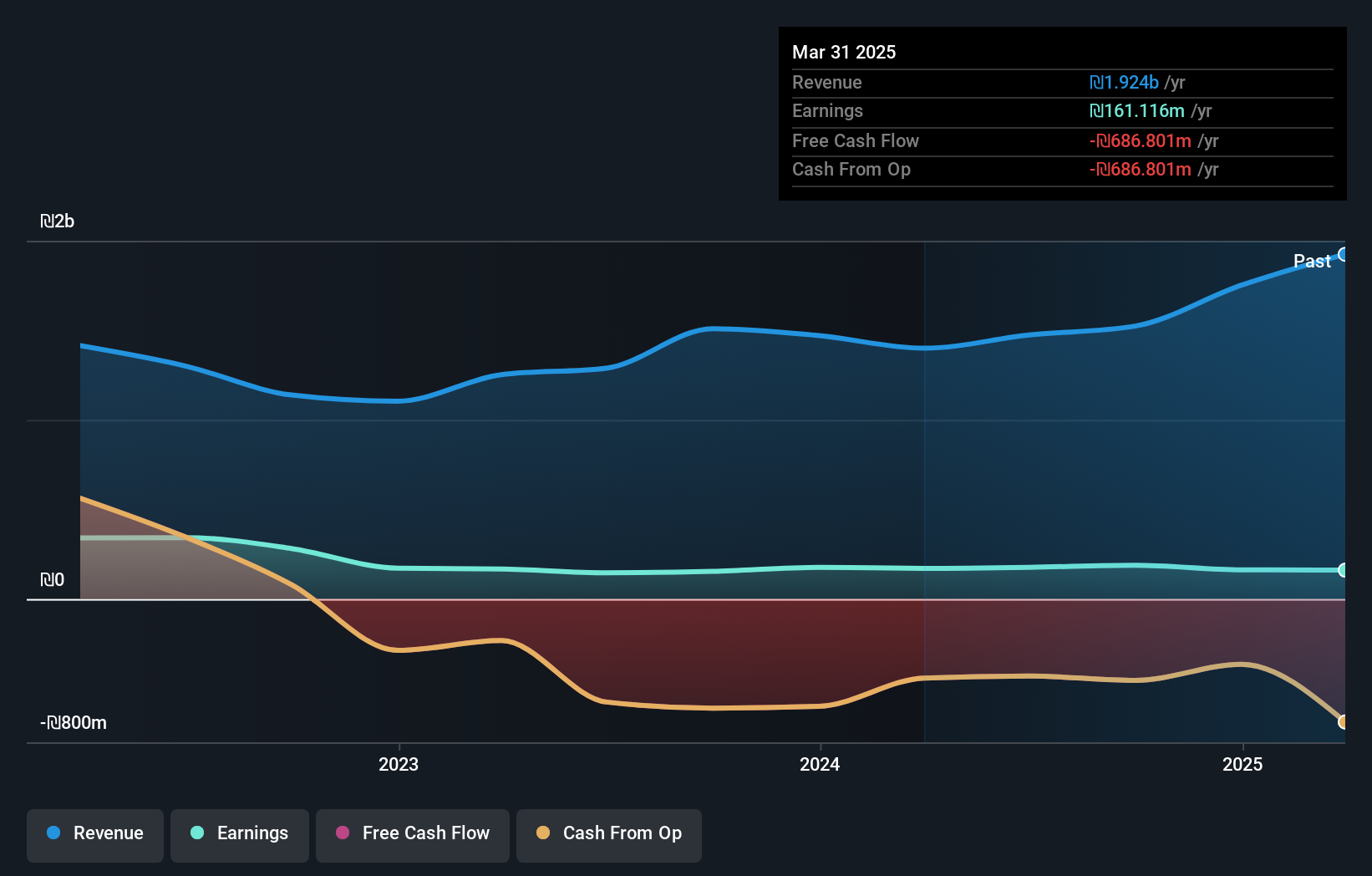

Azorim-Investment Development & Construction (TASE:AZRM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Azorim-Investment Development & Construction Co. operates in the real estate sector, focusing on residential construction and rental properties primarily in Israel and the USA, with a market cap of ₪4.16 billion.

Operations: Azorim-Investment Development & Construction Co. generates revenue primarily from residential construction in Israel, contributing ₪1.38 billion to its total income. Additional revenue streams include residences for rent in Israel and the USA, accounting for ₪79.59 million and ₪29.16 million respectively, as well as income-producing assets in Israel at ₪45.93 million.

Azorim, a dynamic player in the investment and construction space, showcases notable financial performance despite its small market presence. Over the past year, earnings surged by 20.6%, outpacing the Consumer Durables industry growth of 9.7%. However, a high net debt to equity ratio of 143.9% suggests leverage concerns that aren't fully offset by operating cash flow coverage. The company has managed to reduce its debt to equity from 175.1% five years ago to 150.8%, indicating some progress on this front. Recent results reveal revenue at ₪400 million for Q2 2024 with net income climbing slightly to ₪69 million compared to last year’s figures.

Next Steps

- Investigate our full lineup of 4739 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605118

Solid track record with excellent balance sheet.

Market Insights

Community Narratives