- China

- /

- Electronic Equipment and Components

- /

- SHSE:603267

Global Market's Top 3 Stocks That May Be Trading Below Fair Value Estimates

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mix of gains and losses, with U.S. stocks closing higher after a period of declines and European markets showing resilience despite trade tensions. Amid this environment, identifying stocks that may be trading below their fair value can present opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Somec (BIT:SOM) | €10.30 | €20.55 | 49.9% |

| Romsdal Sparebank (OB:ROMSB) | NOK130.30 | NOK259.95 | 49.9% |

| Gesco (XTRA:GSC1) | €15.60 | €31.15 | 49.9% |

| STI (KOSDAQ:A039440) | ₩22050.00 | ₩44000.09 | 49.9% |

| S Foods (TSE:2292) | ¥2553.00 | ¥5084.09 | 49.8% |

| Deutsche Beteiligungs (XTRA:DBAN) | €26.60 | €53.06 | 49.9% |

| dormakaba Holding (SWX:DOKA) | CHF682.00 | CHF1357.16 | 49.7% |

| Zhejiang Juhua (SHSE:600160) | CN¥23.90 | CN¥47.61 | 49.8% |

| Carasent (OM:CARA) | SEK20.70 | SEK41.06 | 49.6% |

| Komplett (OB:KOMPL) | NOK11.05 | NOK21.97 | 49.7% |

Let's review some notable picks from our screened stocks.

Carote (SEHK:2549)

Overview: Carote Ltd is an investment holding company that offers a variety of kitchenware products under the CAROTE brand to brand-owners and retailers, with a market capitalization of approximately HK$3.22 billion.

Operations: Carote Ltd's revenue is primarily derived from its Branded Business segment, which generated CN¥1.58 billion, and its ODM Business segment, contributing CN¥210.80 million.

Estimated Discount To Fair Value: 20.3%

Carote is trading at HK$5.8, significantly below its estimated fair value of HK$7.28, indicating it may be undervalued based on cash flows. Earnings grew by 92.1% last year and are forecast to grow at 25.66% annually, outpacing the Hong Kong market's growth rate of 11.1%. Revenue is also expected to expand rapidly at 25.6% per year, surpassing the market average of 7.8%.

- Our earnings growth report unveils the potential for significant increases in Carote's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Carote.

Yangmei ChemicalLtd (SHSE:600691)

Overview: Yangmei Chemical Co., Ltd. is involved in the research, development, production, and sale of chemical products in China with a market cap of CN¥5.11 billion.

Operations: Revenue Segments (in millions of CN¥):

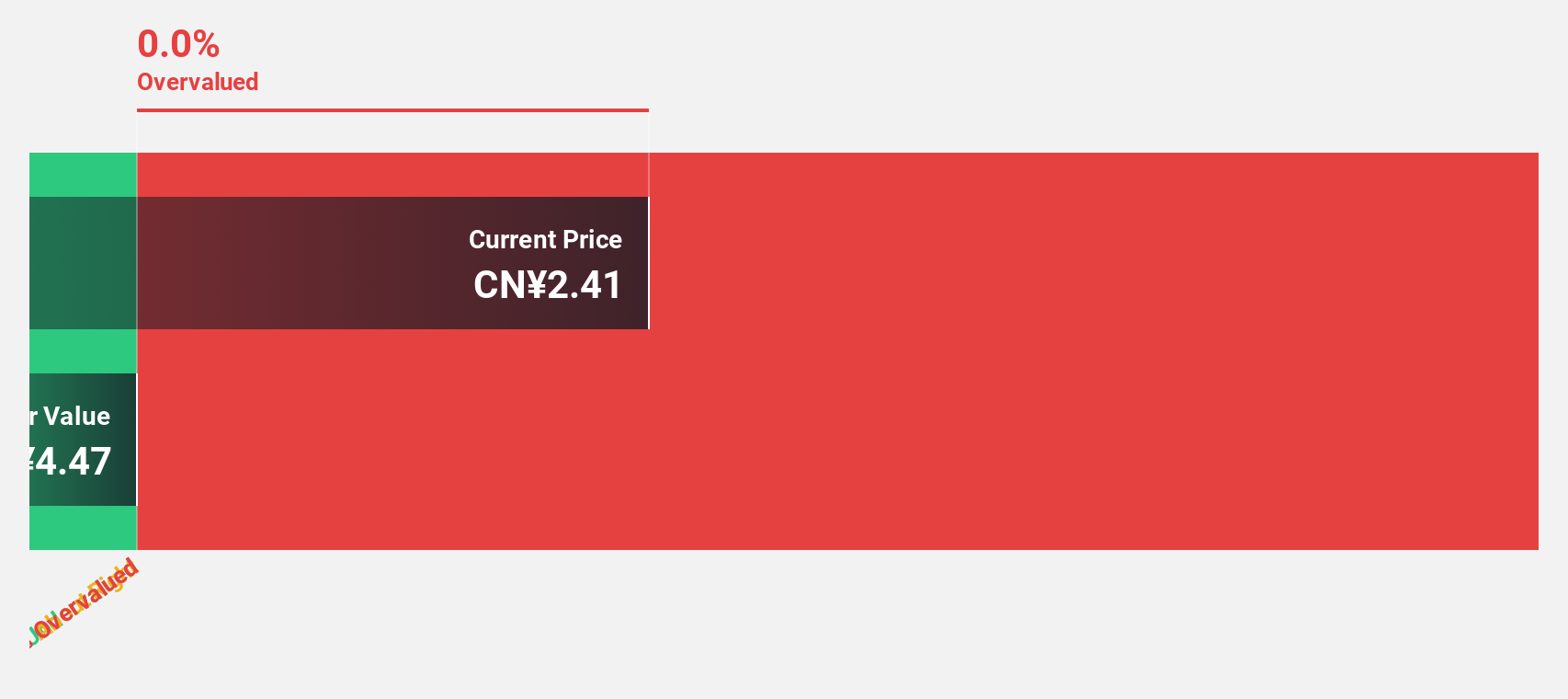

Estimated Discount To Fair Value: 25.4%

Yangmei Chemical Ltd. is trading at CN¥2.24, significantly below its estimated fair value of CN¥3, suggesting it is undervalued based on cash flows. The company anticipates a robust revenue growth of 21.2% annually, surpassing the Chinese market's average growth rate of 13.1%. Despite low forecasted return on equity at 2.5%, earnings are projected to grow substantially by 108.05% per year, with profitability expected within three years.

- Insights from our recent growth report point to a promising forecast for Yangmei ChemicalLtd's business outlook.

- Take a closer look at Yangmei ChemicalLtd's balance sheet health here in our report.

Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267)

Overview: Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. operates in the electronic technology sector with a market capitalization of approximately CN¥11.73 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment data for Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. If you have additional information or another source, I can assist further in summarizing it.

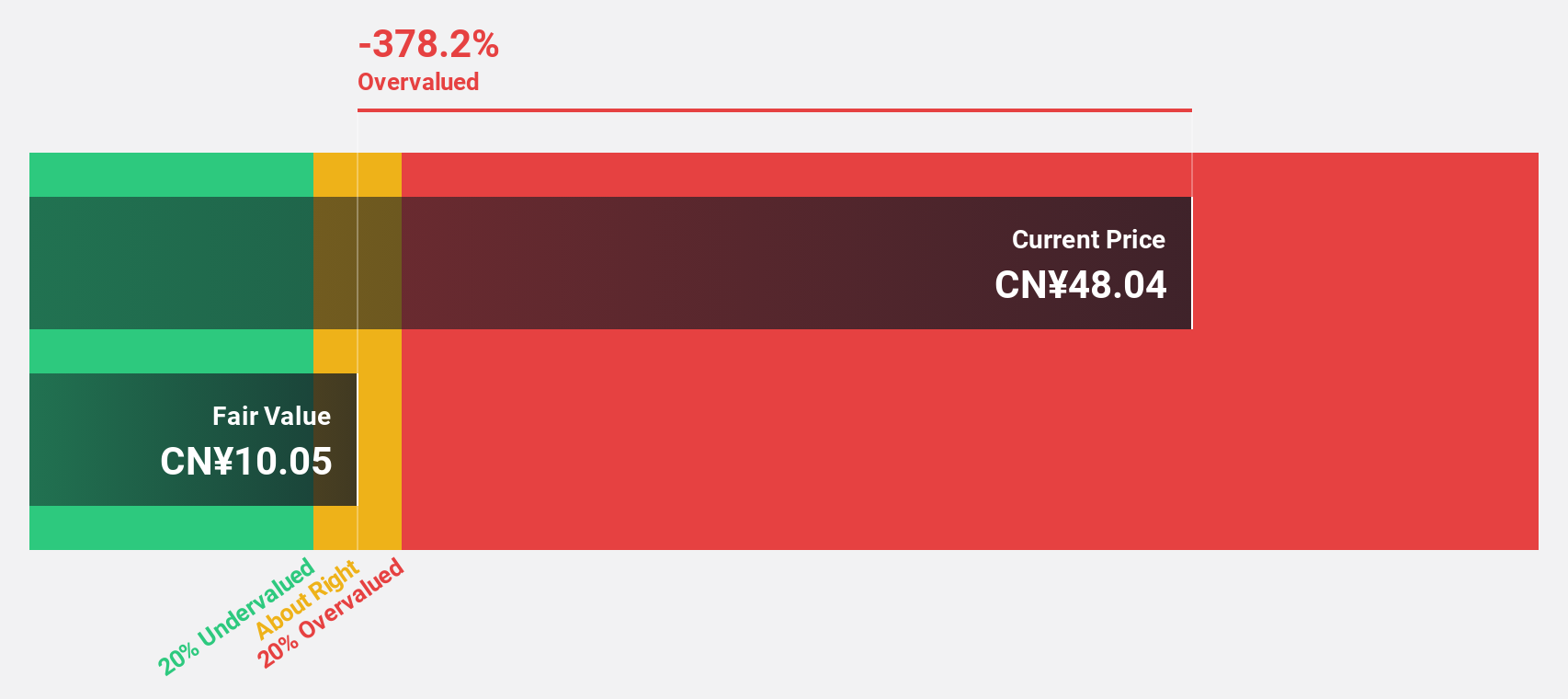

Estimated Discount To Fair Value: 16.7%

Beijing Yuanliu Hongyuan Electronic Technology is trading at CN¥56.13, below its estimated fair value of CN¥67.42, indicating undervaluation based on cash flows. Earnings are projected to grow significantly at 36.1% annually over the next three years, outpacing the Chinese market's 24.9% growth rate. Revenue is expected to increase by 21% per year, although profit margins have decreased from last year and return on equity remains low at a forecasted 8.3%.

- Our comprehensive growth report raises the possibility that Beijing Yuanliu Hongyuan Electronic Technology is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Beijing Yuanliu Hongyuan Electronic Technology stock in this financial health report.

Seize The Opportunity

- Discover the full array of 518 Undervalued Global Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Yuanliu Hongyuan Electronic Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603267

Beijing Yuanliu Hongyuan Electronic Technology

Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives