- China

- /

- Communications

- /

- SHSE:603083

Little Excitement Around CIG ShangHai Co., Ltd.'s (SHSE:603083) Revenues As Shares Take 28% Pounding

The CIG ShangHai Co., Ltd. (SHSE:603083) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 17% in that time.

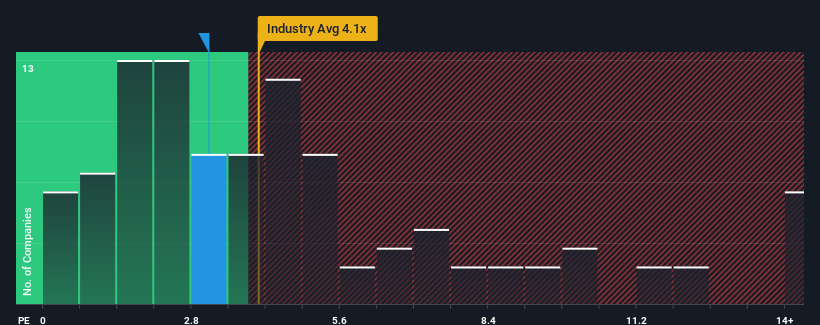

Although its price has dipped substantially, CIG ShangHai may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.1x, since almost half of all companies in the Communications industry in China have P/S ratios greater than 4.1x and even P/S higher than 7x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for CIG ShangHai

How CIG ShangHai Has Been Performing

For example, consider that CIG ShangHai's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for CIG ShangHai, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like CIG ShangHai's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 14% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 51% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why CIG ShangHai's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

CIG ShangHai's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of CIG ShangHai confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for CIG ShangHai that you should be aware of.

If you're unsure about the strength of CIG ShangHai's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603083

CIG Shanghai

Engages in the research and development, production, and sale of edge computing, industrial interconnection, and high-speed optical module products in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives