- China

- /

- Electronic Equipment and Components

- /

- SHSE:603236

High Growth Tech Stocks In Asia To Watch March 2025

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and trade policy uncertainties, Asian tech stocks are capturing attention amid shifting economic dynamics. In this environment, identifying high-growth opportunities requires a focus on companies that demonstrate resilience and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.74% | 33.49% | ★★★★★★ |

| Xi'an NovaStar Tech | 30.18% | 35.32% | ★★★★★★ |

| Fositek | 36.17% | 45.30% | ★★★★★★ |

| Seojin SystemLtd | 31.08% | 34.32% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company that focuses on the development and commercialization of monoclonal antibodies and other drug assets targeting oncology, ophthalmology, autoimmune, cardiovascular, and metabolic diseases in China with a market cap of approximately HK$67.08 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥7.46 billion.

Innovent Biologics, a frontrunner in the biotech sector, recently celebrated a significant milestone with the NMPA's approval of SYCUME®, an innovative therapy for thyroid eye disease (TED), marking it as China’s first IGF-1R antibody drug. This approval not only ends a 70-year treatment gap but also positions Innovent at the forefront of addressing high-incidence autoimmune disorders. The company's commitment to R&D is evident from its robust pipeline and recent approvals, including ipilimumab for MSI-H/dMMR colon cancer, showcasing its strategic focus on oncology and immunotherapy. With revenue growth surpassing 40% year-over-year in 2024 and earnings projected to surge by 44% annually, Innovent is strategically expanding its influence in global markets while enhancing patient care through groundbreaking treatments.

- Click here to discover the nuances of Innovent Biologics with our detailed analytical health report.

Assess Innovent Biologics' past performance with our detailed historical performance reports.

Quectel Wireless Solutions (SHSE:603236)

Simply Wall St Growth Rating: ★★★★☆☆

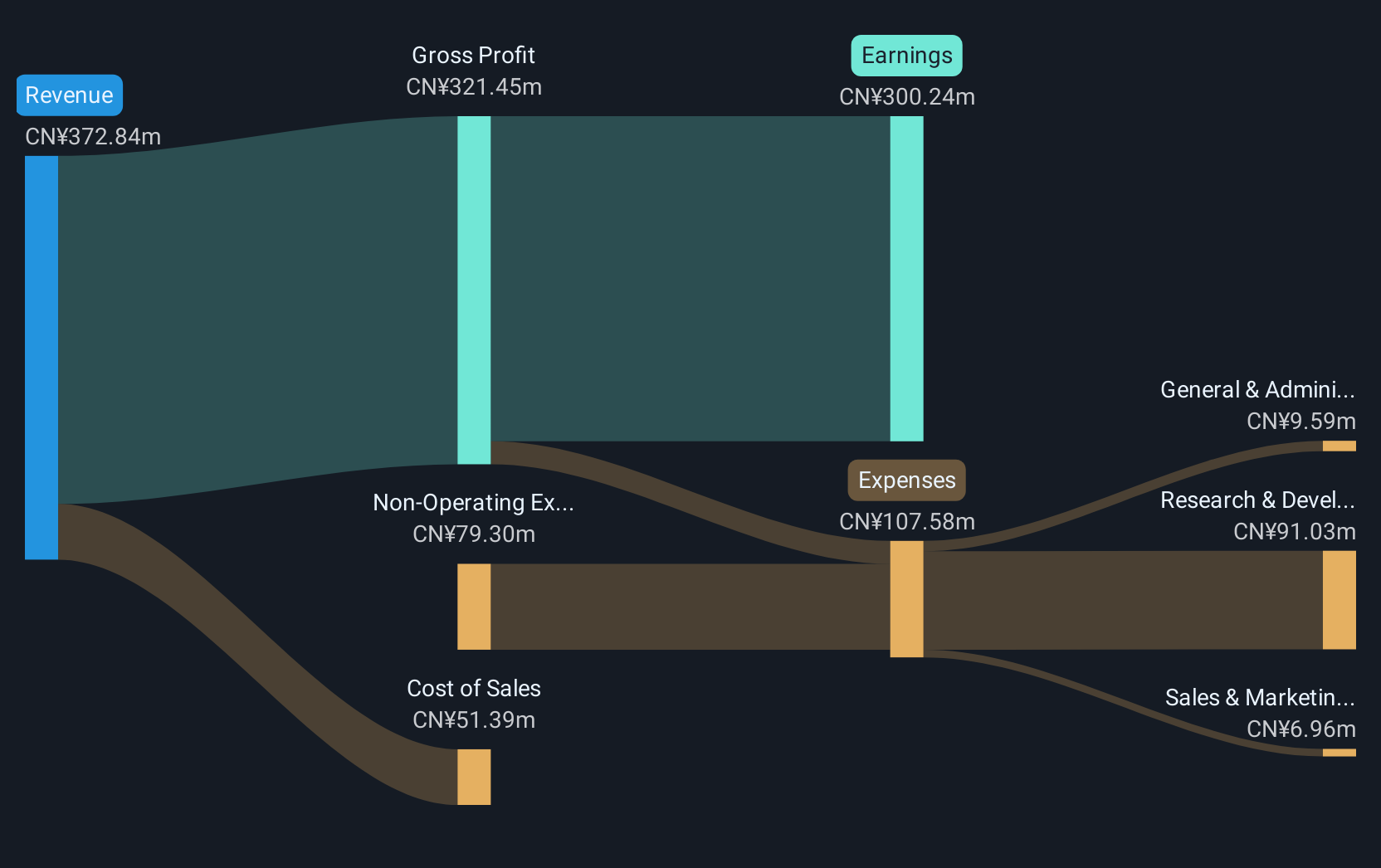

Overview: Quectel Wireless Solutions Co., Ltd. specializes in the R&D, design, production, and sales of wireless communication modules and solutions globally, with a market cap of CN¥22.50 billion.

Operations: The company generates revenue primarily from the sale of wireless communication modules and solutions. It focuses on research, development, design, and production activities to support its global operations.

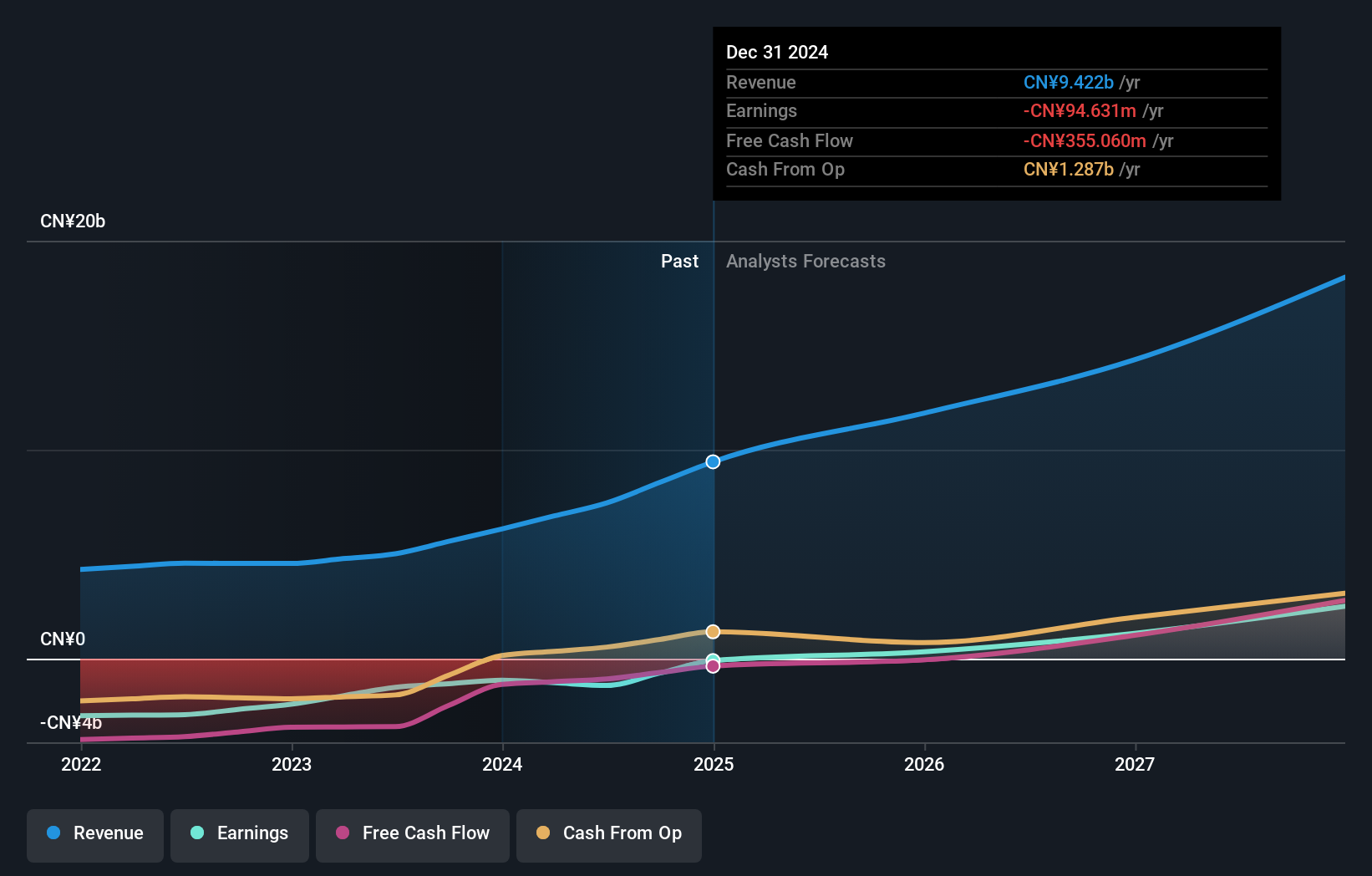

Quectel Wireless Solutions, a key player in the high-growth tech sector in Asia, recently showcased its innovative prowess with the launch of the FCM363X module. This module not only enhances short-range connectivity through Wi-Fi 6 and Bluetooth Low Energy 5.3 but also fortifies device security with multi-layered features like EdgeLock Secure Enclave and Arm TrustZone technology. The company's dedication to R&D is reflected in its strategic product expansions that cater to evolving market needs, ensuring Quectel remains at the forefront of IoT and wireless communication solutions. With an annualized revenue growth rate of 18.2% and earnings expected to surge by 31.2% annually, Quectel is effectively capitalizing on technological advancements to secure its position in competitive tech landscapes.

Shenzhen Fortune Trend Technology (SHSE:688318)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Fortune Trend Technology Co., Ltd. is a company with a market cap of CN¥29.46 billion, primarily engaged in the development and provision of financial software solutions.

Operations: Fortune Trend Technology focuses on creating financial software solutions, generating revenue primarily from the sale and licensing of these products. The company's operations are supported by a market cap of CN¥29.46 billion.

Shenzhen Fortune Trend Technology is capturing attention with its robust annualized revenue growth of 34.9% and earnings projected to climb by 39.2% annually, outpacing the Chinese market averages significantly. This performance is underpinned by strategic R&D investments, which are not only substantial but also pivotal in driving innovation within the tech sector. The company's recent special shareholders meeting highlights active engagement in refining operational strategies, further bolstering its position in Asia's competitive high-growth technology landscape. With such dynamic financial and developmental strides, Shenzhen Fortune Trend is poised to continue its upward trajectory, leveraging cutting-edge technology solutions that meet evolving market demands.

- Unlock comprehensive insights into our analysis of Shenzhen Fortune Trend Technology stock in this health report.

Understand Shenzhen Fortune Trend Technology's track record by examining our Past report.

Summing It All Up

- Navigate through the entire inventory of 519 Asian High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Quectel Wireless Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603236

Quectel Wireless Solutions

Engages in the research and development, design, production, and sale of wireless communication modules and solutions worldwide.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion