- Taiwan

- /

- Tech Hardware

- /

- TWSE:2382

High Growth Tech Stocks To Watch In July 2025

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising consumer inflation in the U.S. and mixed performances across major indices, tech stocks have shown resilience with strong corporate earnings boosting the S&P 500 and Nasdaq Composite to new highs. Amidst these dynamic conditions, identifying high growth tech stocks involves looking for companies that not only demonstrate robust earnings potential but also possess innovative capabilities to thrive in an evolving economic landscape.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Pharma Mar | 26.26% | 43.28% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Olympic Circuit Technology (SHSE:603920)

Simply Wall St Growth Rating: ★★★★☆☆

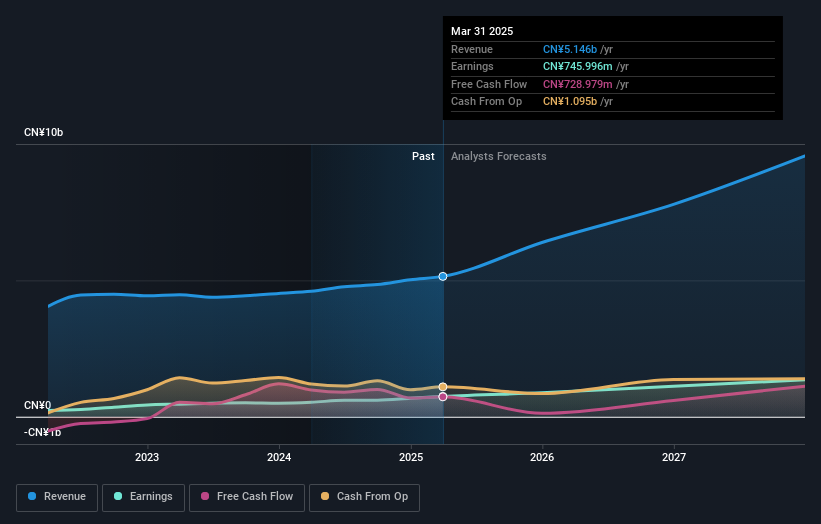

Overview: Olympic Circuit Technology Co., Ltd specializes in the manufacturing and sale of rigid printed circuit boards (PCBs) with a market capitalization of approximately CN¥22.44 billion.

Operations: The company generates revenue primarily from the sale of electronic components and parts, totaling CN¥5.15 billion.

Olympic Circuit Technology has demonstrated robust performance, with earnings growth outpacing the Electronic industry by a significant margin, recording a 41% increase over the past year compared to the industry's 2.9%. This growth trajectory is supported by substantial R&D investments, aligning with a revenue forecast that anticipates a 21.6% annual increase, surpassing both the CN market's expectations and broader industry trends. The company's strategic focus on innovation is evident from its R&D spending trends which are crucial for sustaining its competitive edge in rapidly evolving tech landscapes. While earnings are projected to grow at 21.6% per year, slightly below the CN market average of 23.4%, Olympic Circuit’s ability to maintain high-quality earnings and positive free cash flow positions it as a resilient contender in high-tech sectors moving forward.

Shanghai Suochen Information TechnologyLtd (SHSE:688507)

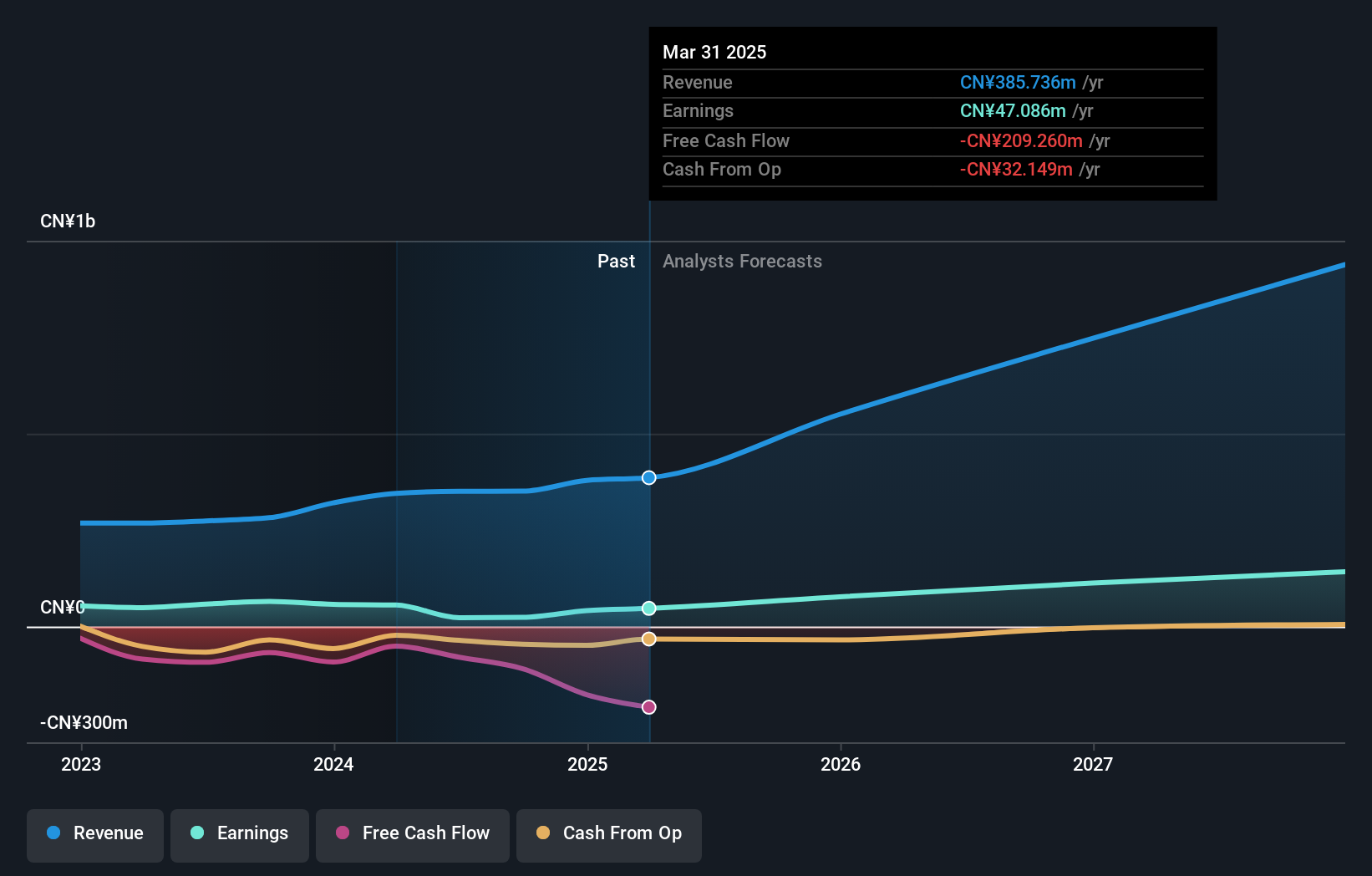

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Suochen Information Technology Ltd. operates in the technology sector and has a market capitalization of CN¥7.24 billion.

Operations: Shanghai Suochen Information Technology Ltd. generates revenue through various segments within the technology sector. The company's cost structure and financial performance details are not specified in the provided text, limiting further analysis of specific revenue streams or profit margins.

Shanghai Suochen Information TechnologyLtd. is navigating a challenging landscape with a notable 30.6% projected annual revenue growth, outpacing the CN market's 12.5%. Despite recent setbacks, including a net loss reduction from CNY 21.27 million to CNY 15.63 million in Q1 2025, the company demonstrates resilience with its focus on R&D and innovation strategies aimed at reversing negative trends. The firm’s commitment is evident in its aggressive pursuit of growth despite a highly volatile share price, positioning it for potential recovery and future gains in the tech sector.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★☆☆

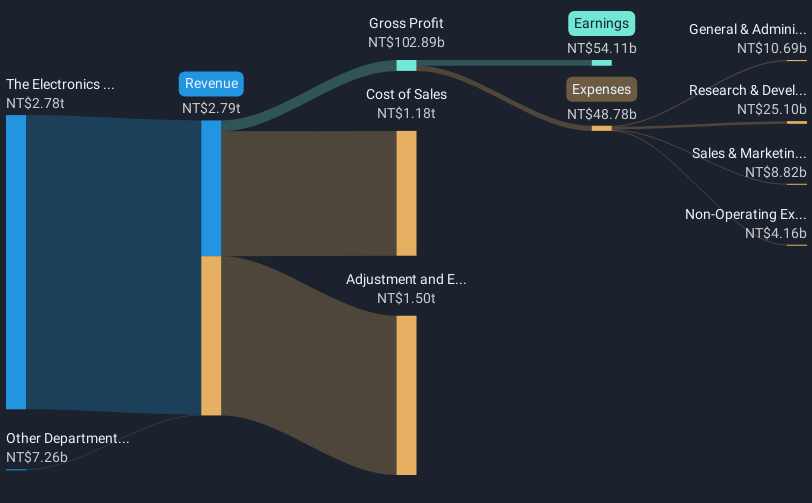

Overview: Quanta Computer Inc. is a global manufacturer and seller of laptop computers and telecommunication products, with operations spanning the United States, Mainland China, the Netherlands, Japan, and other international markets; it has a market cap of NT$1.05 trillion.

Operations: Quanta Computer Inc. generates significant revenue from its electronics sector, amounting to NT$3.40 trillion. The company operates across several key international markets, including the United States and Mainland China.

Quanta Computer's recent expansion with Lumus to enhance AR technology production underscores its strategic alignment with burgeoning tech trends, evidenced by a substantial investment in automated manufacturing lines. This move not only boosts production efficiency but also positions Quanta at the forefront of the AR market, which is critical as the industry shifts towards more immersive technology experiences. Moreover, Quanta's robust annual revenue growth of 23.9% and an impressive earnings increase of 48.3% over the past year reflect its effective adaptation and innovation in a competitive landscape. With R&D expenses consistently channeling into pivotal tech advancements, Quanta is setting a benchmark for operational excellence and market readiness in high-tech sectors.

Turning Ideas Into Actions

- Access the full spectrum of 743 Global High Growth Tech and AI Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2382

Quanta Computer

Manufactures, processes, and sells laptop computers and telecommunication products in the United States, Mainland China, the Netherlands, Japan, and internationally.

Very undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives