Stock Analysis

- China

- /

- Communications

- /

- SZSE:300136

High Growth Tech Stocks To Explore This October 2024

Reviewed by Simply Wall St

As of late October 2024, global markets are navigating a complex landscape influenced by rising U.S. Treasury yields and tempered economic growth, with the S&P 500 experiencing a downturn after six weeks of gains and small-cap stocks underperforming their larger counterparts. In this environment, identifying promising high-growth tech stocks requires careful consideration of factors such as innovative potential, market adaptability, and financial resilience to withstand macroeconomic pressures.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EmbedWay Technologies (Shanghai) Corporation is a Chinese company specializing in network visibility infrastructure and intelligent system platforms, with a market capitalization of CN¥9.21 billion.

Operations: The company focuses on providing network visibility infrastructure and intelligent system platforms in China. It generates revenue through its specialized technology solutions, catering to various industry needs.

EmbedWay Technologies (Shanghai) has demonstrated robust growth, with its recent earnings report showing a surge in sales to CNY 880.94 million from CNY 498.37 million year-over-year and net income climbing to CNY 78.28 million from CNY 31.84 million. This performance is a testament to its increasing market presence, particularly after being added to the S&P Global BMI Index, signaling enhanced investor confidence and visibility in global markets. Notably, the company's commitment to innovation is evident from its R&D investments which are crucial for sustaining long-term growth in the competitive tech landscape; these strategic allocations are expected to foster further advancements and market share expansion.

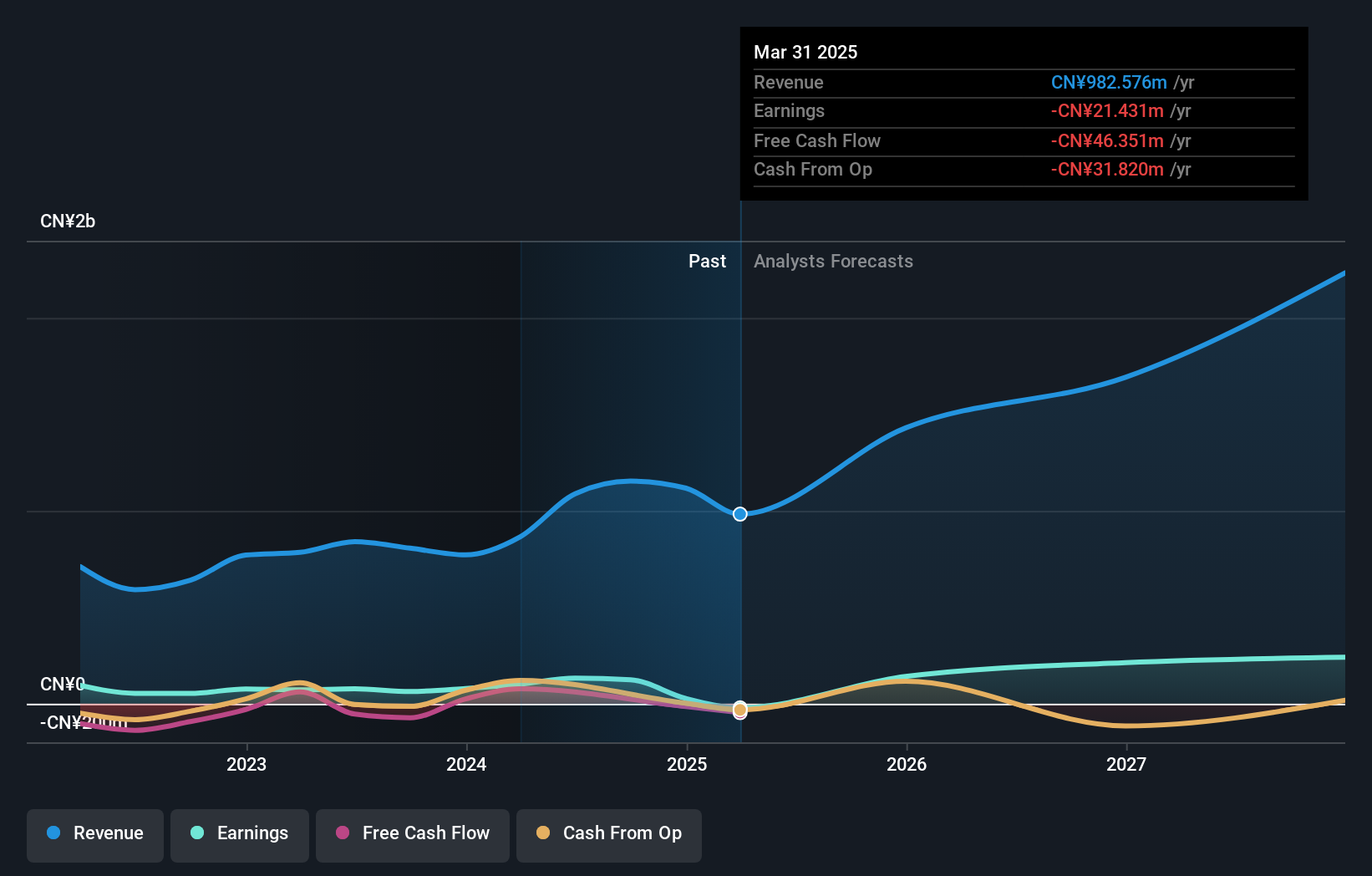

Shenzhen Sunway Communication (SZSE:300136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunway Communication Co., Ltd. focuses on the research, development, manufacture, and sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions both in China and internationally with a market cap of CN¥24.02 billion.

Operations: Sunway Communication generates revenue from the design and production of advanced communication components, including antennas and wireless charging modules, serving both domestic and international markets. The company's operations are supported by a robust research and development framework aimed at innovation in precision connectors, cables, passive components, and EMC/EMI solutions.

Shenzhen Sunway Communication has shown a commendable revenue increase to CNY 6.39 billion, up from CNY 5.59 billion year-over-year, signaling robust market demand and operational efficiency. The company's strategic R&D investment is evident with expenses aligning closely with its revenue growth, underscoring a commitment to innovation that sustains its competitive edge in the communications sector. Additionally, the recent completion of a share buyback program underscores management’s confidence in the firm’s value proposition and future prospects, enhancing shareholder value through a return of CNY 268 million to investors. This blend of financial prudence and aggressive market posture positions Shenzhen Sunway Communication well for anticipated annual earnings growth of 35.7%, outpacing the broader Chinese market forecast of 24.6%.

Nayax (TASE:NYAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nayax Ltd. is a fintech company that provides a system and payment platform for various retailers across the United States, Europe, the United Kingdom, Australia, Israel, and other global markets with a market capitalization of ₪3.99 billion.

Operations: The company's primary revenue stream is from its Internet Software and Services segment, generating $268.97 million.

Nayax's strategic maneuvers in the tech landscape, particularly through its recent partnerships and R&D commitments, underscore its potential within high-growth sectors. The company has notably increased its R&D spending to 23.5% of revenue, aligning investment with innovative payment solutions for automated services and EV charging—a move that not only enhances product offerings but also positions Nayax favorably against competitors. Furthermore, recent alliances with major players like Adyen amplify Nayax’s operational scope and market penetration, evidenced by a projected annual earnings growth of 61.7%. These developments suggest a robust framework for scaling operations and potentially lucrative future returns as these technologies gain traction globally.

- Take a closer look at Nayax's potential here in our health report.

Examine Nayax's past performance report to understand how it has performed in the past.

Where To Now?

- Take a closer look at our High Growth Tech and AI Stocks list of 1281 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300136

Shenzhen Sunway Communication

Engages in the research, development, manufacture, and sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions in China and internationally.