- Hong Kong

- /

- Real Estate

- /

- SEHK:697

Discovering Asia's Hidden Gems In July 2025

Reviewed by Simply Wall St

In recent weeks, the Asian markets have been capturing attention with their dynamic shifts, as key indices like China's CSI 300 and Japan's Nikkei 225 show varied performance amid ongoing trade negotiations and economic indicators. As investors navigate this landscape, identifying promising small-cap stocks becomes crucial; these companies often offer unique growth opportunities by capitalizing on regional strengths and emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sinopower Semiconductor | NA | 1.45% | -4.33% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.24% | -15.32% | 17.90% | ★★★★★★ |

| Zhejiang Sling Automobile Bearing | NA | 6.76% | 24.26% | ★★★★★★ |

| Hokkan Holdings | 66.84% | -5.71% | 18.42% | ★★★★★☆ |

| Wholetech System Hitech | 3.31% | 15.16% | 19.61% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 39.11% | 5.91% | 0.76% | ★★★★★☆ |

| KinjiroLtd | 22.32% | 10.69% | 21.02% | ★★★★★☆ |

| Qingdao Daneng Environmental Protection Equipment | 65.76% | 31.58% | 23.66% | ★★★★☆☆ |

| Techno Smart | 10.18% | 12.81% | 17.66% | ★★★★☆☆ |

| ASRock Rack Incorporation | 26.93% | 225.32% | 6287.64% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Shoucheng Holdings (SEHK:697)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shoucheng Holdings Limited is an investment holding company involved in the infrastructure asset management business, with a market capitalization of approximately HK$13.18 billion.

Operations: The company generates revenue from its infrastructure asset management business, amounting to HK$1.22 billion.

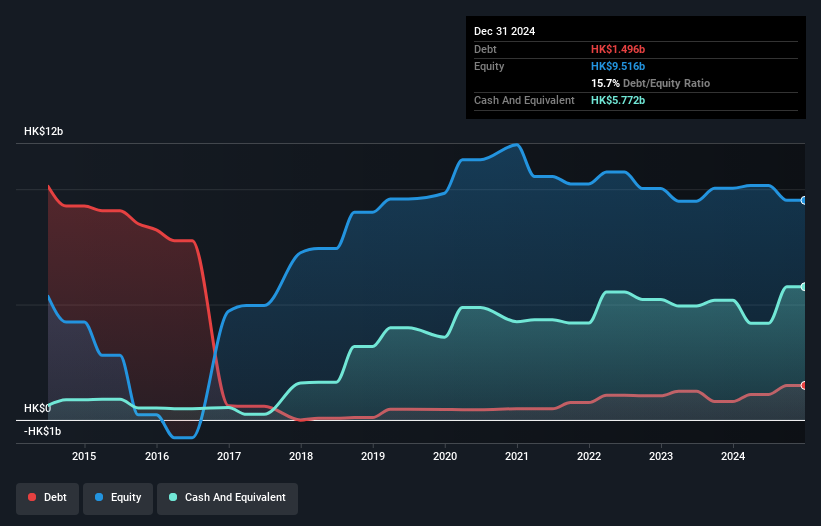

Shoucheng Holdings, a smaller player in the market, has shown resilience with earnings growth of 1.6% over the past year, outpacing the Real Estate industry's -19.9%. The company is on solid footing financially, with more cash than total debt and high-quality earnings that ensure interest payments are well-covered. Recent board changes indicate an active management strategy; Mr. Li Hao and Mr. Liu Jingwei have been re-designated as Executive Directors, potentially aligning leadership closer to operational goals. Future growth seems promising with earnings forecasted to grow at 26.85% annually, reflecting strong potential for value creation in the coming years.

- Unlock comprehensive insights into our analysis of Shoucheng Holdings stock in this health report.

Understand Shoucheng Holdings' track record by examining our Past report.

Xiamen Leading Optics (SHSE:605118)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xiamen Leading Optics Co., Ltd. offers optical solutions globally and has a market capitalization of CN¥11.20 billion.

Operations: Xiamen Leading Optics generates revenue primarily from its Optical Manufacturing segment, which accounts for CN¥640.46 million. The company's market capitalization stands at CN¥11.20 billion.

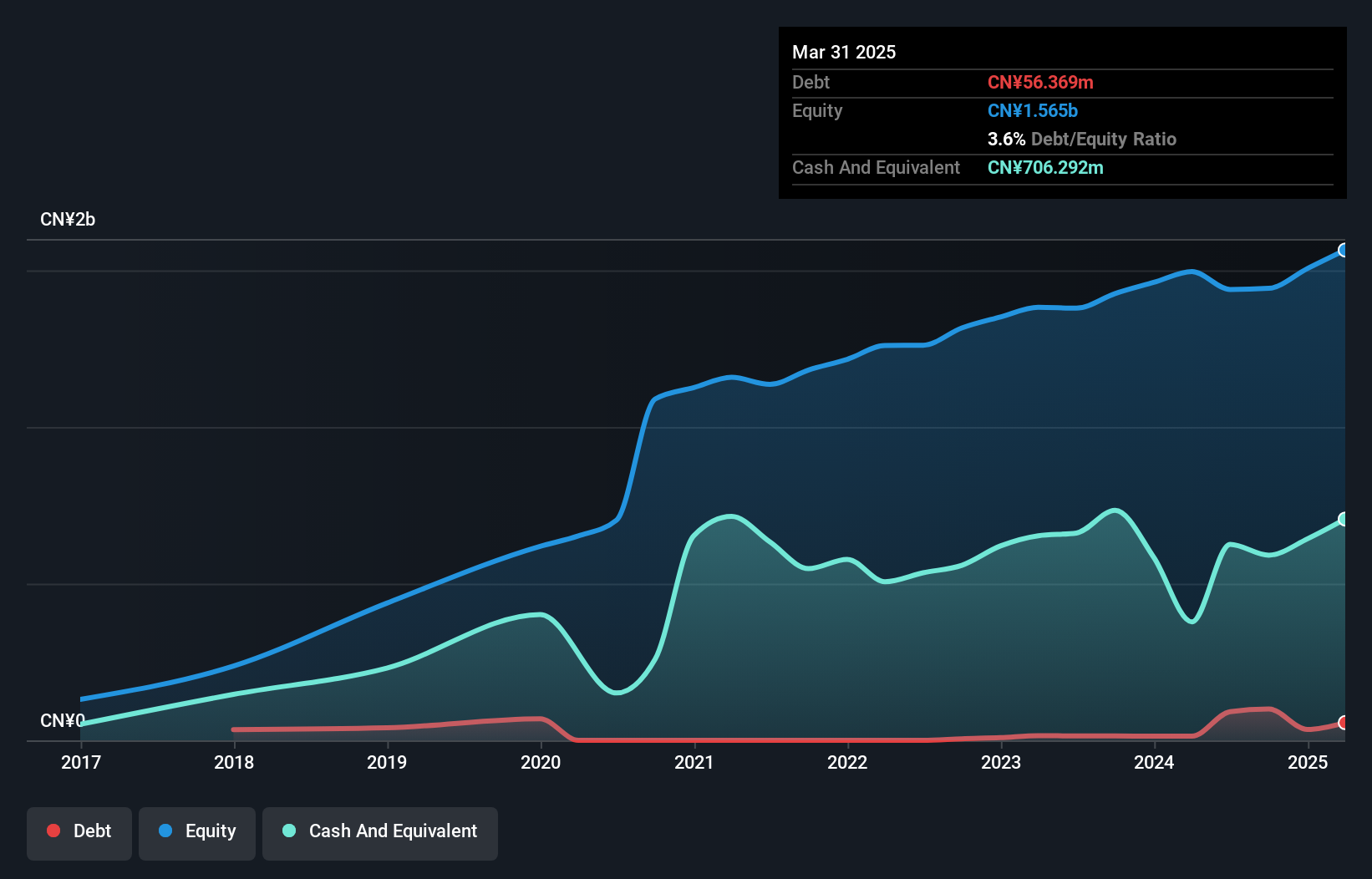

Xiamen Leading Optics, a promising player in the optics industry, has demonstrated robust financial health with earnings growth of 24.9% over the past year, outpacing the electronic industry's 2.9%. The company reported a net income increase to CNY 56.87 million in Q1 2025 from CNY 34.3 million a year earlier, alongside sales rising to CNY 165.1 million from CNY 145.12 million. Despite an increase in its debt-to-equity ratio from zero to 3.6% over five years, Xiamen remains free cash flow positive and holds more cash than total debt, indicating solid financial management and potential for sustained growth.

- Navigate through the intricacies of Xiamen Leading Optics with our comprehensive health report here.

Explore historical data to track Xiamen Leading Optics' performance over time in our Past section.

Suzhou Tianmai Thermal Technology (SZSE:301626)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Tianmai Thermal Technology Co., Ltd. specializes in the development and production of thermal management solutions for electronic components, with a market cap of CN¥13.48 billion.

Operations: Suzhou Tianmai derives its revenue primarily from the electronic components and parts segment, generating CN¥956.46 million. The company's focus on this segment is a key contributor to its financial performance.

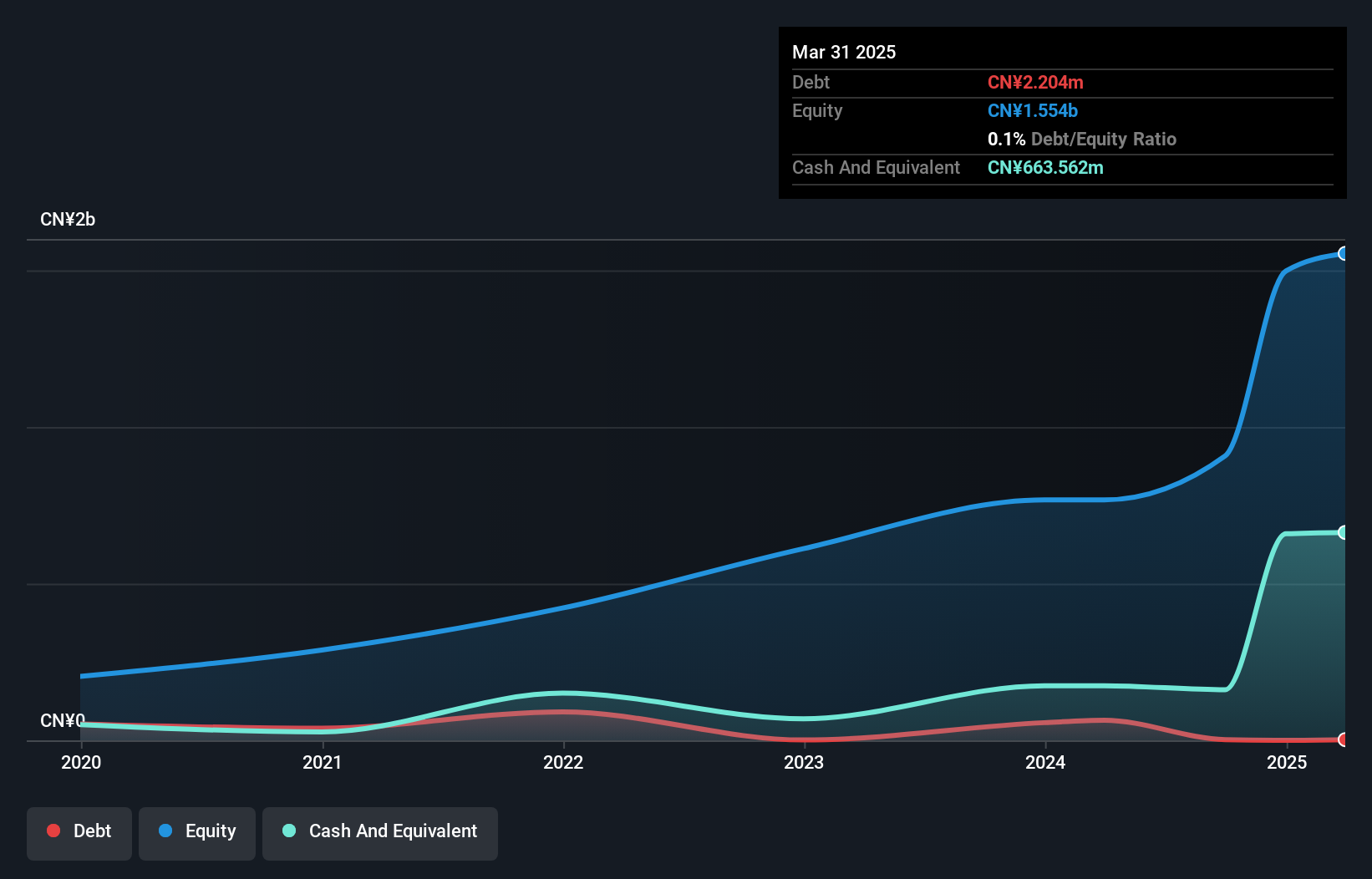

Suzhou Tianmai Thermal Technology, a relatively small player in the thermal technology sector, has shown resilience with earnings growth of 3.2% last year, outpacing the electronic industry's average of 2.9%. The company has effectively managed its debt levels, reducing its debt-to-equity ratio from 21.7% to just 0.1% over five years, indicating strong financial discipline. Despite a volatile share price recently, it maintains high-quality earnings and positive free cash flow at CNY 43.78 million as of March 2025. Recent dividend announcements reflect shareholder confidence with CNY 5.60 per ten shares approved for distribution in June 2025.

Turning Ideas Into Actions

- Unlock our comprehensive list of 2608 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:697

Shoucheng Holdings

An investment holding company, engages in the infrastructure asset management business.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion