- China

- /

- Electronic Equipment and Components

- /

- SHSE:603920

Asian Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

Amid ongoing geopolitical tensions and fluctuating trade dynamics, the Asian markets have shown resilience, with Chinese stocks experiencing a mid-week boost due to promising trade discussions. In such an environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 43% |

Below we spotlight a couple of our favorites from our exclusive screener.

Lotte Tour Development (KOSE:A032350)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Tour Development Co., Ltd., along with its subsidiaries, provides travel and tourism services in South Korea and has a market cap of ₩1.18 trillion.

Operations: The company's revenue is primarily derived from the Dream Tower Integrated Resort Division at ₩396.33 billion, followed by the Travel Related Service Sector (excluding Internet Journalism) at ₩88.05 billion, and the Internet Media Sector contributing ₩2.80 billion.

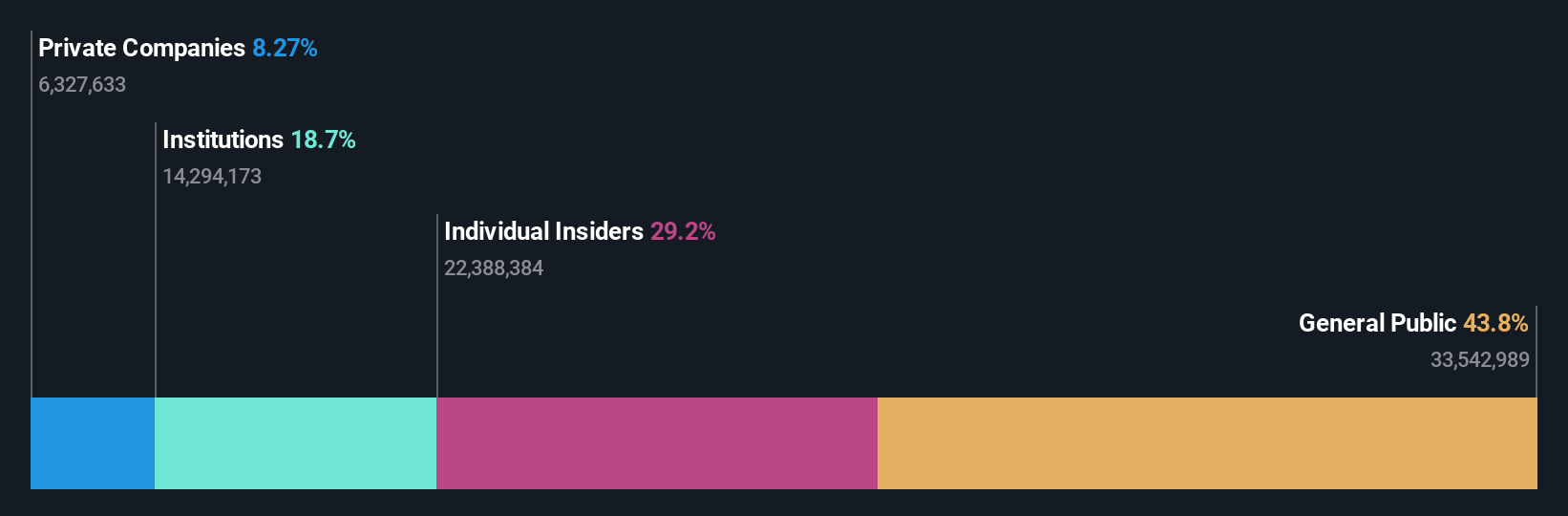

Insider Ownership: 29.2%

Lotte Tour Development's recent earnings report revealed a significant reduction in net loss, down to KRW 116.57 billion from KRW 202.22 billion the previous year, alongside an impressive sales increase to KRW 471.47 billion. Trading at a substantial discount to its estimated fair value, the company is expected to achieve profitability within three years with revenue growth forecast at 13.7% annually, surpassing market averages but lacking insider trading activity in recent months.

- Unlock comprehensive insights into our analysis of Lotte Tour Development stock in this growth report.

- In light of our recent valuation report, it seems possible that Lotte Tour Development is trading behind its estimated value.

Olympic Circuit Technology (SHSE:603920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Olympic Circuit Technology Co., Ltd specializes in the manufacturing and sale of rigid PCBs, with a market cap of CN¥20.04 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, generating CN¥5.15 billion.

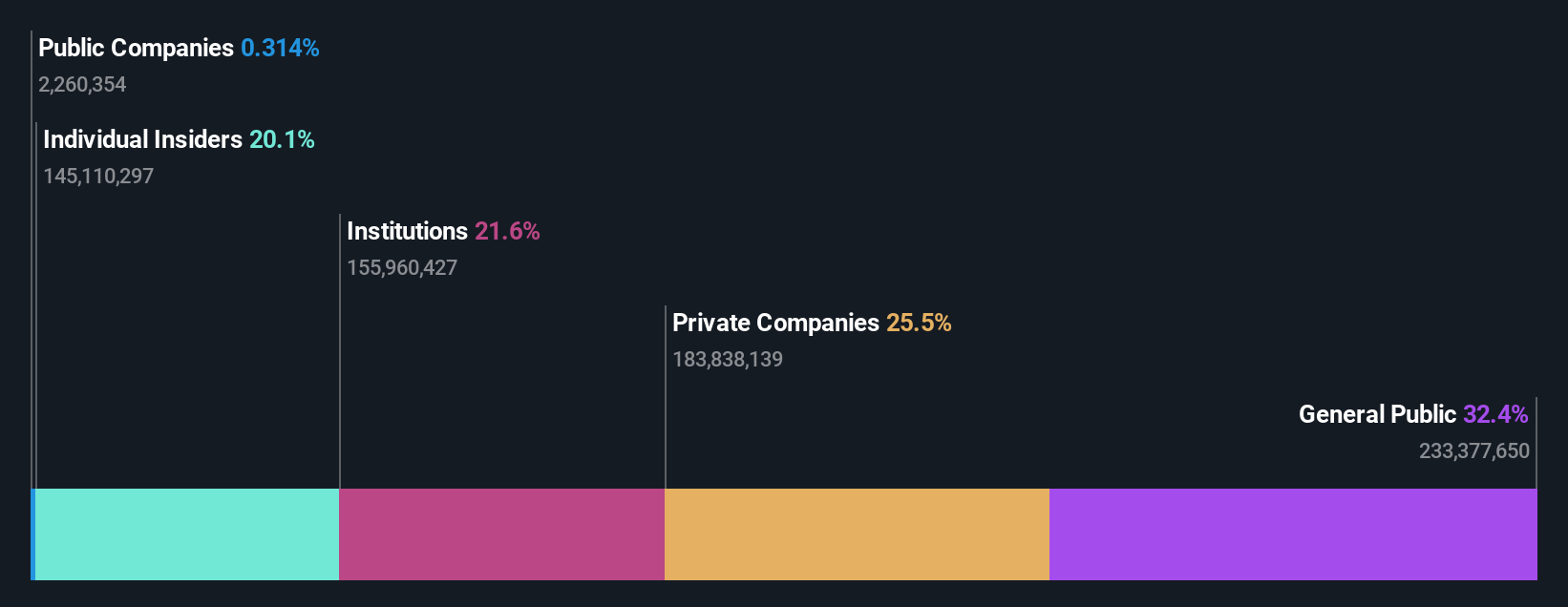

Insider Ownership: 20.1%

Olympic Circuit Technology's recent financial performance shows robust growth, with Q1 2025 sales rising to CNY 1.22 billion from CNY 1.09 billion and net income increasing to CNY 179.84 million from CNY 108.59 million year-on-year. Despite a low forecasted return on equity of 15.4%, the company is expected to maintain a significant annual earnings growth rate of over 20%. Insider ownership remains high without substantial insider trading activity recently, indicating confidence in its future prospects.

- Click to explore a detailed breakdown of our findings in Olympic Circuit Technology's earnings growth report.

- Upon reviewing our latest valuation report, Olympic Circuit Technology's share price might be too pessimistic.

SBT Ultrasonic Technology (SHSE:688392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SBT Ultrasonic Technology Co., Ltd. specializes in the development, manufacture, and sale of ultrasonic equipment and application solutions globally, with a market cap of CN¥6.84 billion.

Operations: The company's revenue primarily comes from its Machinery & Industrial Equipment segment, which generated CN¥611.51 million.

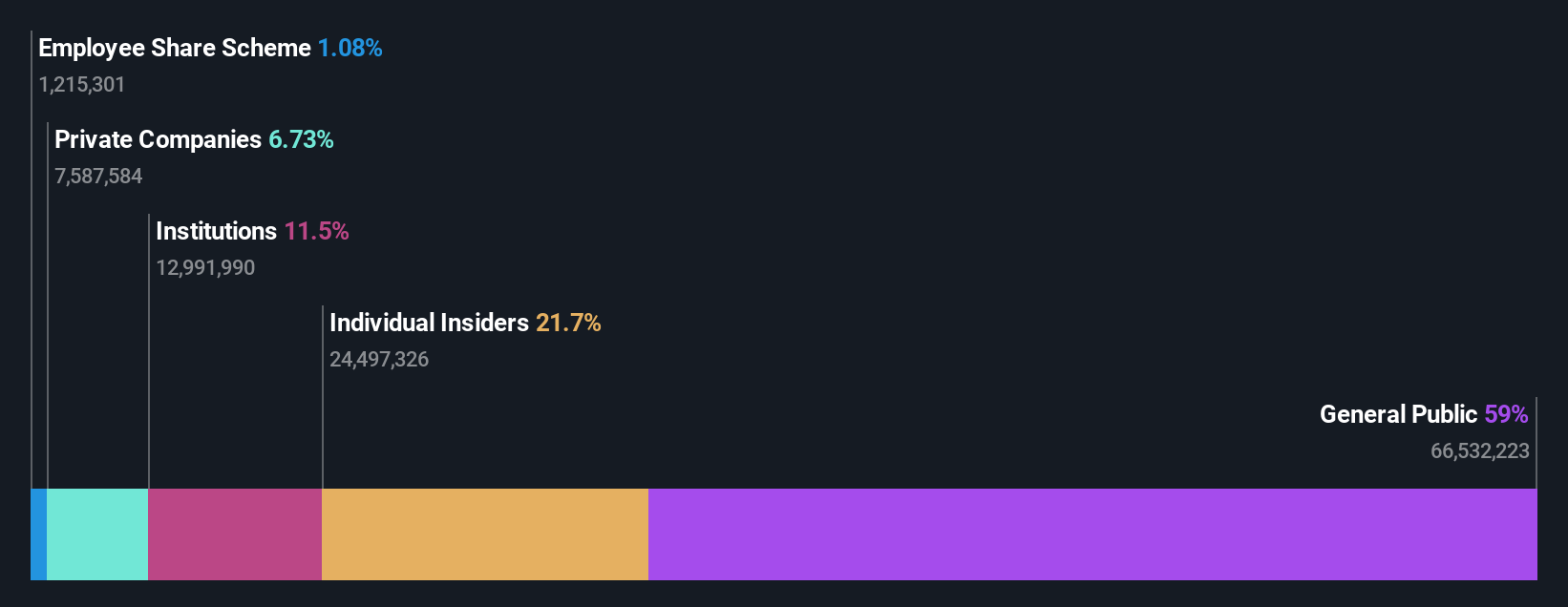

Insider Ownership: 22.7%

SBT Ultrasonic Technology demonstrates strong growth potential with earnings expected to rise by 39% annually over the next three years, outpacing the Chinese market's growth. Recent Q1 2025 results showed a significant increase in net income to CNY 23.63 million from CNY 1.05 million year-on-year, indicating robust performance. Despite a low forecasted return on equity of 12.3%, high insider ownership and no recent substantial insider trading suggest confidence in its trajectory amidst rapid revenue expansion at nearly 30% per year.

- Dive into the specifics of SBT Ultrasonic Technology here with our thorough growth forecast report.

- The analysis detailed in our SBT Ultrasonic Technology valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Delve into our full catalog of 606 Fast Growing Asian Companies With High Insider Ownership here.

- Curious About Other Options? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603920

Olympic Circuit Technology

Olympic Circuit Technology Co., Ltd is involved in the research and development, manufacture, and sales of various printed circuit boards (PCBs) in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion