Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:603629

The three-year decline in earnings for Jiangsu Lettall ElectronicLtd SHSE:603629) isn't encouraging, but shareholders are still up 39% over that period

Jiangsu Lettall Electronic Co.,Ltd (SHSE:603629) shareholders might be concerned after seeing the share price drop 30% in the last quarter. But that doesn't change the fact that the returns over the last three years have been pleasing. To wit, the share price did better than an index fund, climbing 36% during that period.

Since the long term performance has been good but there's been a recent pullback of 9.9%, let's check if the fundamentals match the share price.

See our latest analysis for Jiangsu Lettall ElectronicLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, Jiangsu Lettall ElectronicLtd actually saw its earnings per share (EPS) drop 2.1% per year.

Given the share price resilience, we don't think the (declining) EPS numbers are a good measure of how the business is moving forward, right now. Therefore, it makes sense to look into other metrics.

The modest 0.5% dividend yield is unlikely to be propping up the share price. It may well be that Jiangsu Lettall ElectronicLtd revenue growth rate of 5.2% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

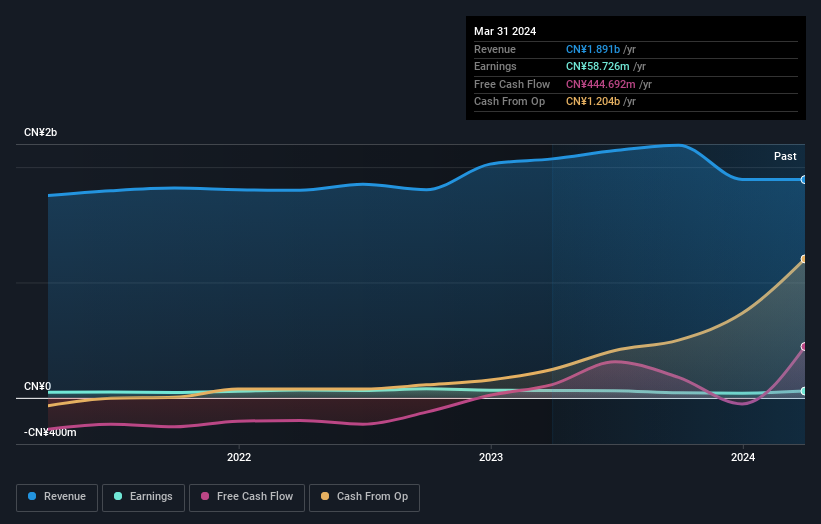

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Jiangsu Lettall ElectronicLtd's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Jiangsu Lettall ElectronicLtd, it has a TSR of 39% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Jiangsu Lettall ElectronicLtd shareholders are down 15% over twelve months (even including dividends), which isn't far from the market return of -17%. The silver lining is that longer term investors would have made a total return of 2% per year over half a decade. If the stock price has been impacted by changing sentiment, rather than deteriorating business conditions, it could spell opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Jiangsu Lettall ElectronicLtd you should be aware of, and 1 of them doesn't sit too well with us.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603629

Jiangsu Lettall ElectronicLtd

Produces and sells electronic components and metal structural parts in China.

Excellent balance sheet unattractive dividend payer.