- China

- /

- Semiconductors

- /

- SHSE:688798

3 Stocks That Might Be Undervalued By Up To 35.9% For Savvy Investors

Reviewed by Simply Wall St

As global markets navigate a whirlwind of economic data and earnings reports, major indices like the Nasdaq Composite and S&P MidCap 400 have experienced significant fluctuations, reflecting cautious investor sentiment amid mixed signals from labor markets and manufacturing sectors. In such an environment, identifying stocks that may be undervalued becomes crucial for investors seeking opportunities; these stocks often possess strong fundamentals but are temporarily overlooked due to broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | US$22.50 | US$44.83 | 49.8% |

| Harmony Gold Mining (JSE:HAR) | ZAR180.36 | ZAR359.54 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.80 | SEK450.91 | 49.7% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.49 | US$46.79 | 49.8% |

| Ligand Pharmaceuticals (NasdaqGM:LGND) | US$129.90 | US$258.67 | 49.8% |

| Redcentric (AIM:RCN) | £1.1775 | £2.35 | 50% |

| DoubleVerify Holdings (NYSE:DV) | US$19.72 | US$39.40 | 49.9% |

| Laboratorio Reig Jofre (BME:RJF) | €2.89 | €5.74 | 49.6% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$272.22 | US$544.40 | 50% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.24 | €16.38 | 49.7% |

Here's a peek at a few of the choices from the screener.

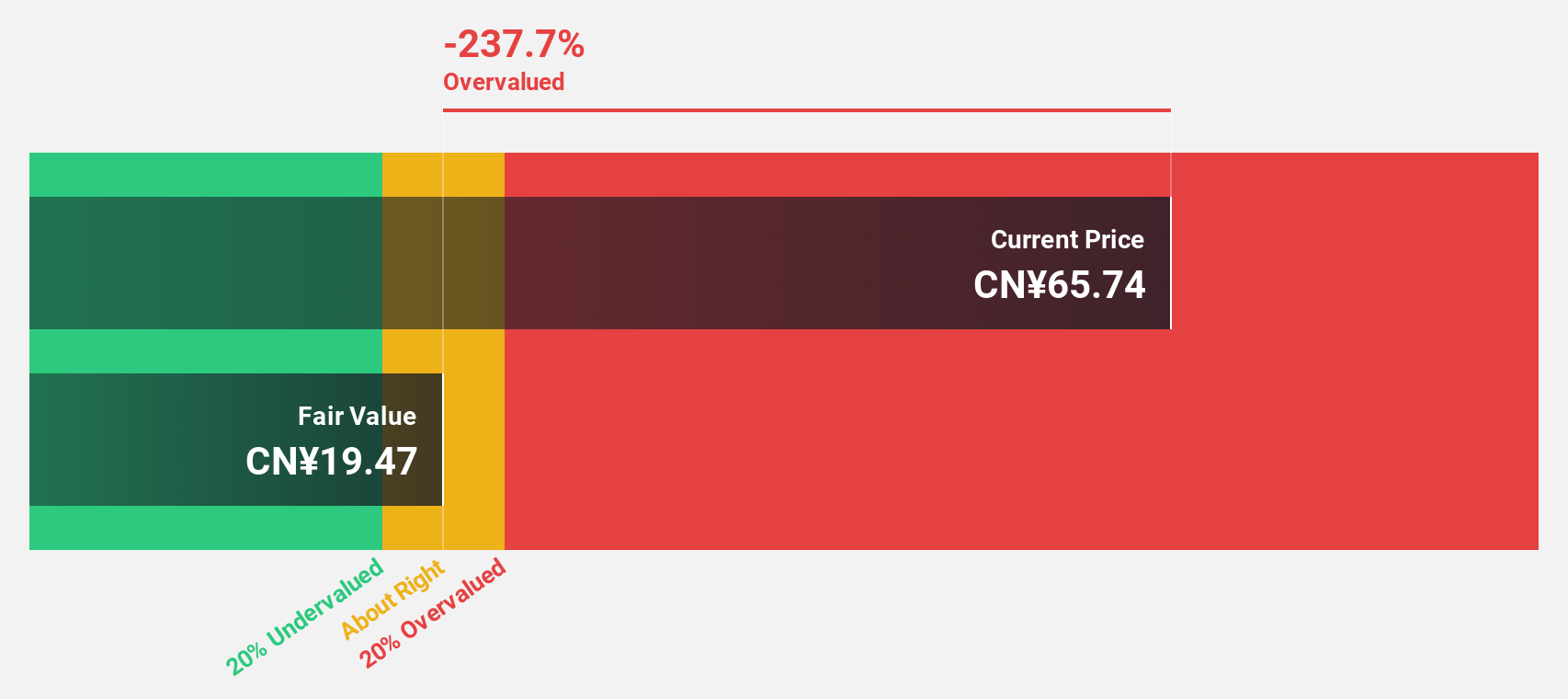

Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267)

Overview: Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. operates in the electronic technology sector with a market cap of CN¥9.88 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd.

Estimated Discount To Fair Value: 35.9%

Beijing Yuanliu Hongyuan Electronic Technology appears undervalued, trading at CNY 45.09, below its estimated fair value of CNY 70.33. Despite a decline in net income to CNY 127.4 million for the first nine months of 2024, the company's revenue and earnings are projected to grow significantly above market averages over the next few years. However, profit margins have decreased from last year and return on equity is expected to remain low at 9.5%.

- Our comprehensive growth report raises the possibility that Beijing Yuanliu Hongyuan Electronic Technology is poised for substantial financial growth.

- Dive into the specifics of Beijing Yuanliu Hongyuan Electronic Technology here with our thorough financial health report.

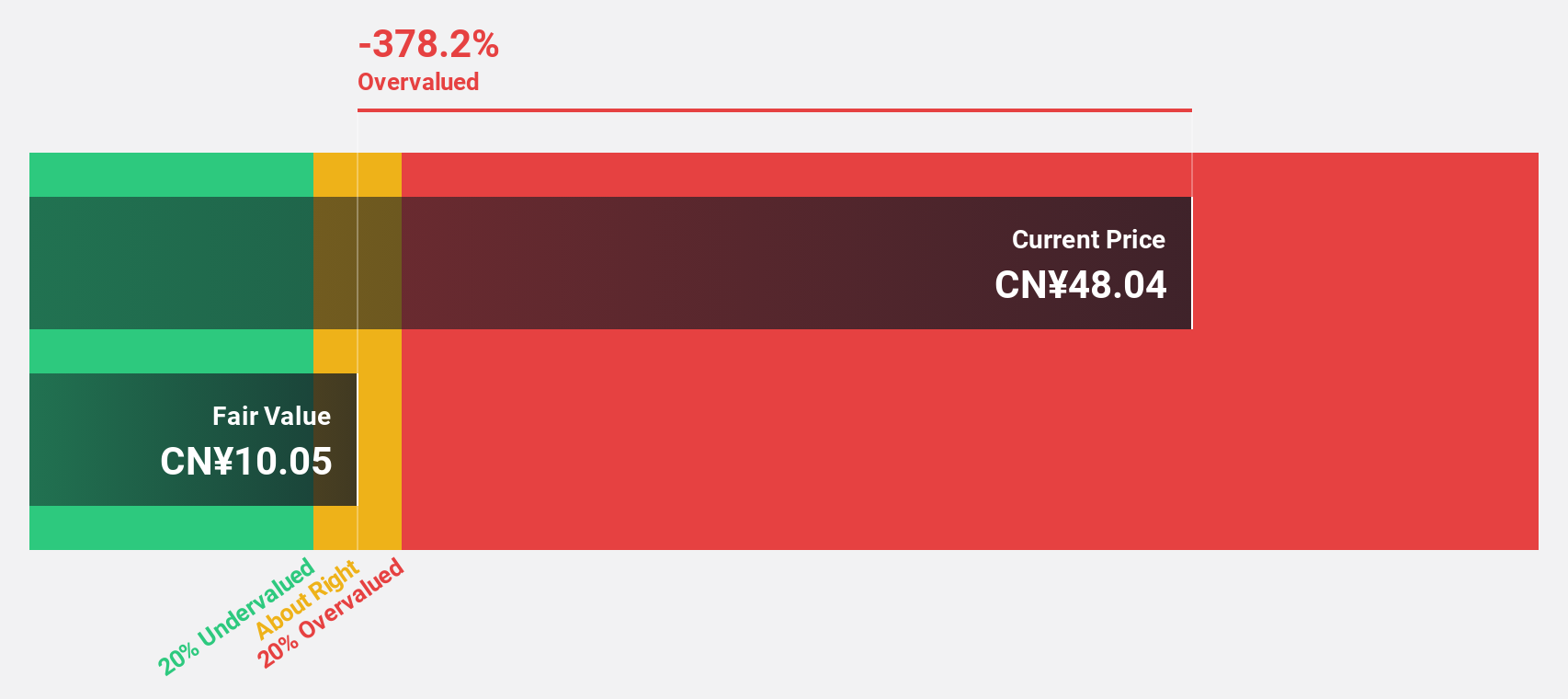

Shanghai Awinic TechnologyLtd (SHSE:688798)

Overview: Shanghai Awinic Technology Co., Ltd. develops and sells integrated circuit chips both in China and internationally, with a market cap of CN¥16.45 billion.

Operations: The company generates revenue of CN¥3.11 billion from its chip research, design, and sales activities.

Estimated Discount To Fair Value: 15.5%

Shanghai Awinic Technology Ltd. is trading at CN¥75.05, below its estimated fair value of CN¥88.86, suggesting it may be undervalued based on cash flows. The company reported a net income of CN¥177.91 million for the first nine months of 2024, recovering from a loss last year, with earnings expected to grow significantly above market averages in the coming years despite recent share price volatility and low forecasted return on equity at 11.4%.

- In light of our recent growth report, it seems possible that Shanghai Awinic TechnologyLtd's financial performance will exceed current levels.

- Click here to discover the nuances of Shanghai Awinic TechnologyLtd with our detailed financial health report.

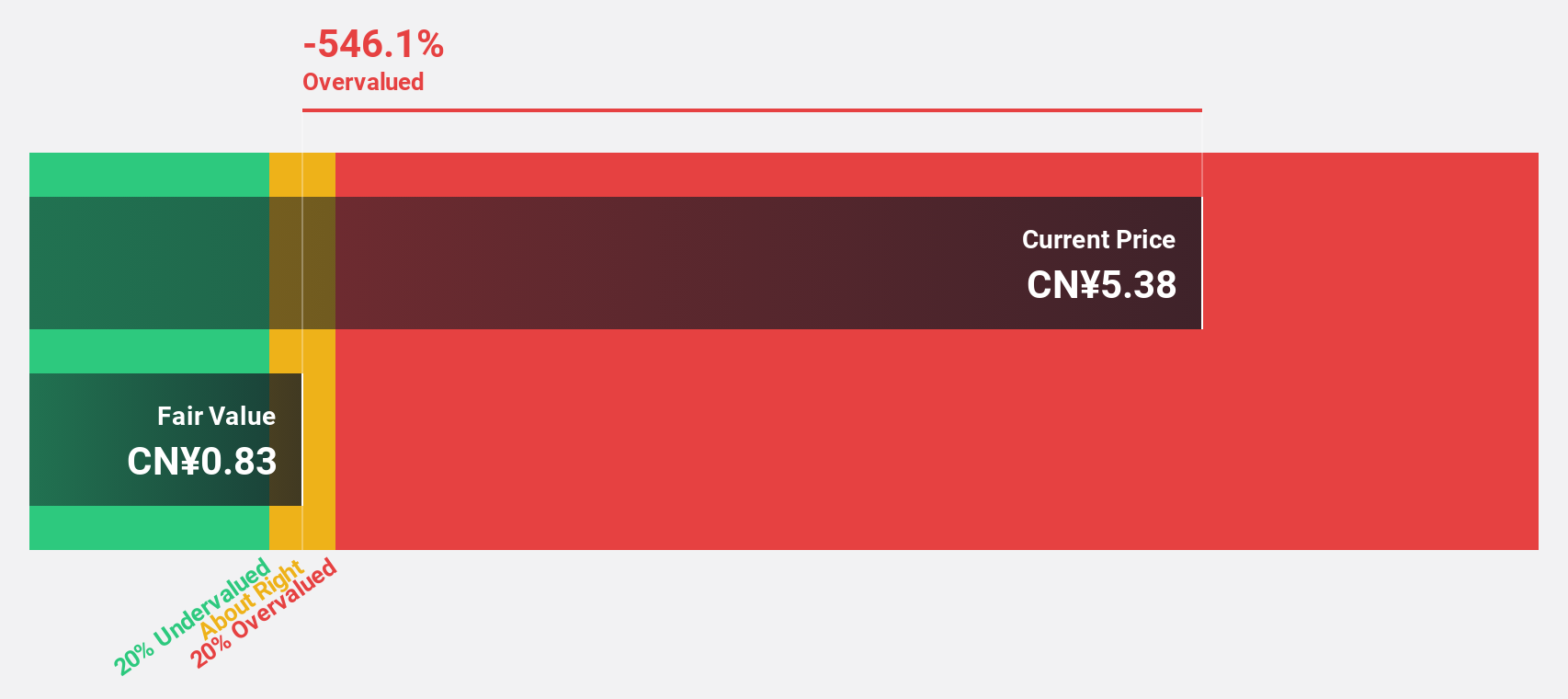

Xuzhou Handler Special Vehicle (SZSE:300201)

Overview: Xuzhou Handler Special Vehicle Co., Ltd focuses on the research, development, production, and sales of aerial work vehicles, electric emergency support vehicles, military products, and fire trucks with a market capitalization of CN¥4.79 billion.

Operations: The company's revenue is derived from its activities in aerial work vehicles, electric emergency support vehicles, military products, and fire trucks.

Estimated Discount To Fair Value: 22.4%

Xuzhou Handler Special Vehicle is trading at CN¥5.82, below its fair value estimate of CN¥7.5, reflecting potential undervaluation based on cash flows. Despite a decline in revenue to CN¥1 billion for the first nine months of 2024 compared to last year, net income remained stable at approximately CN¥133 million. Earnings are projected to grow significantly over the next three years, although recent earnings reports indicate challenges in sustaining revenue growth.

- Our growth report here indicates Xuzhou Handler Special Vehicle may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Xuzhou Handler Special Vehicle stock in this financial health report.

Turning Ideas Into Actions

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 922 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688798

Shanghai Awinic TechnologyLtd

Engages in the research, development, and sale of integrated circuit chips in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives