- China

- /

- Electronic Equipment and Components

- /

- SHSE:603228

High Growth Tech Stocks In Asia Featuring Three Promising Companies

Reviewed by Simply Wall St

The Asian tech market is currently witnessing a dynamic phase, buoyed by positive developments in global trade relations and easing geopolitical tensions, which have contributed to a more optimistic outlook for the region's economic growth. In this environment, identifying high-growth tech stocks involves looking for companies that not only capitalize on technological advancements but also demonstrate resilience amidst fluctuating market conditions and evolving consumer demands.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Fositek | 28.54% | 35.14% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.91% | 26.60% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Shenzhen Kinwong Electronic (SHSE:603228)

Simply Wall St Growth Rating: ★★★★☆☆

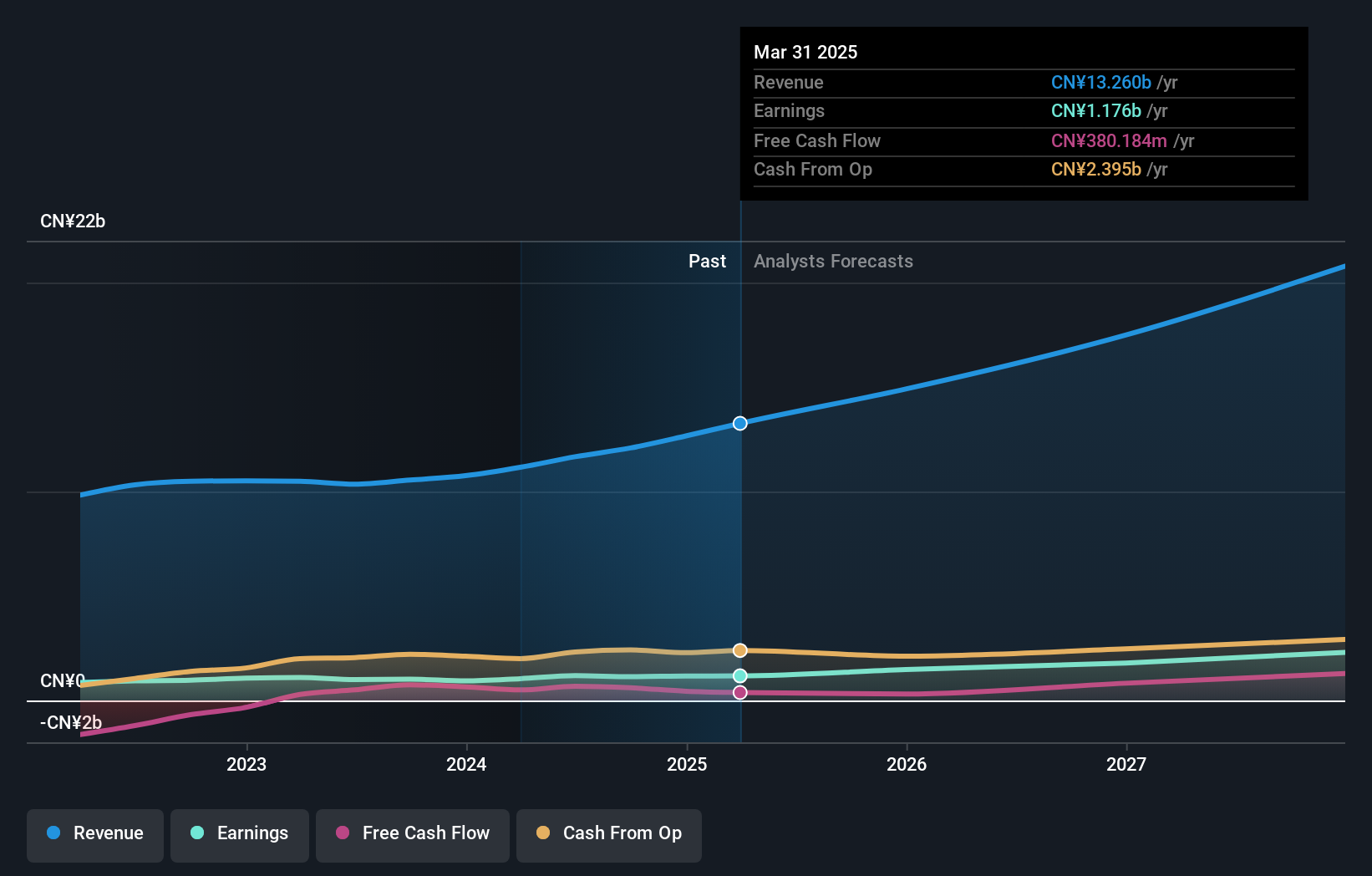

Overview: Shenzhen Kinwong Electronic Co., Ltd. specializes in the research, development, production, and sale of printed circuit boards and electronic materials both domestically and internationally, with a market cap of CN¥39.59 billion.

Operations: Kinwong Electronic focuses on the production and sale of printed circuit boards, generating revenue primarily from this segment, which amounts to CN¥13.26 billion.

Shenzhen Kinwong Electronic, a standout in the Asian tech sector, is navigating through a landscape marked by robust growth and innovation. With an annual revenue increase of 16.4% and earnings growth surpassing industry averages at 23.7%, the company is setting benchmarks that exceed even the vigorous CN market expectations. Notably, its commitment to advancement is underscored by substantial R&D investments, aligning with its strategic focus on enhancing technological capabilities which saw a significant uptick in expenditure last year. Recent events such as dividend increases and positive earnings calls further highlight Kinwong's financial health and operational success, positioning it well amidst evolving market dynamics despite its volatile share price over recent months.

iFLYTEKLTD (SZSE:002230)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iFLYTEK CO., LTD. provides intelligent application system services in China and has a market cap of CN¥110.17 billion.

Operations: iFLYTEK CO., LTD. focuses on intelligent application system services within China. It operates primarily in the technology sector, leveraging artificial intelligence to enhance its service offerings.

iFLYTEK, a dynamic force in the Asian tech landscape, recently showcased its AI-driven solutions at MWC Shanghai 2025, reflecting its deep commitment to innovation and global market expansion. The company's revenue surged by 14.8% annually, outpacing the broader CN market growth of 12.4%. This performance is bolstered by an impressive earnings increase of 60.9% over the past year, significantly ahead of the software industry's average decline. iFLYTEK continues to invest heavily in R&D to fuel these advancements, with recent product launches like the Dual-Screen Translator 2.0 highlighting its focus on enhancing communication technologies across diverse linguistic landscapes.

- Click here to discover the nuances of iFLYTEKLTD with our detailed analytical health report.

Review our historical performance report to gain insights into iFLYTEKLTD's's past performance.

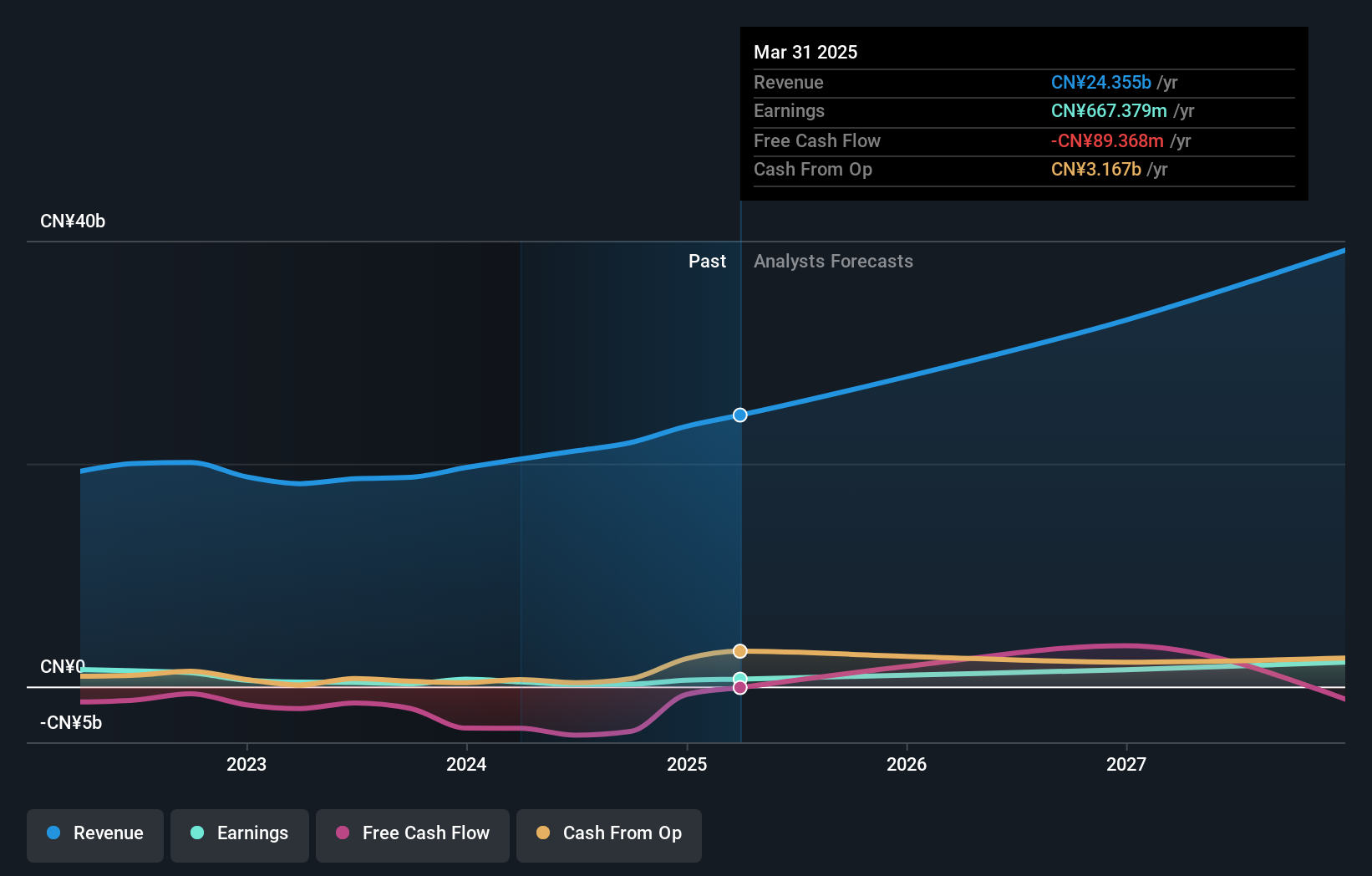

Longshine Technology Group (SZSE:300682)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Longshine Technology Group Co., Ltd. is a technology company based in China with a market capitalization of CN¥24.51 billion.

Operations: Longshine Technology Group Co., Ltd. focuses on technology services within China, with a significant market presence reflected in its CN¥24.51 billion market capitalization.

Longshine Technology Group, navigating through a challenging tech landscape, reported a notable turnaround with first-quarter sales stabilizing at CNY 666.69 million and a shift to net income of CNY 3.37 million from a significant loss the previous year. This pivot underscores its resilience amid market fluctuations, highlighted by an annualized revenue growth of 14.7% and an impressive forecasted earnings growth of 65.8%. The company's commitment to innovation is evident in its R&D spending trends, crucial for sustaining growth in the competitive Asian tech sector. These strategic moves, coupled with recent governance enhancements and dividend adjustments at their AGM, reflect Longshine's proactive approach to strengthening its market position while adapting to dynamic industry demands.

Summing It All Up

- Take a closer look at our Asian High Growth Tech and AI Stocks list of 485 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603228

Shenzhen Kinwong Electronic

Engages in research, development, production, and sale of printed circuit boards (PCB) and electronic materials in China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives