- China

- /

- Electronic Equipment and Components

- /

- SHSE:600563

Xiamen Faratronic (SHSE:600563) Looks To Prolong Its Impressive Returns

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Ergo, when we looked at the ROCE trends at Xiamen Faratronic (SHSE:600563), we liked what we saw.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Xiamen Faratronic is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.21 = CN¥1.1b ÷ (CN¥6.6b - CN¥1.6b) (Based on the trailing twelve months to June 2024).

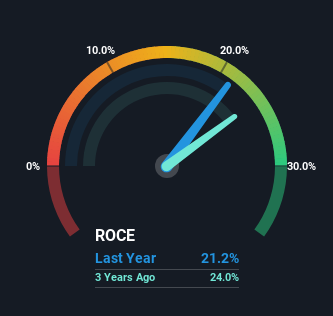

Thus, Xiamen Faratronic has an ROCE of 21%. That's a fantastic return and not only that, it outpaces the average of 5.4% earned by companies in a similar industry.

Check out our latest analysis for Xiamen Faratronic

In the above chart we have measured Xiamen Faratronic's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Xiamen Faratronic .

So How Is Xiamen Faratronic's ROCE Trending?

It's hard not to be impressed by Xiamen Faratronic's returns on capital. Over the past five years, ROCE has remained relatively flat at around 21% and the business has deployed 104% more capital into its operations. With returns that high, it's great that the business can continually reinvest its money at such appealing rates of return. If Xiamen Faratronic can keep this up, we'd be very optimistic about its future.

Another point to note, we noticed the company has increased current liabilities over the last five years. This is intriguing because if current liabilities hadn't increased to 24% of total assets, this reported ROCE would probably be less than21% because total capital employed would be higher.The 21% ROCE could be even lower if current liabilities weren't 24% of total assets, because the the formula would show a larger base of total capital employed. With that in mind, just be wary if this ratio increases in the future, because if it gets particularly high, this brings with it some new elements of risk.

The Bottom Line

In short, we'd argue Xiamen Faratronic has the makings of a multi-bagger since its been able to compound its capital at very profitable rates of return. And the stock has done incredibly well with a 153% return over the last five years, so long term investors are no doubt ecstatic with that result. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

While Xiamen Faratronic looks impressive, no company is worth an infinite price. The intrinsic value infographic for 600563 helps visualize whether it is currently trading for a fair price.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600563

Xiamen Faratronic

Manufactures and sells film capacitors and metallized coating materials in China and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success