- China

- /

- Electronic Equipment and Components

- /

- SZSE:300790

Fujian Foxit Software Development And 2 High Growth Tech Stocks To Watch

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 reach record highs before experiencing declines, with growth stocks lagging behind value shares amid cautious earnings from key tech players. Despite these fluctuations, small-cap stocks demonstrated resilience compared to their larger counterparts, highlighting the importance of identifying companies with strong fundamentals and innovative potential in navigating current market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.43% | 41.52% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Fujian Foxit Software Development (SHSE:688095)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Foxit Software Development Joint Stock Co., Ltd. is a company focused on software development with a market capitalization of CN¥5.95 billion.

Operations: Foxit Software specializes in software development, generating revenue primarily through its range of PDF solutions and related services. The company operates with a focus on innovation within the document management industry, catering to both individual and enterprise clients.

Fujian Foxit Software Development has demonstrated a remarkable turnaround, transitioning from a net loss to generating CNY 38.67 million in net income over the nine months ending September 2024. This shift is underscored by a robust revenue increase to CNY 509.2 million from CNY 442.52 million year-over-year, reflecting a growth rate of 17.6%. The firm's commitment to innovation is evident in its R&D spending, which aligns with its revenue uptick and strategic focus on enhancing product offerings. Moreover, Fujian Foxit's aggressive earnings forecast anticipates a surge by 107.6% annually, positioning it well above the broader Chinese market's expectations and highlighting its potential within the competitive software landscape.

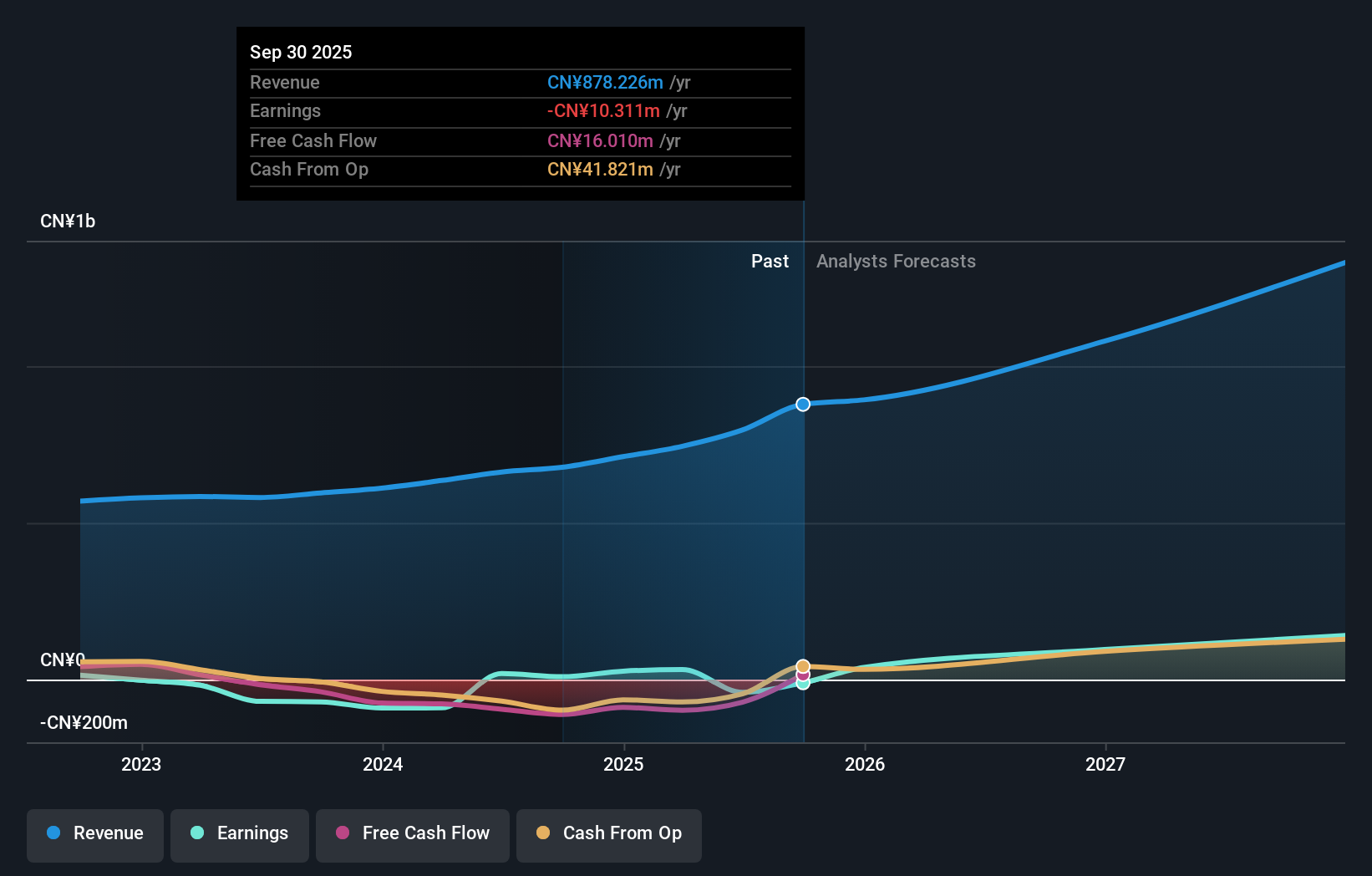

DongGuan YuTong Optical TechnologyLtd (SZSE:300790)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DongGuan YuTong Optical Technology Co., Ltd. specializes in the production and development of optical components and systems, with a market cap of CN¥5.61 billion.

Operations: The company generates revenue primarily through the sale of optical components and systems. It focuses on leveraging its expertise in optical technology to cater to various industry needs.

DongGuan YuTong Optical Technology Co., Ltd. has demonstrated substantial growth, with its recent earnings report showing a surge in net income to CNY 133.31 million from CNY 41.48 million year-over-year, marking a significant increase of 221%. This performance is backed by a robust revenue rise of 33.7% for the same period, indicating strong market demand for their optical technologies. The company's commitment to innovation is reflected in its R&D investments which have been strategically aligned with its revenue growth, underpinning future product development and potential market expansion. Moreover, forecasts suggest an impressive annual earnings growth rate of 32.4%, positioning DongGuan YuTong well above many peers in the tech sector and signaling promising prospects for sustained financial health and industry impact.

YD Electronic TechnologyLtd (SZSE:301123)

Simply Wall St Growth Rating: ★★★★★☆

Overview: YD Electronic Technology Co., Ltd. focuses on the research, development, production, and sale of FPC boards, connector components, LED backlight modules, and other precision electronic components in China with a market capitalization of CN¥4.52 billion.

Operations: The company specializes in producing and selling FPC boards, connector components, and LED backlight modules. Its operations are centered around precision electronic components within the Chinese market.

YD Electronic TechnologyLtd. has shown promising financial trends, with a revenue increase to CNY 1.23 billion, up from CNY 1.09 billion year-over-year, and a net income rise to CNY 17.03 million from CNY 11.16 million in the same period. Notably, the company's earnings per share also grew from CNY 0.0478 to CNY 0.0729, reflecting stronger profitability and market positioning despite previous challenges of negative earnings growth (-86.3%). The firm's strategic R&D investments are paying off as they align with an impressive forecasted annual profit growth of 76.3%, significantly above the Chinese market average of 26%. Additionally, YD’s proactive approach in shareholder returns is evident with its recent repurchase of over three million shares for approximately CNY 50 million, underscoring confidence in its financial health and commitment to delivering value.

Summing It All Up

- Unlock our comprehensive list of 1289 High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300790

DongGuan YuTong Optical TechnologyLtd

DongGuan YuTong Optical Technology Co.,Ltd.

Reasonable growth potential with proven track record.