As December 2024 unfolds, global markets have shown a mixed performance, with U.S. indices like the Nasdaq Composite and Russell 1000 Growth Index experiencing fluctuations amid declining consumer confidence and manufacturing indicators. Despite these challenges, high growth tech stocks remain an area of interest for investors seeking potential opportunities in a volatile market environment; key attributes such as innovation, scalability, and adaptability are crucial for identifying promising candidates in this dynamic sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 43.17% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Ningbo Yongxin OpticsLtd (SHSE:603297)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Yongxin Optics Co., Ltd specializes in the manufacturing and sale of precision optical instruments and components in China, with a market capitalization of approximately CN¥10.56 billion.

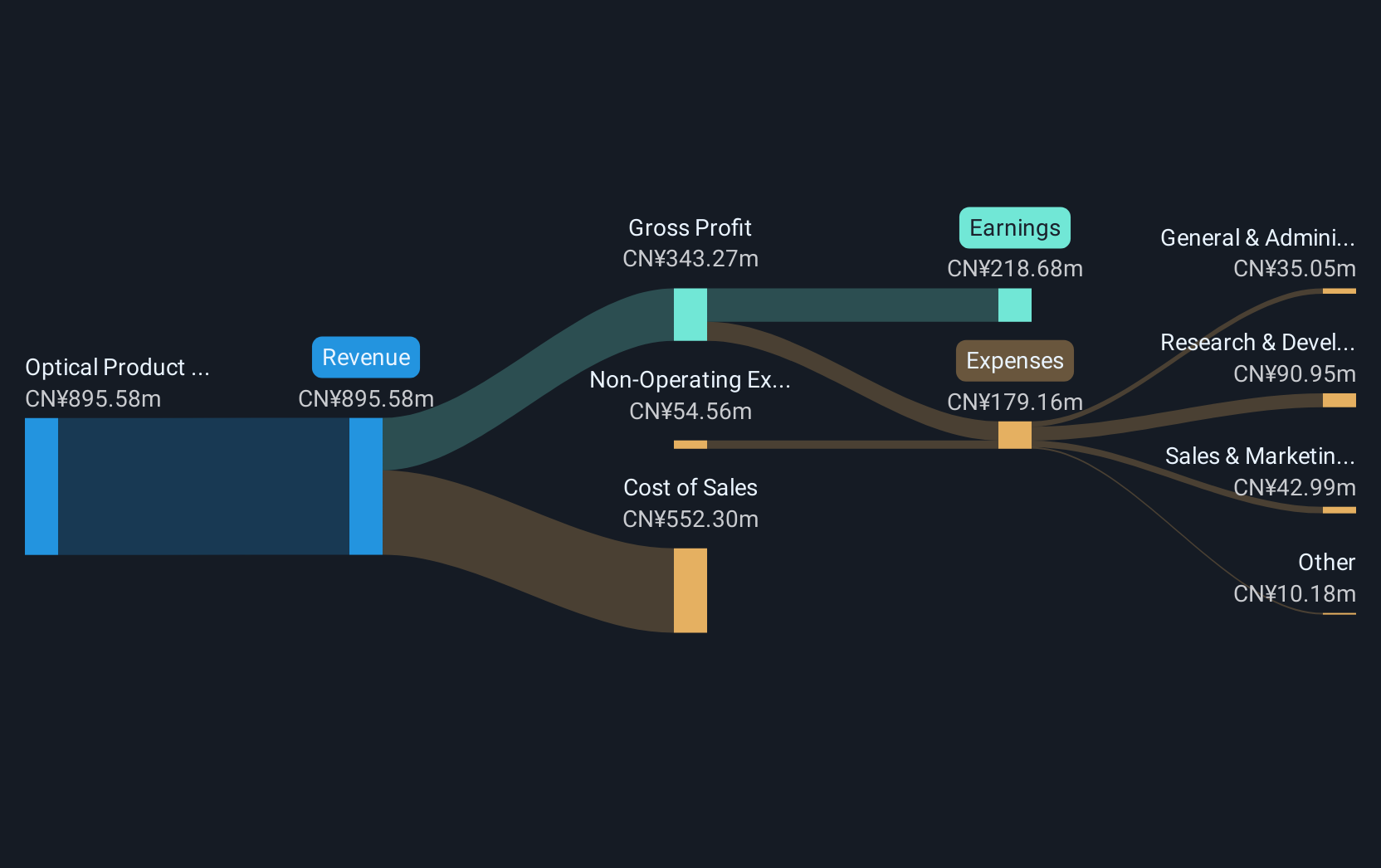

Operations: Yongxin Optics generates revenue primarily from its optical product manufacturing segment, which amounts to CN¥894.06 million. The company focuses on precision optical instruments and components, serving the Chinese market.

