- China

- /

- Tech Hardware

- /

- SHSE:600734

Shareholders in Fujian Start GroupLtd (SHSE:600734) have lost 49%, as stock drops 9.5% this past week

The main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Fujian Start Group Co.Ltd (SHSE:600734) shareholders for doubting their decision to hold, with the stock down 49% over a half decade. More recently, the share price has dropped a further 12% in a month.

With the stock having lost 9.5% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Fujian Start GroupLtd

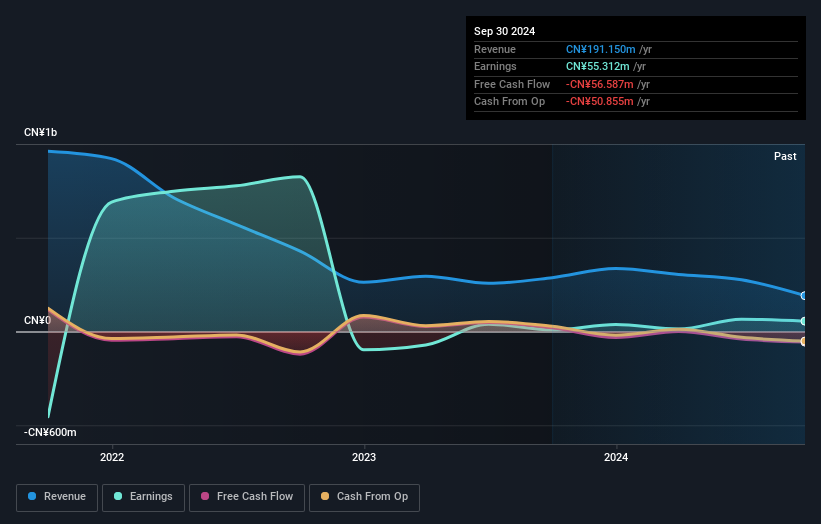

Given that Fujian Start GroupLtd only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last five years Fujian Start GroupLtd saw its revenue shrink by 48% per year. That puts it in an unattractive cohort, to put it mildly. On the face of it we'd posit the share price fall of 8% compound, over five years is well justified by the fundamental deterioration. We doubt many shareholders are delighted with this share price performance. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Fujian Start GroupLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Fujian Start GroupLtd had a tough year, with a total loss of 0.8%, against a market gain of about 10%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 8% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Fujian Start GroupLtd is showing 1 warning sign in our investment analysis , you should know about...

But note: Fujian Start GroupLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600734

Fujian Start GroupLtd

Provides anti-intrusion detection systems in China.

Adequate balance sheet with weak fundamentals.

Market Insights

Community Narratives