- China

- /

- Communications

- /

- SHSE:603803

Even after rising 10% this past week, RAISECOM TECHNOLOGYLtd (SHSE:603803) shareholders are still down 50% over the past five years

RAISECOM TECHNOLOGY CO.,Ltd. (SHSE:603803) shareholders should be happy to see the share price up 19% in the last month. But if you look at the last five years the returns have not been good. After all, the share price is down 51% in that time, significantly under-performing the market.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for RAISECOM TECHNOLOGYLtd

RAISECOM TECHNOLOGYLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade RAISECOM TECHNOLOGYLtd reduced its trailing twelve month revenue by 6.9% for each year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 9% per year doesn't really surprise us. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Not that many investors like to invest in companies that are losing money and not growing revenue.

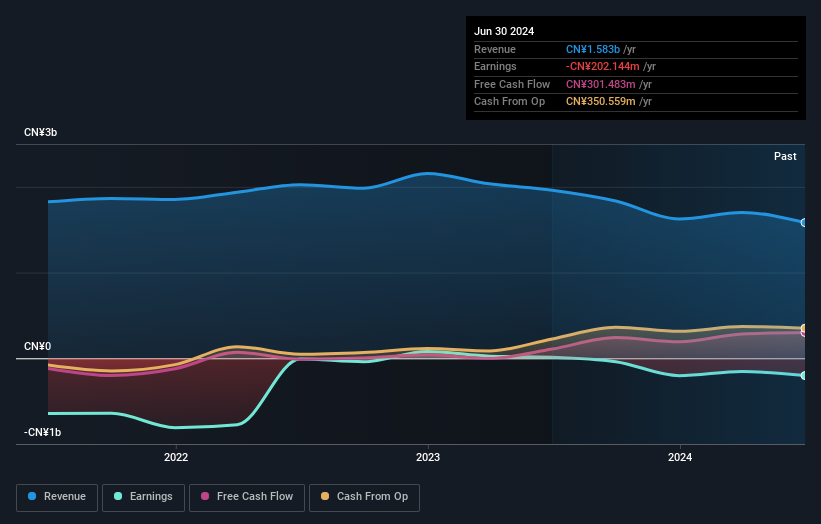

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

RAISECOM TECHNOLOGYLtd shareholders are down 19% for the year, but the market itself is up 3.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for RAISECOM TECHNOLOGYLtd you should know about.

But note: RAISECOM TECHNOLOGYLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603803

RAISECOM TECHNOLOGYLtd

Researches, develops, manufactures, supports, and markets network devices and access solutions worldwide.

Flawless balance sheet and slightly overvalued.