- China

- /

- Electronic Equipment and Components

- /

- SHSE:600353

Chengdu Xuguang Electronics (SHSE:600353) sheds 6.4% this week, as yearly returns fall more in line with earnings growth

While Chengdu Xuguang Electronics Co., Ltd. (SHSE:600353) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 16% in the last quarter. But over three years, the returns would have left most investors smiling In the last three years the share price is up, 80%: better than the market.

In light of the stock dropping 6.4% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

View our latest analysis for Chengdu Xuguang Electronics

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

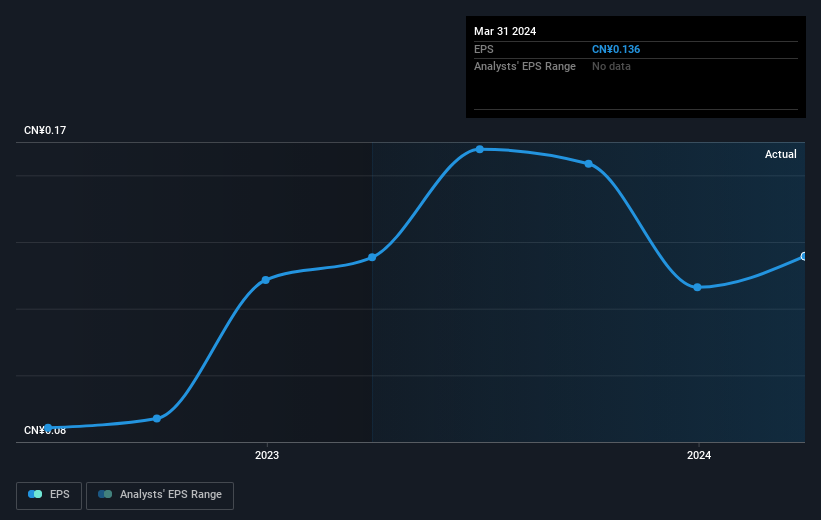

During three years of share price growth, Chengdu Xuguang Electronics achieved compound earnings per share growth of 14% per year. In comparison, the 22% per year gain in the share price outpaces the EPS growth. So it's fair to assume the market has a higher opinion of the business than it did three years ago. It is quite common to see investors become enamoured with a business, after a few years of solid progress. This optimism is also reflected in the fairly generous P/E ratio of 53.43.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Chengdu Xuguang Electronics' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 10% in the twelve months, Chengdu Xuguang Electronics shareholders did even worse, losing 19% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before deciding if you like the current share price, check how Chengdu Xuguang Electronics scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600353

Chengdu Xuguang Electronics

Manufactures and sells metal-ceramic electric vacuum devices worldwide.

Adequate balance sheet second-rate dividend payer.