- Taiwan

- /

- Tech Hardware

- /

- TWSE:6669

Exploring High Growth Tech Stocks In April 2025

Reviewed by Simply Wall St

In April 2025, global markets are grappling with heightened volatility following the Trump administration's announcement of unexpected tariffs, which has led to significant declines in major indices such as the S&P 500 and Russell 2000. Amidst these challenging conditions, investors may look for high growth tech stocks that demonstrate resilience through innovation and adaptability to navigate economic uncertainties and potential trade disruptions effectively.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 20.52% | 25.50% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.31% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

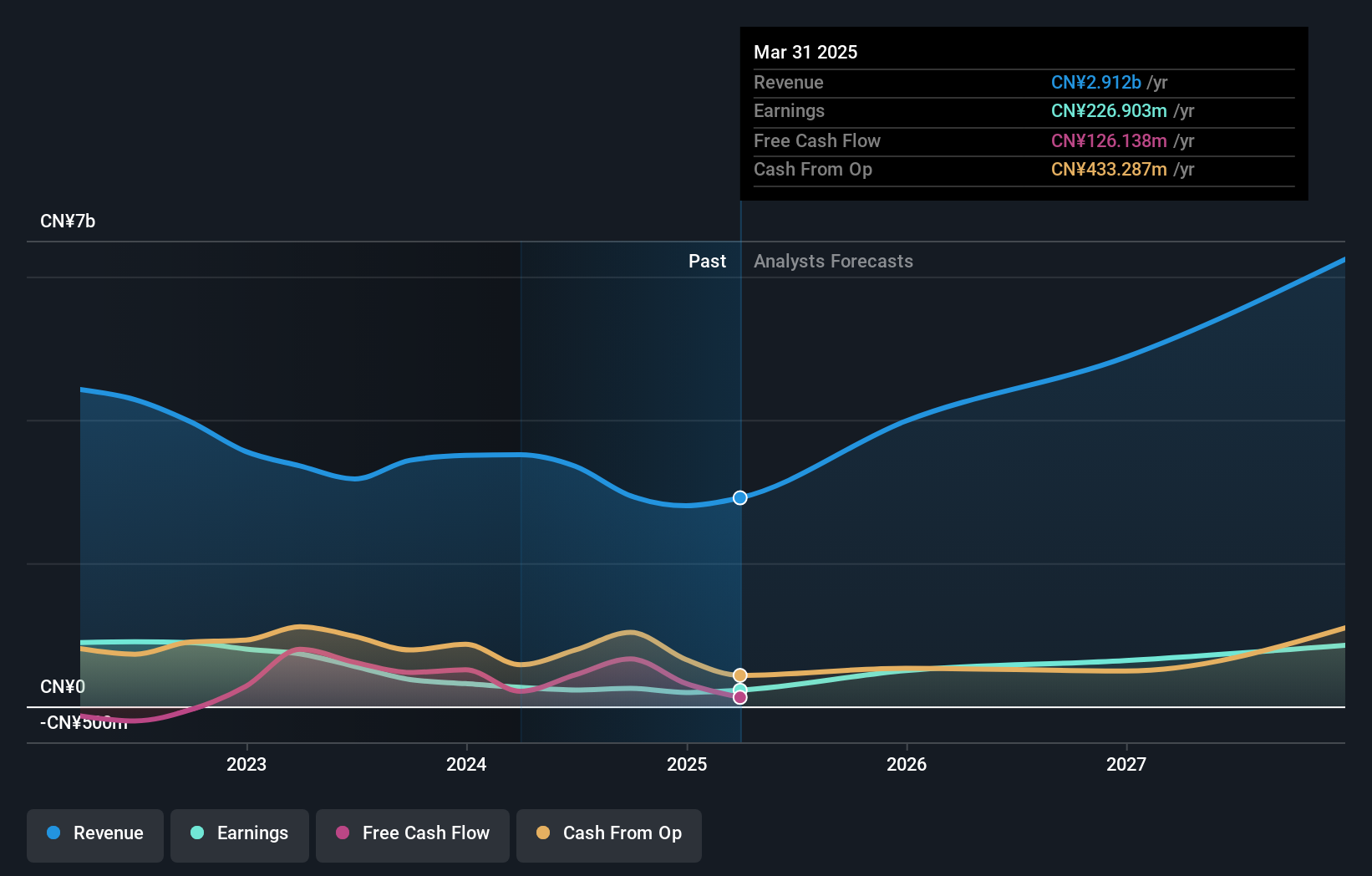

Fujian Torch Electron Technology (SHSE:603678)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fujian Torch Electron Technology Co., Ltd. is a company engaged in the production and sale of electronic components, with a market cap of approximately CN¥17.97 billion.

Operations: Fujian Torch Electron Technology focuses on producing and selling electronic components, deriving its revenue primarily from these sales. The company operates with a market cap of around CN¥17.97 billion.

Fujian Torch Electron Technology's recent performance highlights a mixed financial landscape, with a notable 24% annual revenue growth outpacing the Chinese market average of 12.7%. Despite this, the company faced challenges as net income dropped to CNY 194.52 million from CNY 318.38 million year-over-year, reflecting broader industry pressures and operational hurdles. The firm's commitment to innovation is evident in its R&D spending trends, crucial for sustaining its competitive edge in the rapidly evolving tech sector. This strategic focus on research may well position Fujian Torch for future recovery and growth despite current volatility in earnings, which are expected to surge by an impressive 38.7% annually over the next three years.

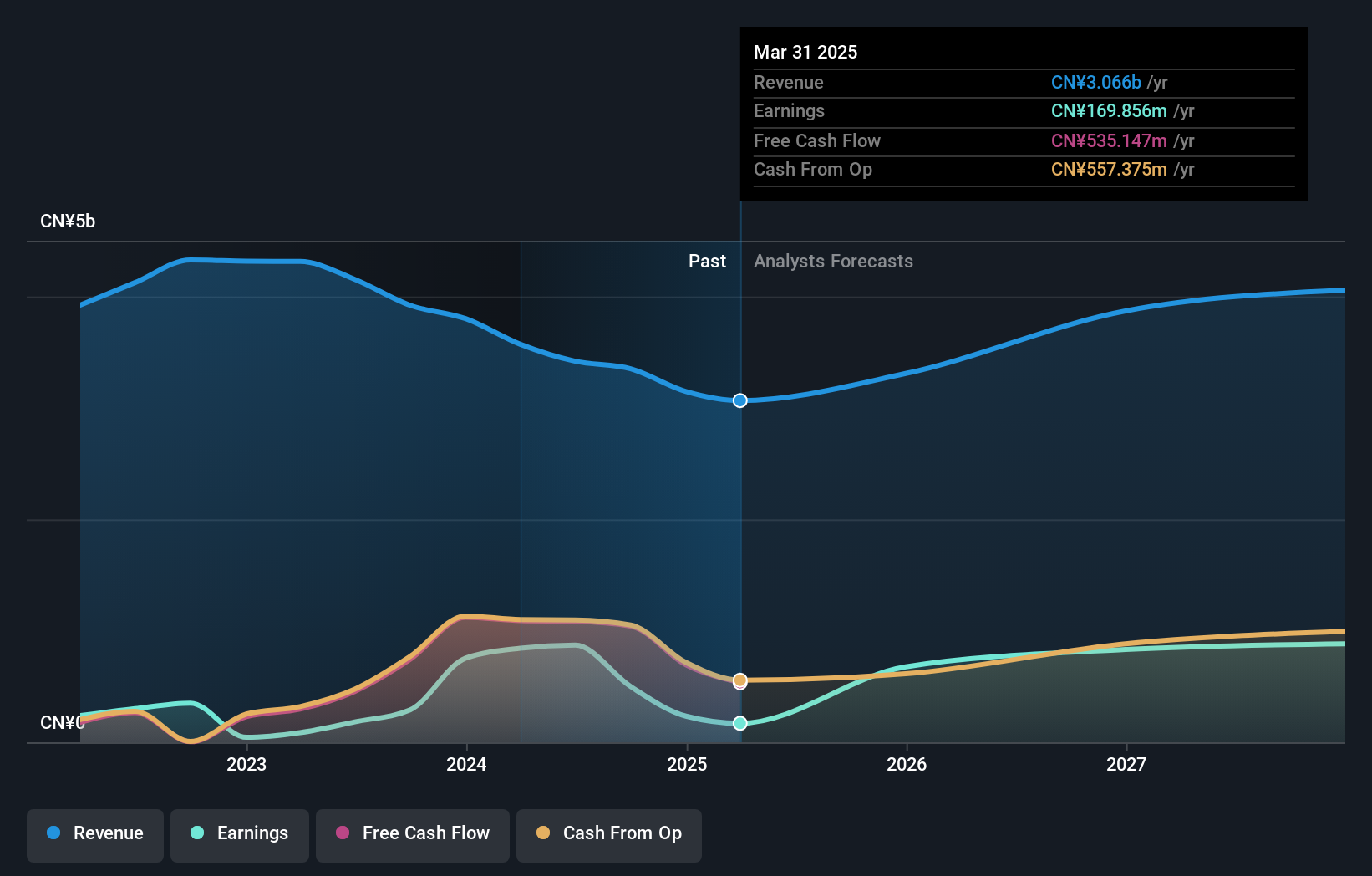

XGD (SZSE:300130)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: XGD Inc. is involved in the research, development, manufacturing, sales, and servicing of payment terminals both in China and internationally, with a market cap of CN¥11.05 billion.

Operations: XGD Inc. generates revenue through the sale and servicing of payment terminals across domestic and international markets. The company's operations encompass research, development, manufacturing, and sales activities within this sector.

XGD Inc. navigates a challenging landscape with its recent earnings revealing a significant drop, from CNY 755.04 million to CNY 234.21 million year-over-year, alongside sales decreasing to CNY 3.15 billion from CNY 3.80 billion previously reported. Despite these hurdles, the company's commitment to innovation remains robust, as evidenced by its R&D investments aligning with industry demands for rapid technological advancement; this strategic focus is crucial for maintaining competitiveness in a fast-evolving market. Moreover, XGD's expected earnings growth of 56.8% annually signals potential recovery and optimism for future performance enhancements within the tech sector.

- Get an in-depth perspective on XGD's performance by reading our health report here.

Explore historical data to track XGD's performance over time in our Past section.

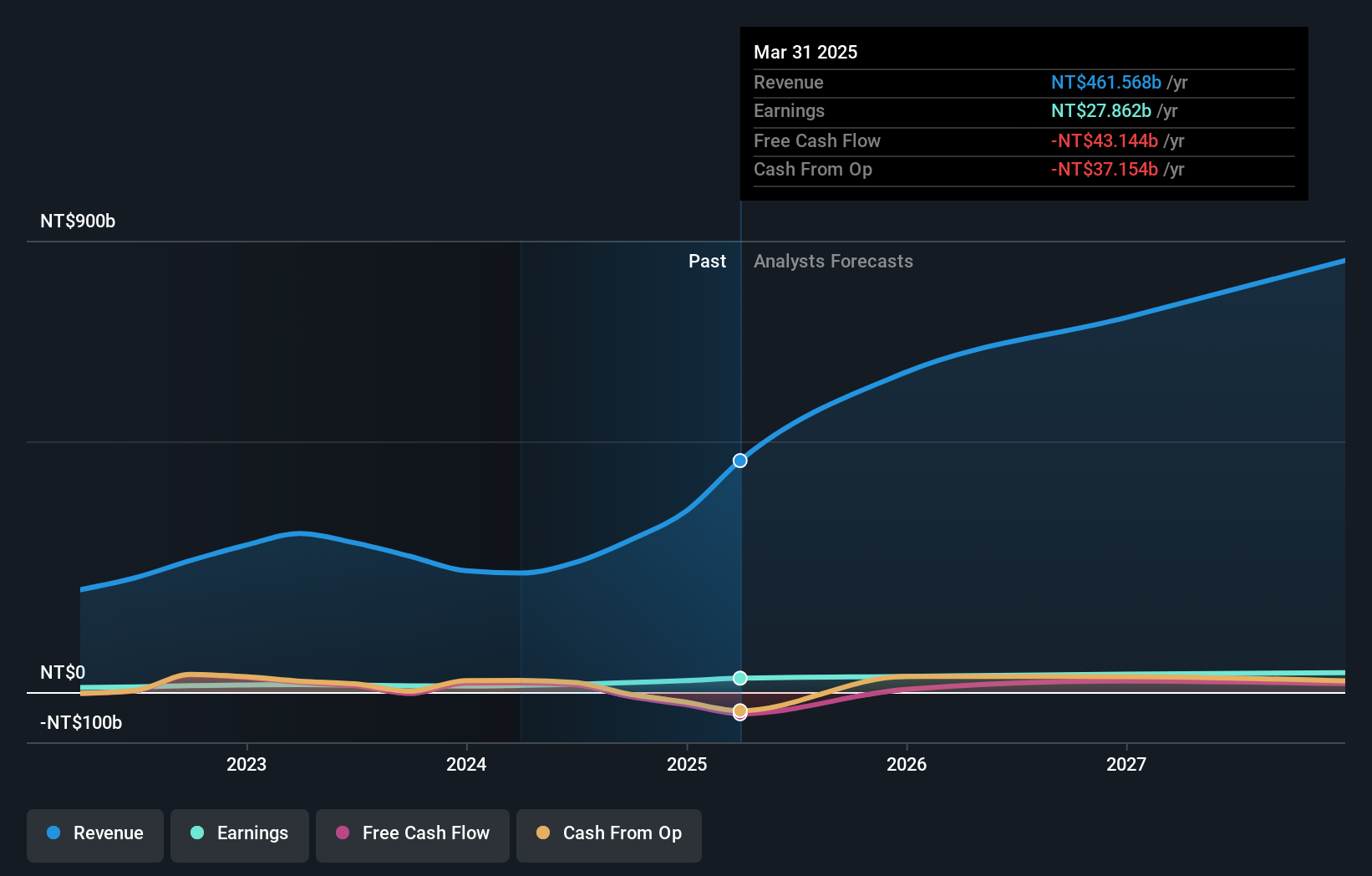

Wiwynn (TWSE:6669)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wiwynn Corporation is involved in the research, development, design, testing, and sales of semi products and peripheral equipment globally, with a market cap of NT$298.27 billion.

Operations: Wiwynn Corporation generates revenue primarily from its computer hardware segment, amounting to NT$360.54 billion. The company's operations span the United States, Europe, Asia, and other international markets.

Wiwynn's recent showcase at GTC 2025 highlighted its innovative AI servers and advanced cooling systems, signaling robust growth in AI infrastructure solutions. With a revenue increase of 25.7% per year and an earnings surge by 18.3%, the company is outpacing industry averages significantly. Additionally, Wiwynn's R&D expenditure, crucial for sustaining technological leadership, has been strategically increased to align with these advancements, ensuring their offerings remain at the forefront of the high-demand GenAI era. This strategic positioning is expected to drive future growth as data centers increasingly rely on sophisticated AI capabilities and thermal management solutions.

Next Steps

- Navigate through the entire inventory of 765 Global High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wiwynn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6669

Wiwynn

Engages in the research, development, design, testing, and sales of semi products, and peripheral equipment and parts in the United States, Europe, Asia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)