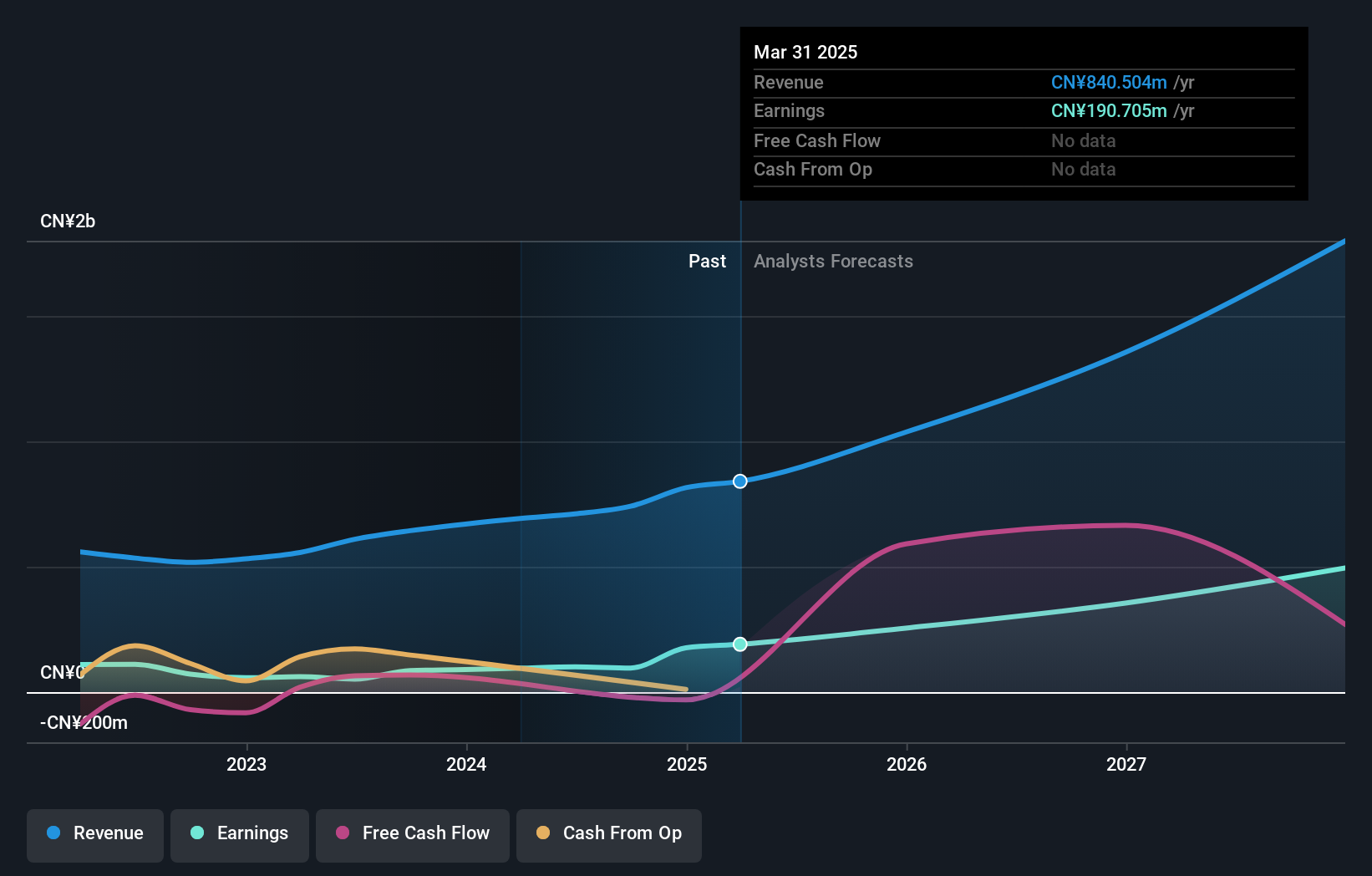

Ningbo Yongxin Optics has demonstrated a robust trajectory in revenue growth, clocking in at 30.4% annually, surpassing the broader Chinese market's expansion rate of 13.7%. Despite facing challenges with a 20.5% dip in earnings last year due to significant one-off gains of CN¥64.9M affecting its financials, the company is poised for a rebound with expected earnings growth of 34.1% per annum over the next three years, outpacing the market forecast of 25.5%. This growth is underpinned by a solid sales increase from CNY 610.64 million to CNY 650.58 million in the recent nine-month period ending September 2024, although net income during this period saw a reduction from CNY 173.76 million to CNY 140.26 million year-over-year. Moreover, Ningbo Yongxin Optics' commitment to innovation and development is evident from its strategic R&D investments aimed at refining its optical technologies—a crucial move that not only enhances product offerings but also positions it well within the competitive tech landscape despite current volatility in share prices and lower than average return on equity projections (16.2%). As it navigates through these financial nuances and leverages its increased revenues for future advancements, Ningbo Yongxin Optics may continue shaping its niche in high-tech optics amidst fluctuating market dynamics.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global provider of algorithms and software solutions in the computer vision industry, with a market cap of CN¥15.95 billion.

Operations: ArcSoft focuses on developing algorithms and software solutions for the computer vision sector globally. The company generates revenue primarily through its innovative software offerings tailored for various applications in this industry.

ArcSoft has demonstrated a compelling growth trajectory in the tech sector, with its revenue increasing by 28.5% annually, outpacing the broader Chinese market's average of 13.7%. This surge is supported by robust earnings growth, which at an annual rate of 40.7%, exceeds both industry and national averages significantly. The company's commitment to innovation is highlighted by its R&D investments which have been pivotal in maintaining competitive advantage and fueling these financial achievements. Despite a volatile share price over the past three months, ArcSoft's strategic focus on enhancing software capabilities through substantial R&D spending—evidenced in recent earnings reports—positions it well for sustained growth amidst dynamic market conditions.

- Dive into the specifics of ArcSoft here with our thorough health report.

Explore historical data to track ArcSoft's performance over time in our Past section.

MeiG Smart Technology (SZSE:002881)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MeiG Smart Technology Co., Ltd. focuses on the research and development, production, and sale of Internet of Things terminals and wireless communication modules and solutions both in China and internationally, with a market cap of CN¥7.61 billion.

Operations: MeiG Smart Technology generates revenue through the sale of Internet of Things terminals and wireless communication modules. The company operates in both domestic and international markets, leveraging its research and development capabilities to offer advanced solutions.

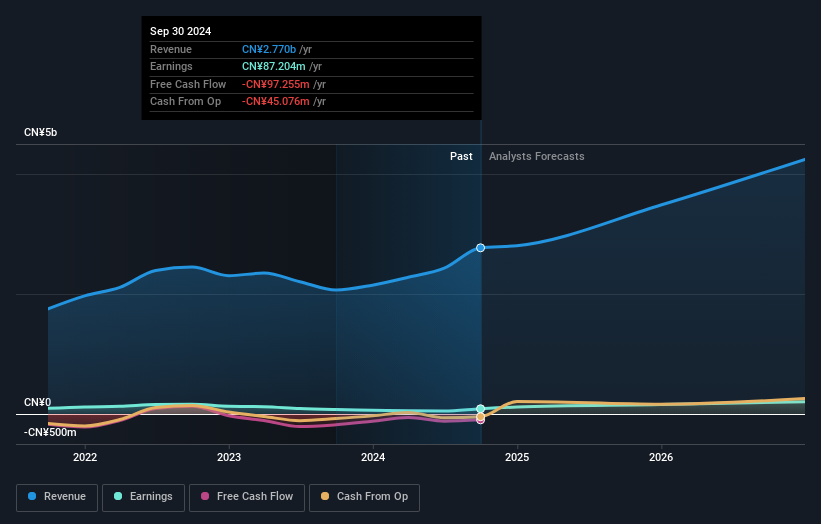

MeiG Smart Technology has shown a robust performance with a 40% increase in revenue to CNY 2.18 billion, outstripping last year's figures significantly. This growth is underpinned by a solid increase in net income, which rose to CNY 91.36 million from CNY 68.66 million, reflecting an earnings growth of about 33% annually—well above the broader market's average. The company’s strategic emphasis on R&D is evident as it continues to innovate within the communications sector, which could further enhance its competitive edge and market position moving forward.

Key Takeaways

- Delve into our full catalog of 1270 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688088

ArcSoft

Operates as an algorithm and software solution provider in the computer vision industry worldwide.

Flawless balance sheet with high growth potential.