- Taiwan

- /

- Tech Hardware

- /

- TPEX:3324

Asian Growth Companies With High Insider Ownership Unveiled

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by economic uncertainties and fluctuating indices, Asia's growth companies are drawing attention for their resilience and potential. In this environment, high insider ownership can be a compelling attribute, signaling confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19.1% | 122.3% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| M31 Technology (TPEX:6643) | 26.3% | 99.1% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

We'll examine a selection from our screener results.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China, with a market cap of CN¥11.36 billion.

Operations: The company's revenue from the Computer, Communication and Other Electronic Equipment Manufacturing segment is CN¥969.72 million.

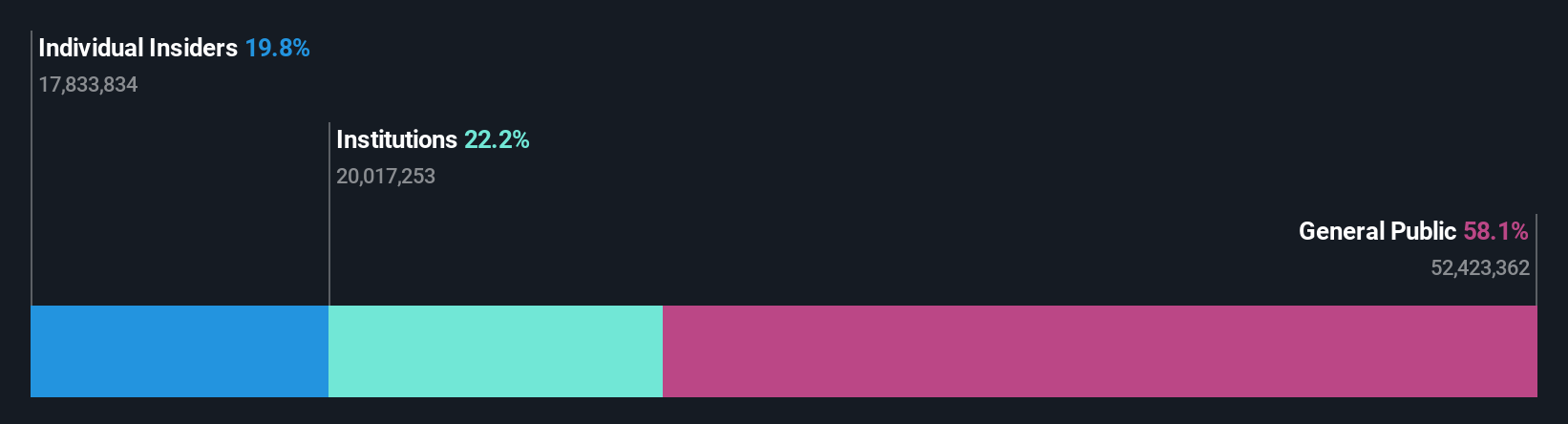

Insider Ownership: 32%

EmbedWay Technologies (Shanghai) is poised for substantial growth, with revenue expected to increase by 30.2% annually, outpacing the Chinese market's 14.1% growth rate. Although its share price has been volatile recently, the company trades at a significant discount to its estimated fair value. Despite recent declines in earnings and revenue, forecasts suggest a transition to profitability within three years, indicating strong potential for future expansion despite current challenges.

- Take a closer look at EmbedWay Technologies (Shanghai)'s potential here in our earnings growth report.

- Our valuation report here indicates EmbedWay Technologies (Shanghai) may be overvalued.

Shenzhen Dynanonic (SZSE:300769)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Dynanonic Co., Ltd focuses on the research, development, production, and sale of materials for lithium-ion batteries in China, with a market cap of CN¥12.85 billion.

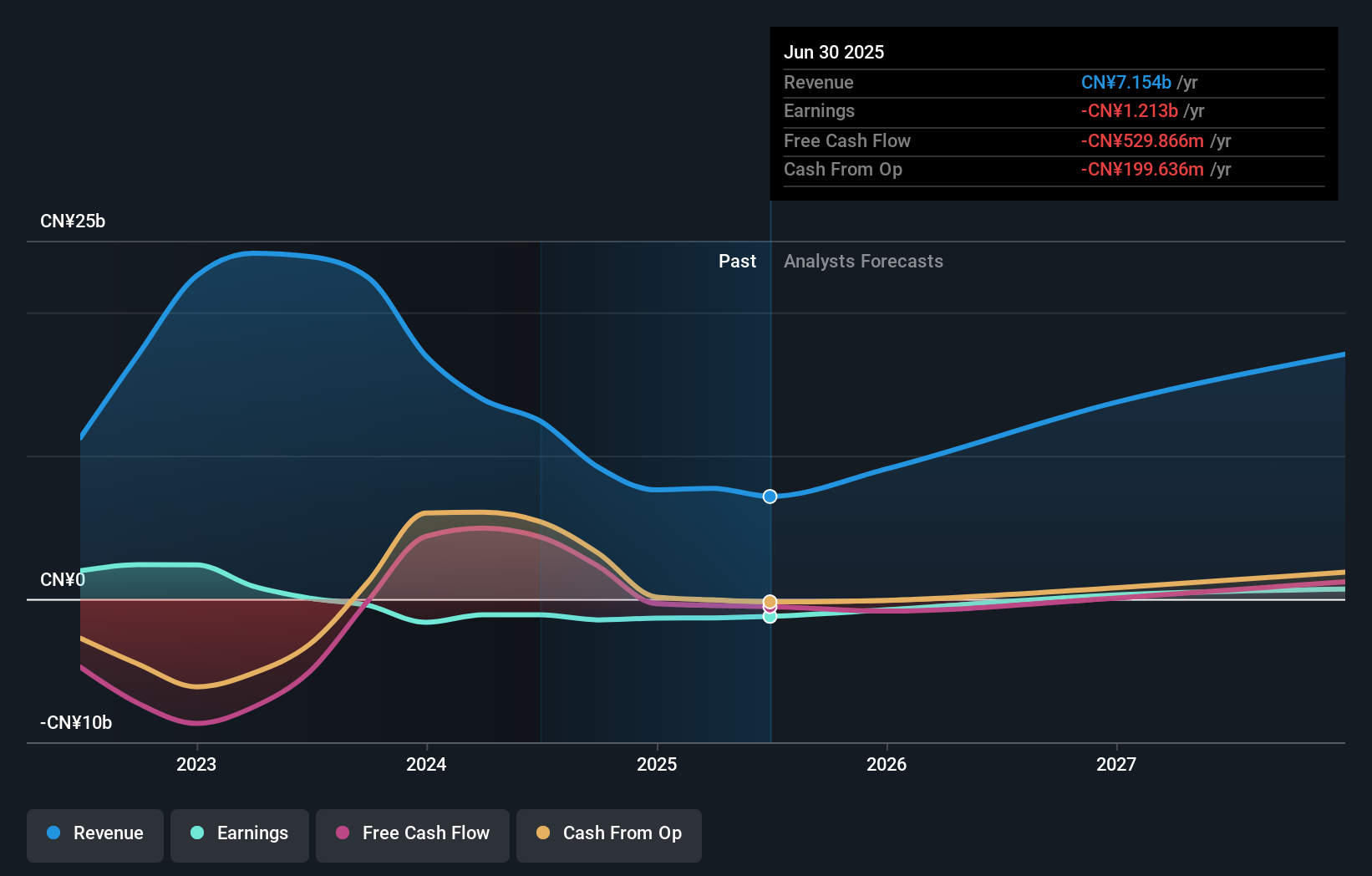

Operations: The company generates revenue of CN¥7.15 billion from its research, development, production, and sales activities related to Nano-Lithium Iron Phosphate materials for lithium-ion batteries.

Insider Ownership: 29.3%

Shenzhen Dynanonic is positioned for growth with a forecasted revenue increase of 34.7% annually, surpassing the Chinese market's 14.1% growth rate. Despite recent declines in sales and revenue, the company is expected to become profitable within three years, reflecting strong potential for future expansion. However, its share price has been highly volatile recently and it trades significantly below estimated fair value, indicating potential risks alongside opportunities.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Dynanonic.

- The valuation report we've compiled suggests that Shenzhen Dynanonic's current price could be quite moderate.

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

Overview: Auras Technology Co., Ltd. manufactures, processes, and retails electronic materials and computer cooling modules across China, Taiwan, Ireland, Singapore, the United States, and other international markets with a market cap of NT$80.62 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, which generated NT$18.07 billion.

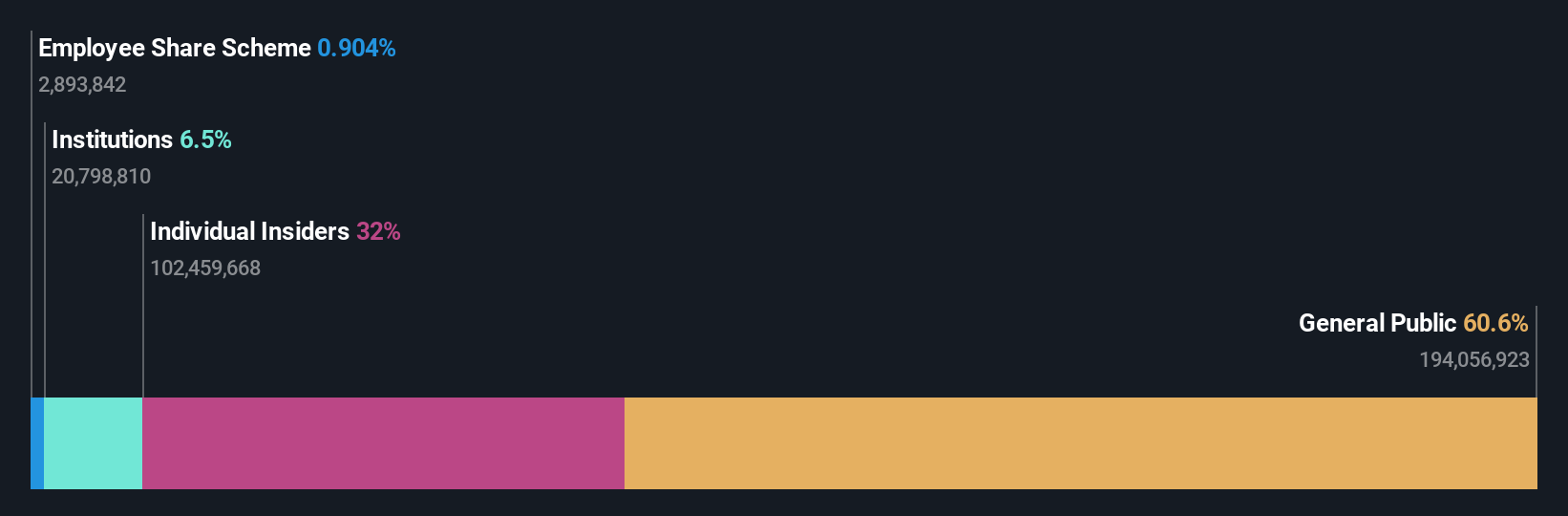

Insider Ownership: 19.8%

Auras Technology's earnings are projected to grow significantly at 39.8% annually, outpacing the Taiwan market's 17.9% growth rate. Despite reporting a drop in net income for Q2 2025, sales increased to TWD 5.31 billion from TWD 4.28 billion year-on-year, showing revenue strength amid profitability challenges. The company's high return on equity forecast of 31.1% and robust insider ownership suggest alignment between management and shareholder interests, although recent share price volatility presents potential risks.

- Navigate through the intricacies of Auras Technology with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Auras Technology implies its share price may be too high.

Seize The Opportunity

- Unlock more gems! Our Fast Growing Asian Companies With High Insider Ownership screener has unearthed 613 more companies for you to explore.Click here to unveil our expertly curated list of 616 Fast Growing Asian Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3324

Auras Technology

Engages in the manufacturing, processing, and retailing of electronic materials and computer cooling modules in China, Taiwan, Ireland, Singapore, the United States, and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives