- China

- /

- Electronic Equipment and Components

- /

- SHSE:603626

The one-year returns have been notable for Kunshan Kersen Science & TechnologyLtd (SHSE:603626) shareholders despite underlying losses increasing

It hasn't been the best quarter for Kunshan Kersen Science & Technology Co.,Ltd. (SHSE:603626) shareholders, since the share price has fallen 19% in that time. But that doesn't change the fact that the returns over the last year have been pleasing. In that time we've seen the stock easily surpass the market return, with a gain of 71%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Kunshan Kersen Science & TechnologyLtd

Because Kunshan Kersen Science & TechnologyLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Kunshan Kersen Science & TechnologyLtd grew its revenue by 16% last year. We respect that sort of growth, no doubt. While the share price performed well, gaining 71% over twelve months, you could argue the revenue growth warranted it. If revenue stays on trend, there may be plenty more share price gains to come. But it's crucial to check profitability and cash flow before forming a view on the future.

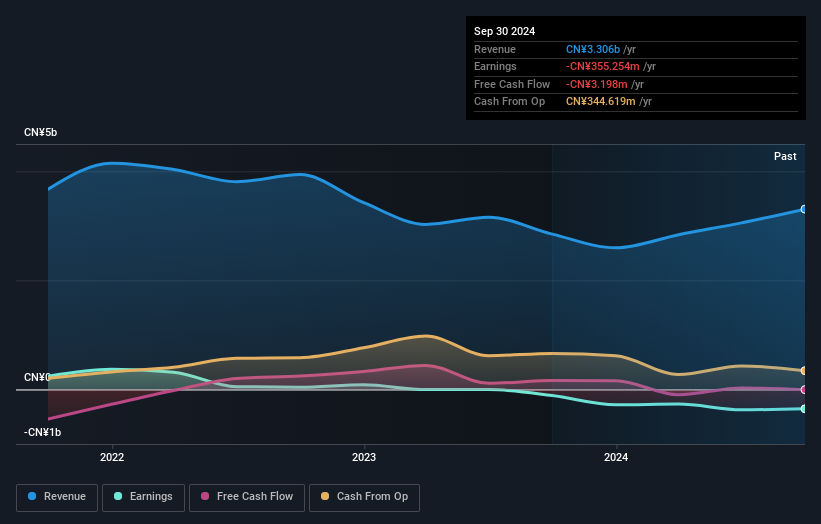

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Kunshan Kersen Science & TechnologyLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Kunshan Kersen Science & TechnologyLtd the TSR over the last 1 year was 75%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Kunshan Kersen Science & TechnologyLtd has rewarded shareholders with a total shareholder return of 75% in the last twelve months. And that does include the dividend. That certainly beats the loss of about 6% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Kunshan Kersen Science & TechnologyLtd better, we need to consider many other factors. For instance, we've identified 3 warning signs for Kunshan Kersen Science & TechnologyLtd (2 are concerning) that you should be aware of.

But note: Kunshan Kersen Science & TechnologyLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kunshan Kersen Science & TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603626

Kunshan Kersen Science & TechnologyLtd

Kunshan Kersen Science & Technology Co.,Ltd.

Mediocre balance sheet low.

Market Insights

Community Narratives