- China

- /

- Communications

- /

- SHSE:600776

Exploring Three Undiscovered Gems In China's Stock Market

Reviewed by Simply Wall St

As Chinese equities experience a modest rise, buoyed by supportive measures from the central bank amidst persistent deflationary pressures, investors are increasingly turning their attention to small-cap stocks in the region. In this dynamic environment, identifying promising opportunities often involves focusing on companies with strong fundamentals and growth potential that can thrive despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zhejiang Wellsun Intelligent TechnologyLtd | NA | 29.72% | 33.99% | ★★★★★★ |

| Changsha Tongcheng HoldingsLtd | 8.27% | -12.36% | -6.10% | ★★★★★★ |

| Tianjin Lisheng PharmaceuticalLtd | 1.23% | -6.38% | 19.81% | ★★★★★★ |

| Beijing WKW Automotive PartsLtd | 6.14% | -1.34% | 69.26% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.32% | -9.98% | 7.95% | ★★★★★★ |

| Forest Packaging GroupLtd | 14.94% | -8.49% | -7.06% | ★★★★★★ |

| Tibet Development | 52.25% | -1.03% | 55.10% | ★★★★★★ |

| Hunan Investment GroupLtd | 7.19% | 29.97% | 17.84% | ★★★★★☆ |

| Shanghai Feilo AcousticsLtd | 36.01% | -17.85% | 55.43% | ★★★★☆☆ |

| Sunny Loan TopLtd | 55.39% | -11.58% | 9.47% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Eastern CommunicationsLtd (SHSE:600776)

Simply Wall St Value Rating: ★★★★★★

Overview: Eastern Communications Co., Ltd. operates in the enterprise network and information security sectors with a market capitalization of CN¥11.99 billion.

Operations: Eastern Communications Co., Ltd. generates revenue primarily from its enterprise network and information security businesses. The company has a market capitalization of CN¥11.99 billion, reflecting its position in these sectors.

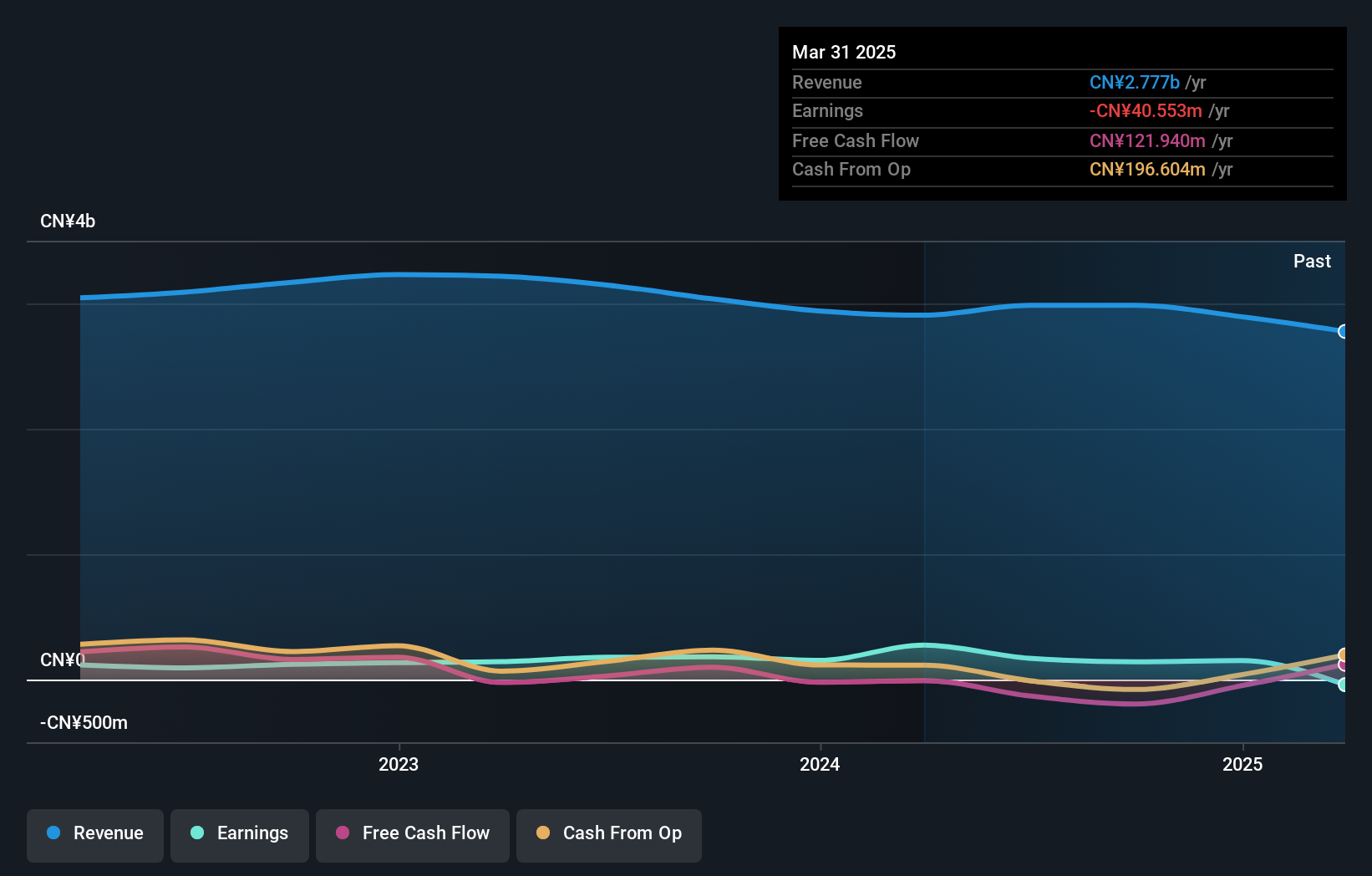

Eastern Communications, with its robust financial health, is debt-free and has maintained this status for the past five years. Despite a negative earnings growth of 4.2% over the last year, which contrasts with the communications industry average of 2.8%, it boasts high-quality earnings. Recently reported half-year results show sales at CNY 1.31 billion and a net income rise to CNY 88 million from CNY 71 million previously, reflecting resilience in challenging conditions. The company's free cash flow remains negative; however, profitability ensures that cash runway issues are minimal for now.

- Delve into the full analysis health report here for a deeper understanding of Eastern CommunicationsLtd.

Gain insights into Eastern CommunicationsLtd's past trends and performance with our Past report.

Caissa Tosun DevelopmentLtd (SZSE:000796)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caissa Tosun Development Co., Ltd. operates in the travel and tourism sector both within China and internationally, with a market capitalization of CN¥7.38 billion.

Operations: Caissa Tosun Development Ltd generates revenue primarily from its travel and tourism operations. The company focuses on both domestic and international markets, leveraging its presence in the sector to drive sales.

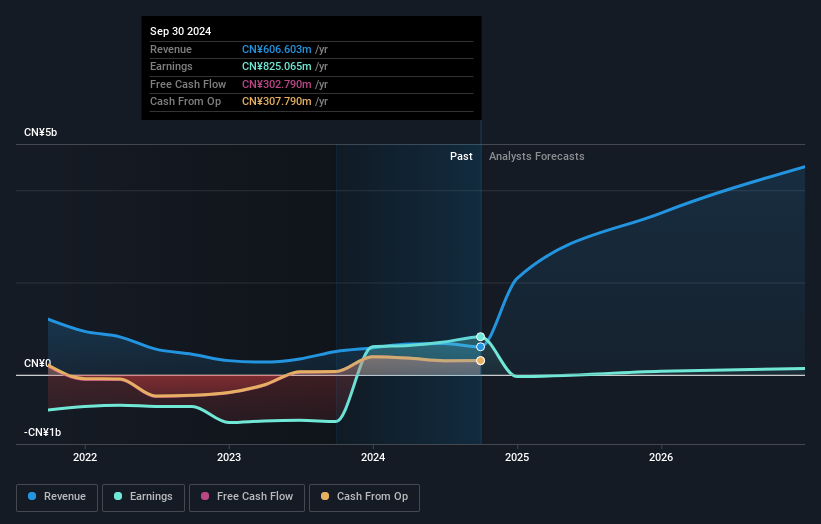

Caissa Tosun Development, a relatively small player in the market, recently reported significant improvements in its financials. The company's revenue for the half-year ended June 2024 increased to ¥320.92 million from ¥227.95 million the previous year, while sales reached ¥318.34 million up from ¥221.87 million. Despite a net loss of ¥16.87 million, this was a notable improvement compared to last year's loss of ¥117.91 million, reflecting better operational efficiency or cost management strategies likely at play here. The basic and diluted loss per share also improved to ¥0.0105 from last year's larger figure of ¥0.147.

Kuangda Technology Group (SZSE:002516)

Simply Wall St Value Rating: ★★★★★★

Overview: Kuangda Technology Group Co., Ltd. specializes in the research, development, manufacture, and sale of interior fabrics for automobiles both in China and internationally, with a market cap of approximately CN¥8.20 billion.

Operations: Kuangda Technology Group generates revenue primarily from its Automotive Products Division, which accounts for CN¥1.84 billion, and the Power Business Segment, contributing CN¥193.78 million.

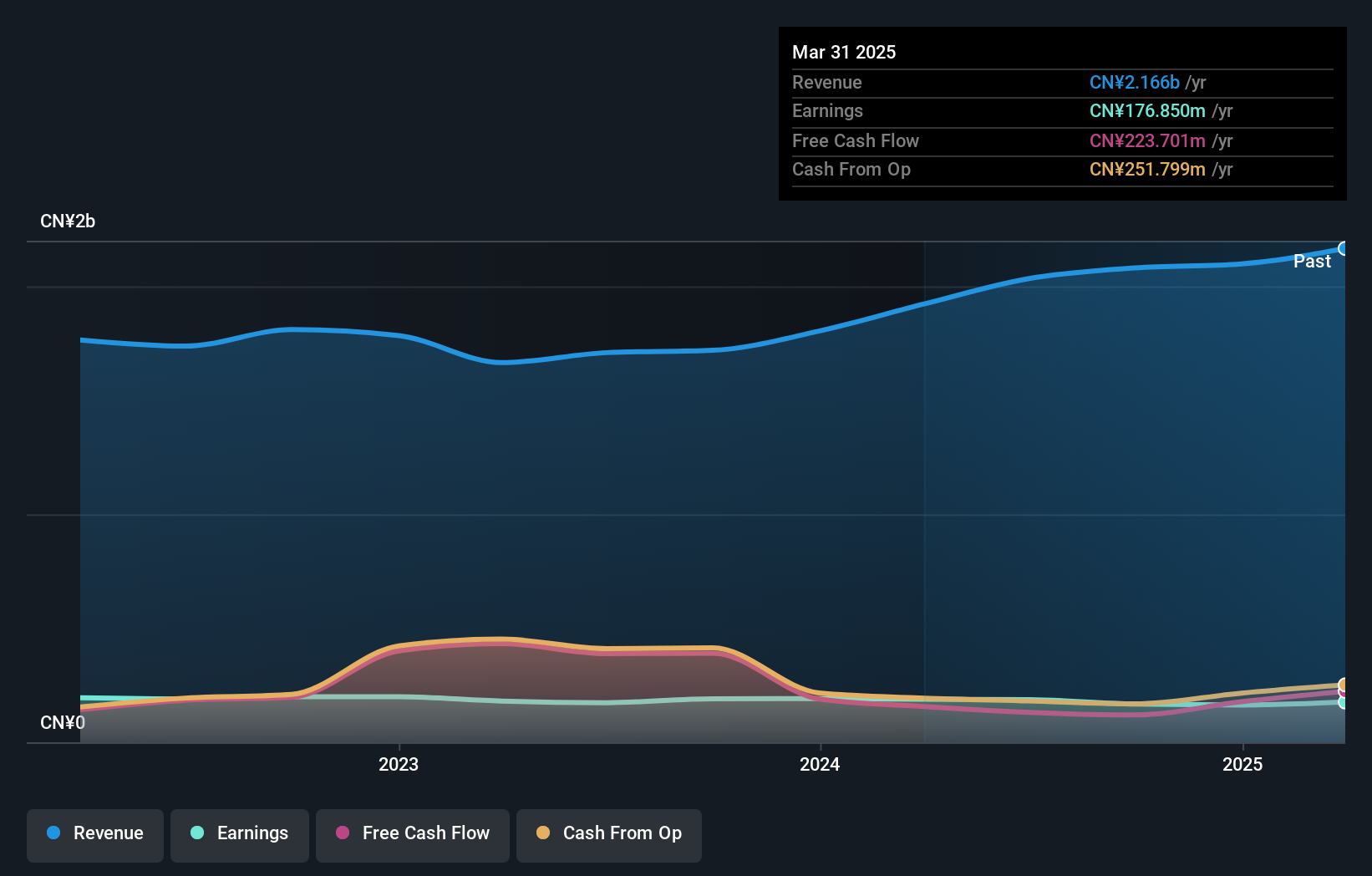

Kuangda Technology Group, a promising player in its sector, has demonstrated consistent growth with earnings increasing by 1.9% annually over the last five years. Despite a recent net income of CNY 71.74 million for the half-year ending June 2024, slightly down from CNY 76.01 million the previous year, it remains debt-free and boasts high-quality past earnings. The company reported sales of CNY 987.42 million compared to CNY 758.46 million a year ago, indicating robust revenue growth despite not outpacing industry benchmarks recently at 7.6%. Its free cash flow is positive, supporting its financial stability and potential for future expansion.

- Click here and access our complete health analysis report to understand the dynamics of Kuangda Technology Group.

Understand Kuangda Technology Group's track record by examining our Past report.

Seize The Opportunity

- Dive into all 891 of the Chinese Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastern CommunicationsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600776

Eastern CommunicationsLtd

Eastern Communications Co.,Ltd. in the enterprise network and information security businesses.

Flawless balance sheet and fair value.

Market Insights

Community Narratives