- South Korea

- /

- Entertainment

- /

- KOSDAQ:A263750

High Growth Tech Stocks To Watch In March 2025

Reviewed by Simply Wall St

As global markets navigate a period of heightened uncertainty, the Federal Reserve's decision to hold rates steady has been a focal point, with U.S. tech stocks experiencing a quieter week and underperforming compared to other sectors. In this environment, identifying high-growth tech stocks requires careful consideration of their potential for innovation and resilience in the face of evolving economic conditions and geopolitical risks.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| CD Projekt | 30.55% | 39.06% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 28.84% | 104.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Pearl Abyss (KOSDAQ:A263750)

Simply Wall St Growth Rating: ★★★★☆☆

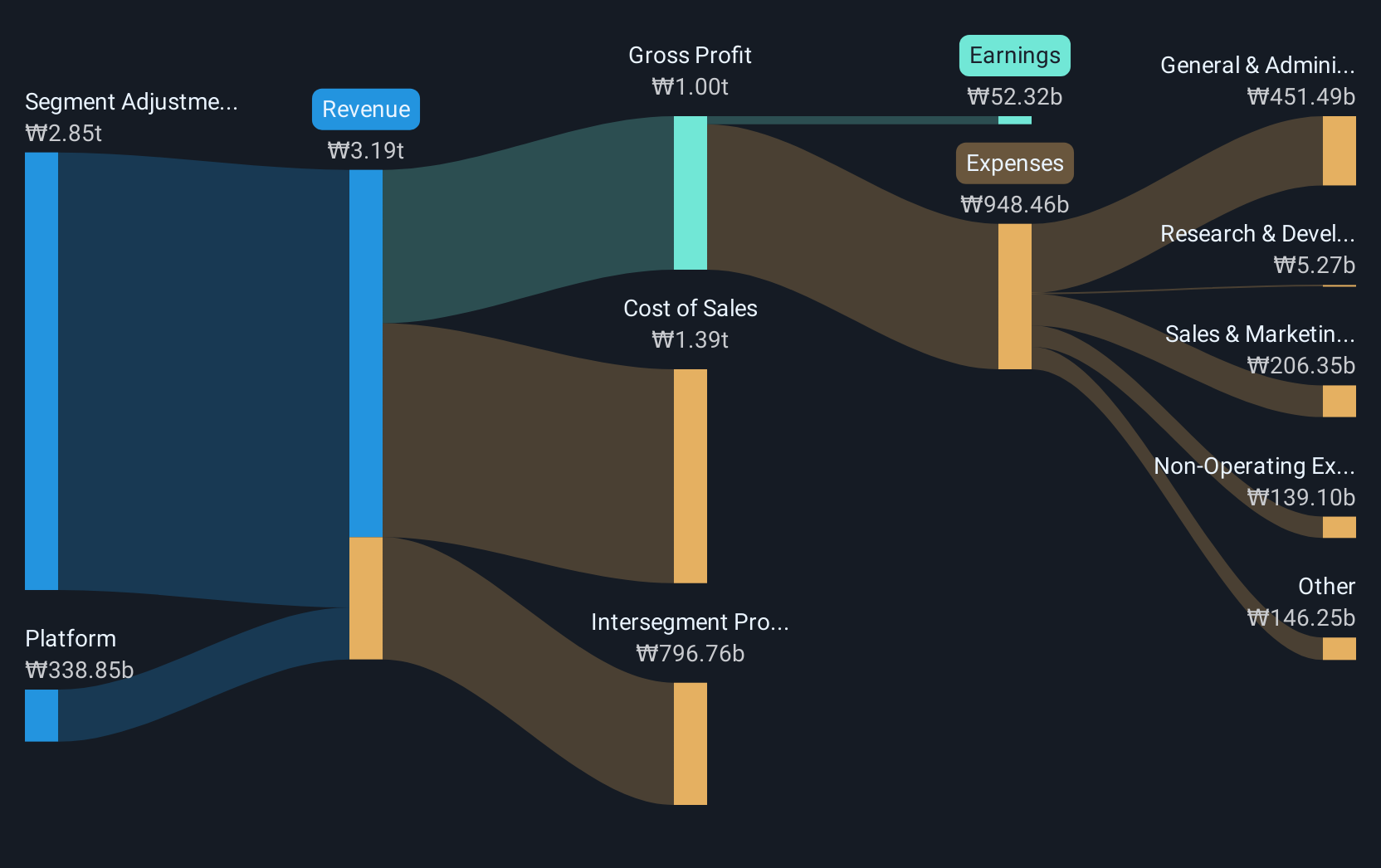

Overview: Pearl Abyss Corp. is a company that specializes in software development for games, with a market capitalization of ₩1.89 trillion.

Operations: The company's primary revenue stream is from game sales, amounting to ₩320.67 billion.

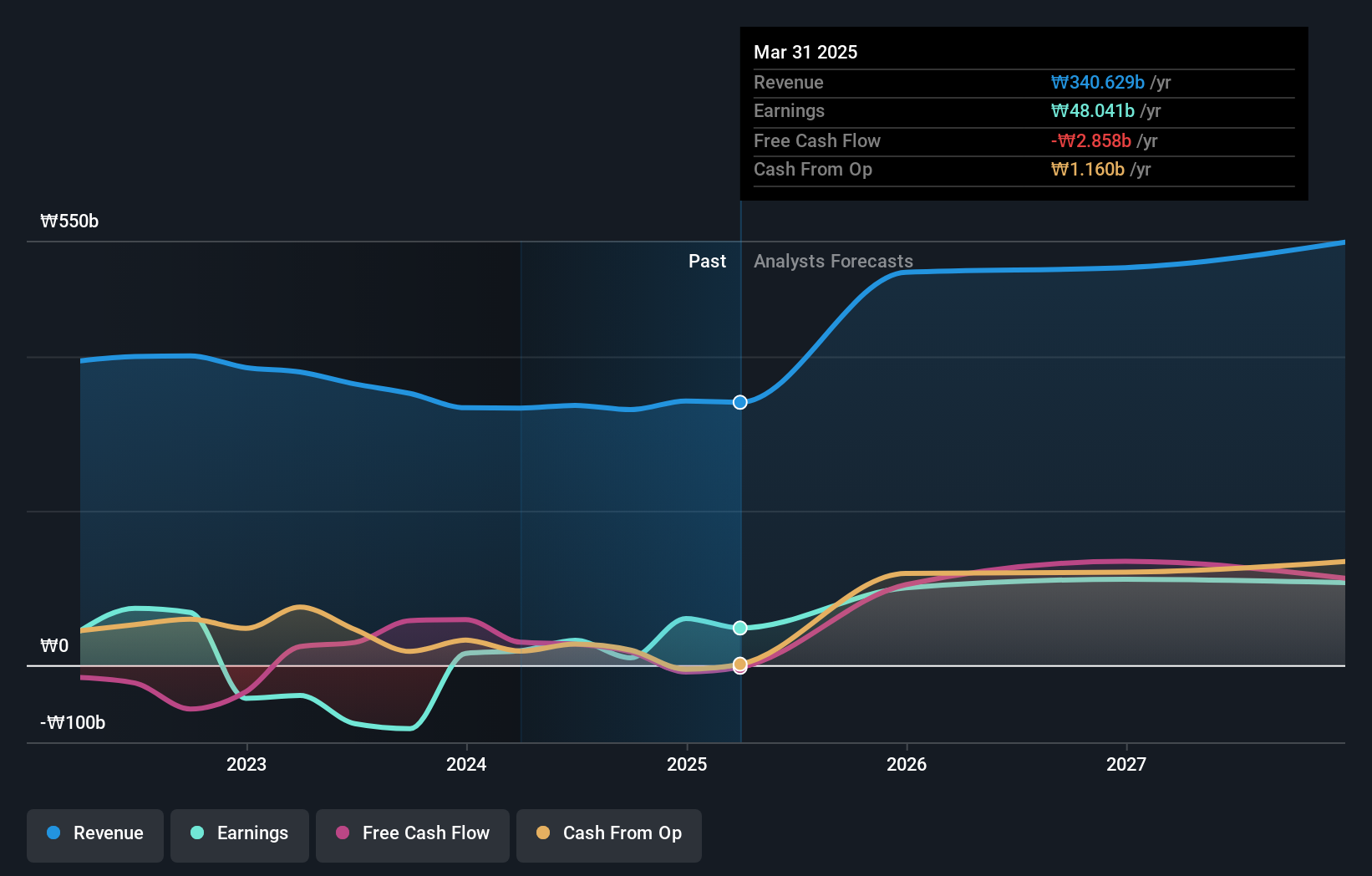

Pearl Abyss has demonstrated robust growth with an annualized revenue increase of 19.4% and an exceptional earnings surge at 84.5% per year, outpacing the Korean market's average. With a commitment to innovation, their R&D expenses have been strategic, fostering developments that resonate well within the tech sector. Recent presentations at the J.P. Morgan Korea Conference highlighted these advancements and their positive reception in the market. Looking ahead, while their Return on Equity is projected at a modest 13%, the company's trajectory in harnessing tech trends and expanding its market presence paints a promising picture for future endeavors.

- Click here to discover the nuances of Pearl Abyss with our detailed analytical health report.

Explore historical data to track Pearl Abyss' performance over time in our Past section.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management, with a market cap of ₩9.70 trillion.

Operations: HYBE Co., Ltd. generates revenue primarily through music production, publishing, and artist management. The company focuses on leveraging its artists' brand value to drive sales across various platforms and merchandise offerings.

HYBE's recent financial performance presents a mixed picture, with a significant drop in net income from KRW 187.25 billion to KRW 9.38 billion year-over-year and basic earnings per share tumbling similarly from KRW 4,504 to KRW 225. Despite these challenges, the company's revenue growth forecast remains robust at 15.8% annually, outpacing the Korean market average of 8.2%. Furthermore, HYBE is expected to see its earnings grow by an impressive 49.1% annually over the next three years, suggesting potential for recovery and growth despite current setbacks and a competitive entertainment industry landscape where it has recently underperformed in terms of profit margins (0.4% compared to last year’s 8.6%).

- Click here and access our complete health analysis report to understand the dynamics of HYBE.

Assess HYBE's past performance with our detailed historical performance reports.

Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. operates in the electronic technology sector and has a market cap of CN¥11.73 billion.

Operations: Yuanliu Hongyuan focuses on the electronic technology industry, with its operations generating significant revenue. The company has a market capitalization of CN¥11.73 billion, indicating its substantial presence in the sector.

Beijing Yuanliu Hongyuan Electronic Technology demonstrates a robust trajectory in the tech sector, with anticipated revenue growth of 21% per year, surpassing the Chinese market average of 13.1%. This growth is complemented by an impressive forecast of earnings expansion at 36.1% annually, significantly outstripping the broader market's 24.9%. The company's commitment to innovation is underscored by its R&D investments, which have consistently aligned with or exceeded industry benchmarks, positioning it well for sustained advancements in electronic technologies. Despite some challenges in net profit margins, which have seen a reduction from last year’s 20.2% to 10.1%, the firm’s strategic focus on high-quality earnings and positive free cash flow signals potential for future resilience and competitive edge in its segment.

Key Takeaways

- Click here to access our complete index of 783 Global High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A263750

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives