- China

- /

- Real Estate

- /

- SHSE:600208

Asian Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

Amid escalating trade tensions between the U.S. and China, Asian markets have been closely watching the impact of tariff developments on economic growth. Despite these challenges, there remains a keen interest in identifying investment opportunities within smaller or newer companies, often referred to as penny stocks. Although the term may seem outdated, these stocks can represent potential value when they are underpinned by strong financial health and a clear path for growth.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Rojana Industrial Park (SET:ROJNA) | THB4.78 | THB9.66B | ✅ 3 ⚠️ 3 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.12 | THB2.55B | ✅ 4 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.189 | SGD37.65M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.04 | SGD8.04B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$3.15 | HK$1.29B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.95 | HK$45.24B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.02 | HK$643.57M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.09 | HK$1.82B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥2.99 | CN¥3.46B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,148 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bosideng International Holdings (SEHK:3998)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bosideng International Holdings Limited operates in the apparel industry in the People’s Republic of China with a market capitalization of HK$45.24 billion.

Operations: The company generates revenue from several segments, including Down Apparels (CN¥20.66 billion), Ladieswear Apparels (CN¥735.22 million), Diversified Apparels (CN¥254.12 million), and Original Equipment Manufacturing (OEM) Management (CN¥2.97 billion).

Market Cap: HK$45.24B

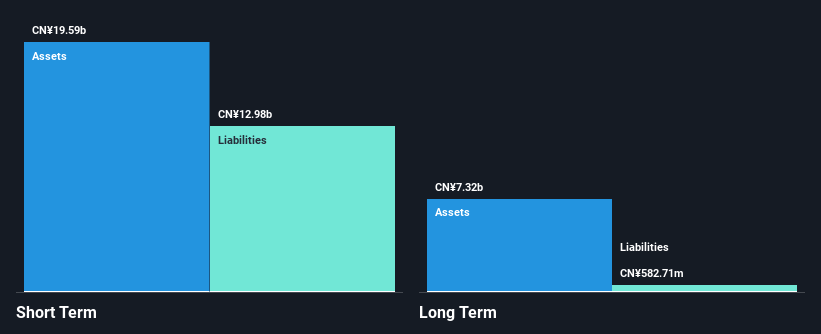

Bosideng International Holdings demonstrates strong financial health with short-term assets (CN¥19.6 billion) exceeding both its short-term (CN¥13.0 billion) and long-term liabilities (CN¥582.7 million). The company trades at a discount to its estimated fair value and has a high Return on Equity of 25.1%. It maintains robust earnings growth, significantly outpacing the luxury industry average, with profits growing 41.4% over the past year. Bosideng's debt is well-covered by operating cash flow, and it holds more cash than total debt, though its dividend track record remains unstable. Management and board members are seasoned with extensive experience.

- Click to explore a detailed breakdown of our findings in Bosideng International Holdings' financial health report.

- Review our growth performance report to gain insights into Bosideng International Holdings' future.

Quzhou Xin'an Development (SHSE:600208)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quzhou Xin'an Development Co., Ltd. operates in real estate development, technology manufacturing, and financial services in China with a market cap of CN¥23.31 billion.

Operations: The company generates revenue of CN¥27.61 billion from its operations in China.

Market Cap: CN¥23.31B

Quzhou Xin'an Development Co., Ltd. presents a mixed financial picture with its CN¥44.1 billion in short-term assets surpassing both short-term and long-term liabilities, indicating solid liquidity. Despite a reduction in debt to equity from 202.1% to 80.7% over five years, the net debt to equity ratio remains high at 65.3%, and operating cash flow coverage is insufficient for debt levels. The company trades at a favorable price-to-earnings ratio of 14x compared to the market average, though recent earnings growth has been negative, impacting profit margins which have fallen from last year’s levels significantly.

- Dive into the specifics of Quzhou Xin'an Development here with our thorough balance sheet health report.

- Understand Quzhou Xin'an Development's earnings outlook by examining our growth report.

Fujian Start GroupLtd (SHSE:600734)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fujian Start Group Co.Ltd specializes in providing anti-intrusion detection systems in China and has a market cap of CN¥9.17 billion.

Operations: Fujian Start Group Co.Ltd has not reported any specific revenue segments.

Market Cap: CN¥9.17B

Fujian Start Group Co. Ltd. has demonstrated impressive earnings growth, with a 532.7% increase over the past year, significantly outperforming the tech industry average. Despite this growth, recent financial results reveal challenges; sales decreased from CN¥335.48 million to CN¥308.69 million in 2024, and net income fell sharply from CN¥37.2 million to CN¥5.65 million over the same period, highlighting volatility and profitability concerns in its operations. The company maintains a strong liquidity position with short-term assets exceeding both short- and long-term liabilities but faces negative operating cash flow impacting debt coverage capabilities.

- Navigate through the intricacies of Fujian Start GroupLtd with our comprehensive balance sheet health report here.

- Learn about Fujian Start GroupLtd's historical performance here.

Where To Now?

- Discover the full array of 1,148 Asian Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? The latest GPUs need a type of rare earth metal called Neodymium and there are only 22 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quzhou Xin'an Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600208

Quzhou Xin'an Development

Engages in the real estate development, technology manufacturing, and financial service businesses in China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives