- China

- /

- Electronic Equipment and Components

- /

- SHSE:600654

China Security (SHSE:600654) Has A Rock Solid Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies China Security Co., Ltd. (SHSE:600654) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for China Security

What Is China Security's Net Debt?

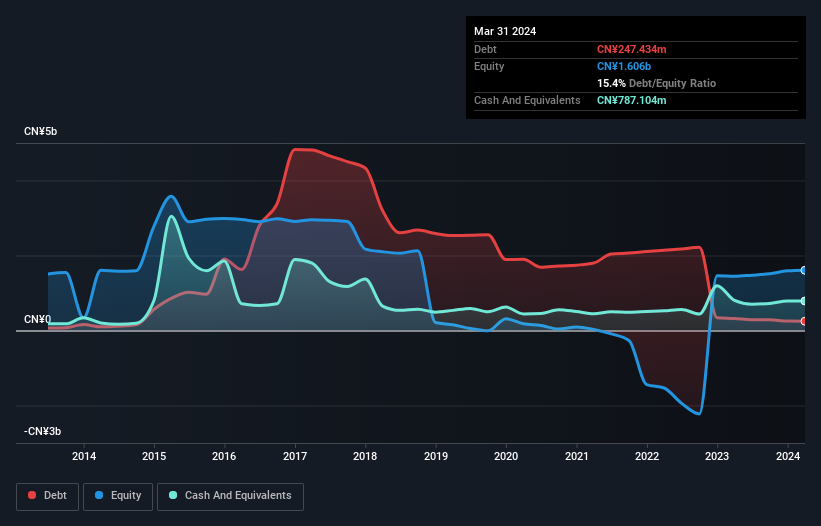

You can click the graphic below for the historical numbers, but it shows that China Security had CN¥247.4m of debt in March 2024, down from CN¥322.1m, one year before. But it also has CN¥787.1m in cash to offset that, meaning it has CN¥539.7m net cash.

How Healthy Is China Security's Balance Sheet?

The latest balance sheet data shows that China Security had liabilities of CN¥2.17b due within a year, and liabilities of CN¥69.0m falling due after that. On the other hand, it had cash of CN¥787.1m and CN¥1.47b worth of receivables due within a year. So these liquid assets roughly match the total liabilities.

Having regard to China Security's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the CN¥6.16b company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, China Security boasts net cash, so it's fair to say it does not have a heavy debt load!

Although China Security made a loss at the EBIT level, last year, it was also good to see that it generated CN¥78m in EBIT over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since China Security will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While China Security has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last year, China Security actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that China Security has net cash of CN¥539.7m, as well as more liquid assets than liabilities. The cherry on top was that in converted 431% of that EBIT to free cash flow, bringing in CN¥338m. So is China Security's debt a risk? It doesn't seem so to us. Over time, share prices tend to follow earnings per share, so if you're interested in China Security, you may well want to click here to check an interactive graph of its earnings per share history.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600654

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026