- China

- /

- Electronic Equipment and Components

- /

- SHSE:600552

Investors Still Aren't Entirely Convinced By Triumph Science & Technology Co.,Ltd's (SHSE:600552) Revenues Despite 29% Price Jump

Despite an already strong run, Triumph Science & Technology Co.,Ltd (SHSE:600552) shares have been powering on, with a gain of 29% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 9.0% isn't as attractive.

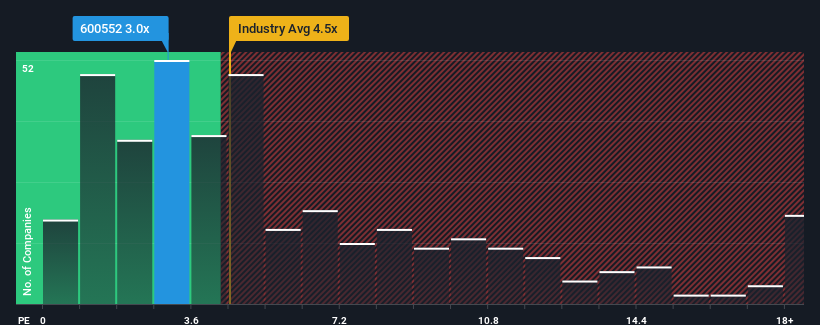

Although its price has surged higher, Triumph Science & TechnologyLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3x, considering almost half of all companies in the Electronic industry in China have P/S ratios greater than 4.5x and even P/S higher than 9x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Triumph Science & TechnologyLtd

How Triumph Science & TechnologyLtd Has Been Performing

Triumph Science & TechnologyLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Triumph Science & TechnologyLtd.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Triumph Science & TechnologyLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.2%. The last three years don't look nice either as the company has shrunk revenue by 29% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 31% over the next year. With the industry only predicted to deliver 27%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Triumph Science & TechnologyLtd's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Despite Triumph Science & TechnologyLtd's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Triumph Science & TechnologyLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you settle on your opinion, we've discovered 3 warning signs for Triumph Science & TechnologyLtd (1 is concerning!) that you should be aware of.

If you're unsure about the strength of Triumph Science & TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Triumph Science & TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600552

Triumph Science & TechnologyLtd

Provides display and applied materials in China and internationally.

Moderate growth potential with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.