- China

- /

- Semiconductors

- /

- SZSE:300708

Undiscovered Gems And 2 Other Promising Stocks With Strong Potential

Reviewed by Simply Wall St

In a week marked by fluctuating indices and mixed economic signals, small-cap stocks have shown resilience amidst broader market volatility. As the S&P MidCap 400 and Russell 2000 held up better than their large-cap counterparts, investors are increasingly looking toward lesser-known opportunities that may offer growth potential in uncertain times. Identifying promising stocks often involves seeking out those with solid fundamentals and growth prospects that align well with current economic conditions, particularly as earnings season unfolds and macroeconomic factors continue to influence market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Macnica Galaxy | 47.16% | 10.05% | 20.58% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Longhua Technology GroupLtd (SZSE:300263)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Longhua Technology Group Co., Ltd. specializes in the manufacturing and sale of heat transfer and energy-saving equipment in China, with a market capitalization of CN¥6.68 billion.

Operations: Longhua Technology Group Co., Ltd. generates revenue primarily from the sale of heat transfer and energy-saving equipment. The company reported a notable net profit margin of 12% in its recent financial period, reflecting its operational efficiency within the industry.

Longhua Technology Group, a smaller player in the machinery industry, has seen its earnings grow by 18.9% over the past year, outpacing the industry's -0.06%. Despite this growth, net income for the nine months ending September 2024 was CNY 154.71 million compared to CNY 177.1 million a year prior, reflecting some challenges in profitability. The company's debt to equity ratio has increased from 12.7% to 48.6% over five years but remains manageable with interest payments well-covered by EBIT at a ratio of 5.5x. Earnings per share dipped slightly from CNY 0.1958 to CNY 0.1711 during this period, suggesting room for improvement in operational efficiency and cost management strategies moving forward.

- Dive into the specifics of Longhua Technology GroupLtd here with our thorough health report.

Gain insights into Longhua Technology GroupLtd's past trends and performance with our Past report.

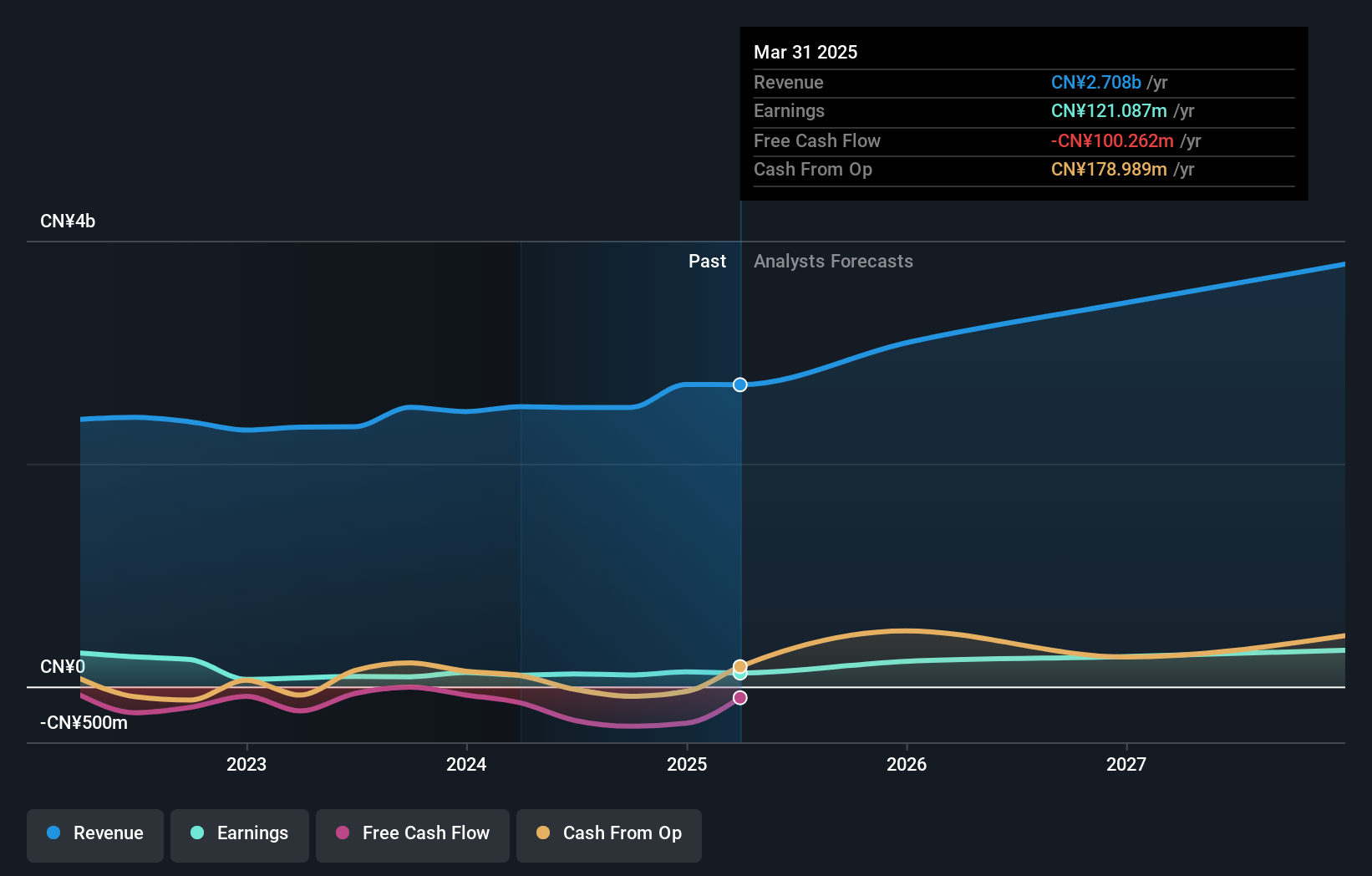

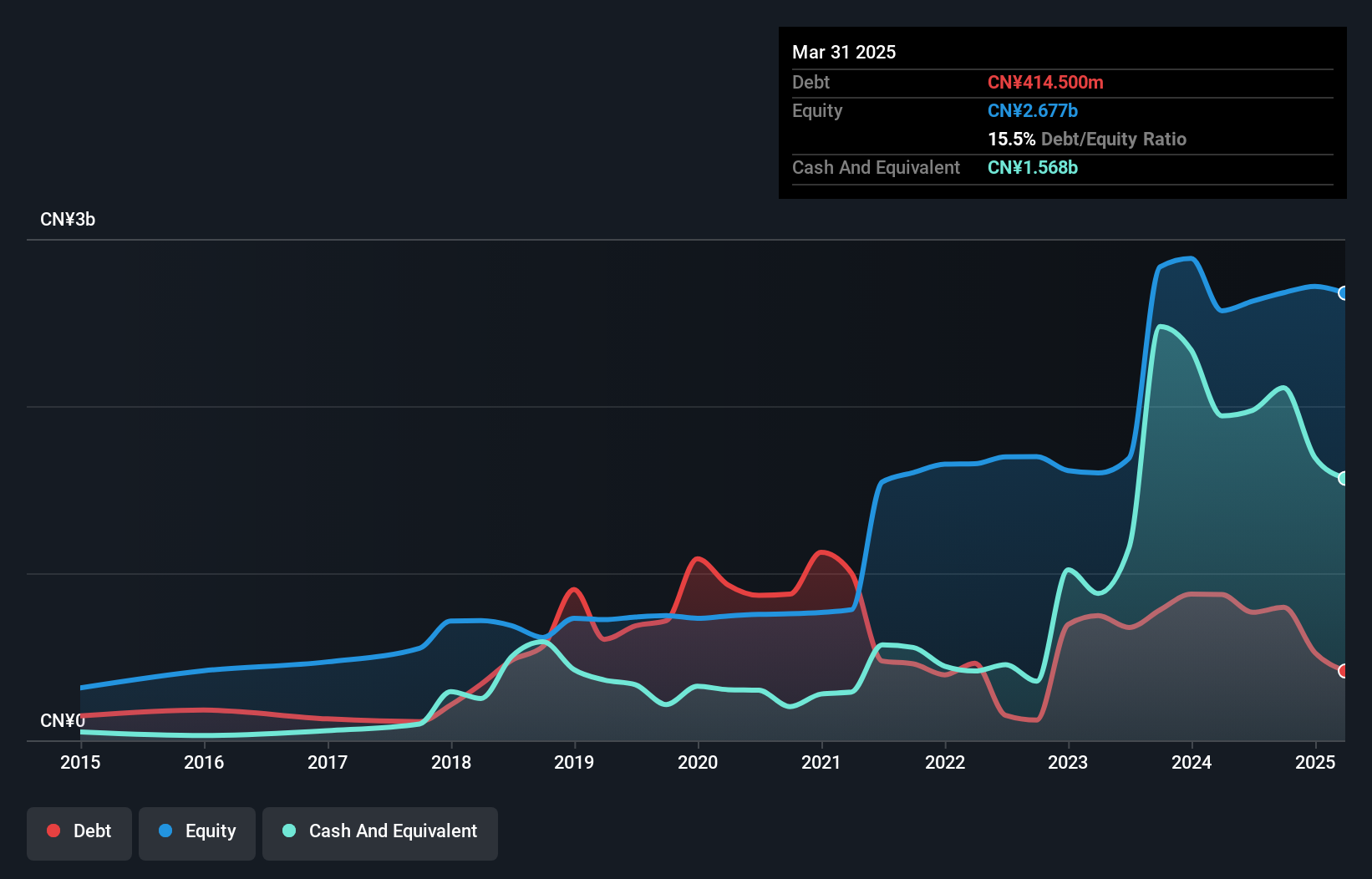

Focus Lightings Tech (SZSE:300708)

Simply Wall St Value Rating: ★★★★★★

Overview: Focus Lightings Tech Co., Ltd. is involved in the research, development, production, and sale of compound optoelectronic semiconductor materials both in China and internationally, with a market cap of CN¥7.78 billion.

Operations: Focus Lightings Tech generates revenue primarily from the sale of compound optoelectronic semiconductor materials. The company has experienced variations in its net profit margin, reflecting changes in profitability over time.

Focus Lightings Tech, a rising player in the semiconductor industry, has turned profitable this year with earnings expected to grow annually by 13.53%. The company reported a net income of CNY 159.57 million for the first nine months of 2024, significantly up from CNY 77.08 million last year, highlighting its robust financial health. Its price-to-earnings ratio stands at 38.4x, notably lower than the industry average of 66.3x, suggesting potential undervaluation. Over five years, Focus Lightings has reduced its debt-to-equity ratio from 95.8% to an impressive 29.7%, indicating strong fiscal management and positioning it well for future growth opportunities in its sector.

- Unlock comprehensive insights into our analysis of Focus Lightings Tech stock in this health report.

Explore historical data to track Focus Lightings Tech's performance over time in our Past section.

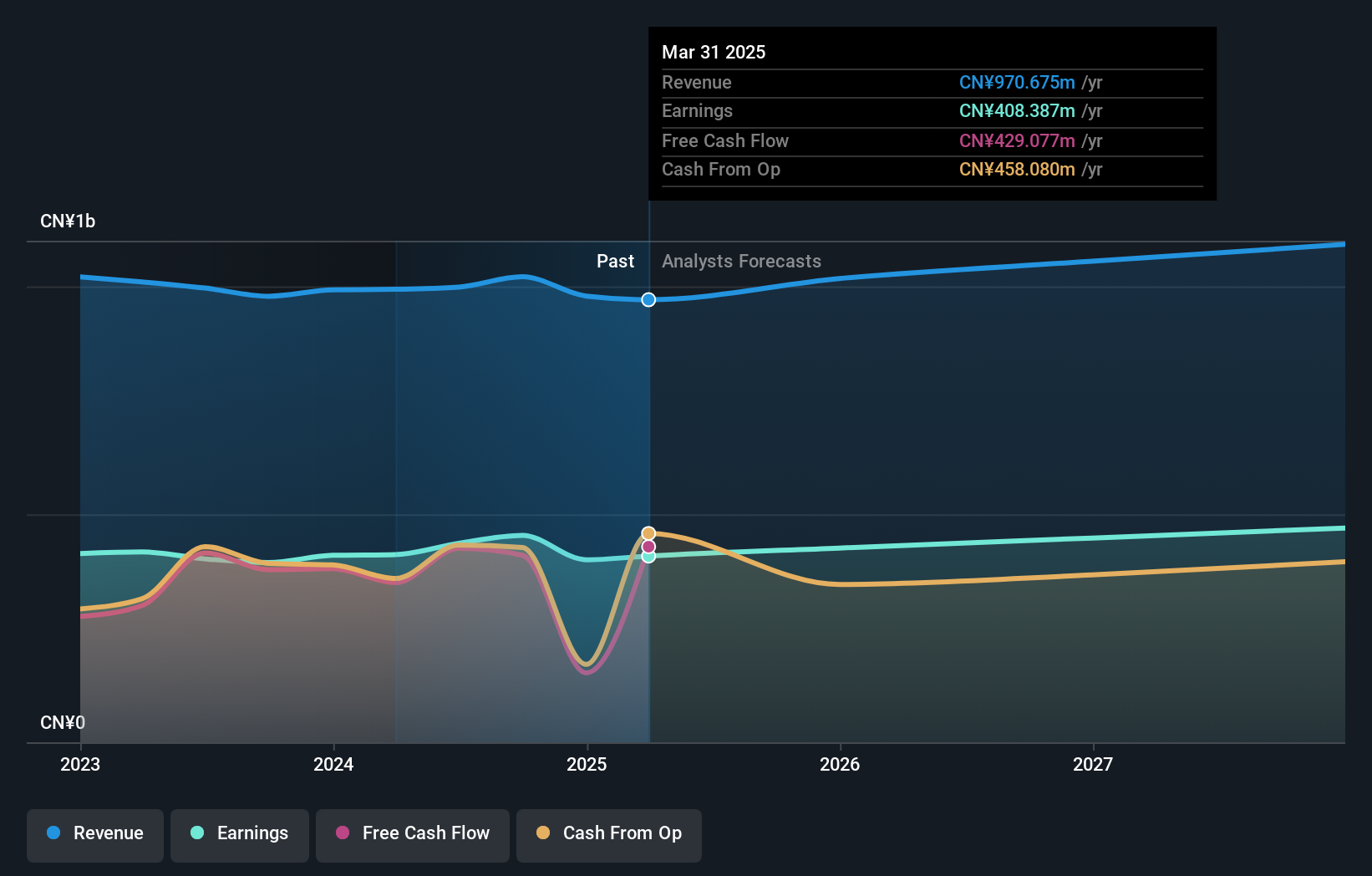

Hicon Network Technology (Shandong)Ltd (SZSE:301262)

Simply Wall St Value Rating: ★★★★★★

Overview: Hicon Network Technology (Shandong) Co., Ltd, with a market cap of CN¥11.10 billion, specializes in providing network technology solutions and services.

Operations: Hicon Network Technology's primary revenue streams are derived from its network technology solutions and services. The company has a market cap of CN¥11.10 billion, reflecting its position in the industry.

Hicon Network Technology, a nimble player in the Interactive Media and Services sector, has been showing promising growth. Over the past year, its earnings surged by 15%, outpacing the industry's 1.7% increase. The company boasts high-quality earnings and remains debt-free for five years, underscoring financial stability. Recent reports highlight sales of CNY 742 million for nine months ending September 2024, up from CNY 714 million last year. Net income rose to CNY 329 million from CNY 285 million previously. With a P/E ratio of 24x below China's market average of 36x, it seems attractively valued amidst its peers.

Next Steps

- Unlock our comprehensive list of 4706 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300708

Focus Lightings Tech

Engages in the research and development, production, and sale of compound optoelectronic semiconductor materials in China and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives