- China

- /

- Electronic Equipment and Components

- /

- SHSE:603773

Returns On Capital At WG TECH (Jiang Xi) (SHSE:603773) Paint A Concerning Picture

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. In light of that, when we looked at WG TECH (Jiang Xi) (SHSE:603773) and its ROCE trend, we weren't exactly thrilled.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on WG TECH (Jiang Xi) is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.015 = CN¥34m ÷ (CN¥4.0b - CN¥1.8b) (Based on the trailing twelve months to March 2024).

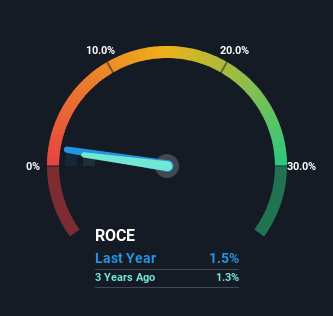

So, WG TECH (Jiang Xi) has an ROCE of 1.5%. In absolute terms, that's a low return and it also under-performs the Electronic industry average of 5.3%.

See our latest analysis for WG TECH (Jiang Xi)

In the above chart we have measured WG TECH (Jiang Xi)'s prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for WG TECH (Jiang Xi) .

What Does the ROCE Trend For WG TECH (Jiang Xi) Tell Us?

We weren't thrilled with the trend because WG TECH (Jiang Xi)'s ROCE has reduced by 72% over the last five years, while the business employed 35% more capital. However, some of the increase in capital employed could be attributed to the recent capital raising that's been completed prior to their latest reporting period, so keep that in mind when looking at the ROCE decrease. WG TECH (Jiang Xi) probably hasn't received a full year of earnings yet from the new funds it raised, so these figures should be taken with a grain of salt.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 44%, which has impacted the ROCE. Without this increase, it's likely that ROCE would be even lower than 1.5%. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

The Bottom Line On WG TECH (Jiang Xi)'s ROCE

While returns have fallen for WG TECH (Jiang Xi) in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. Furthermore the stock has climbed 68% over the last five years, it would appear that investors are upbeat about the future. So while the underlying trends could already be accounted for by investors, we still think this stock is worth looking into further.

If you'd like to know about the risks facing WG TECH (Jiang Xi), we've discovered 1 warning sign that you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if WG TECH (Jiang Xi) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603773

WG TECH (Jiang Xi)

Provides glass-based circuit boards and related electronic devices in China.

Exceptional growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.