- China

- /

- Tech Hardware

- /

- SHSE:603296

Improved Earnings Required Before Huaqin Technology Co., Ltd. (SHSE:603296) Stock's 28% Jump Looks Justified

Despite an already strong run, Huaqin Technology Co., Ltd. (SHSE:603296) shares have been powering on, with a gain of 28% in the last thirty days. The last 30 days bring the annual gain to a very sharp 39%.

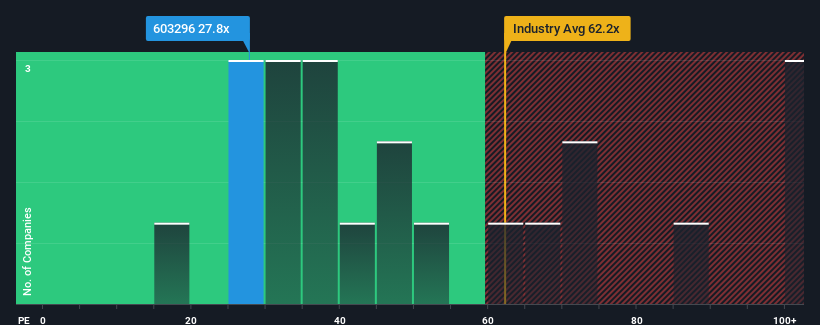

Even after such a large jump in price, Huaqin Technology's price-to-earnings (or "P/E") ratio of 27.8x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 36x and even P/E's above 69x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Huaqin Technology has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Huaqin Technology

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Huaqin Technology's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. Even so, admirably EPS has lifted 32% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 26% over the next year. With the market predicted to deliver 38% growth , the company is positioned for a weaker earnings result.

With this information, we can see why Huaqin Technology is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Huaqin Technology's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Huaqin Technology maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Huaqin Technology with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Huaqin Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Huaqin Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603296

Huaqin Technology

Engages in the development, manufacturing, and operation service of software, hardware, systems for tech companies worldwide.

Very undervalued with adequate balance sheet.

Market Insights

Community Narratives