As global markets experience mixed performance with major indexes like the S&P 500 and Nasdaq Composite reaching record highs, small-cap stocks represented by the Russell 2000 have seen a decline after recent outperformance. This divergence highlights the potential for uncovering hidden opportunities within smaller companies, especially as economic indicators such as job growth show resilience and investors anticipate potential interest rate cuts from the Federal Reserve. In this environment, a good stock might be characterized by its ability to capitalize on niche market positions or innovative strategies that align with current economic trends and investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Anhui Tongfeng Electronics (SHSE:600237)

Simply Wall St Value Rating: ★★★★★★

Overview: Anhui Tongfeng Electronics Company Limited focuses on the R&D, production, and sales of thin films, film capacitors, and related electronic components in China with a market cap of CN¥4.69 billion.

Operations: Anhui Tongfeng Electronics generates revenue primarily from the sales of thin films, film capacitors, and electronic components within China. The company has a market capitalization of CN¥4.69 billion.

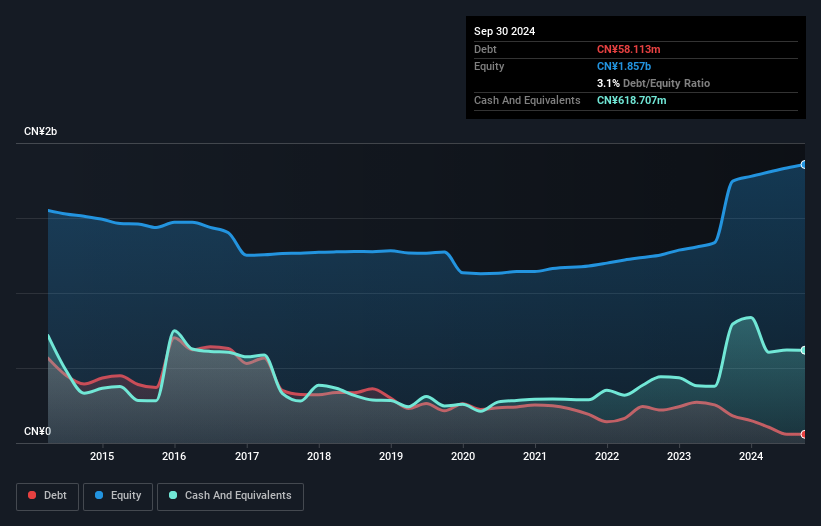

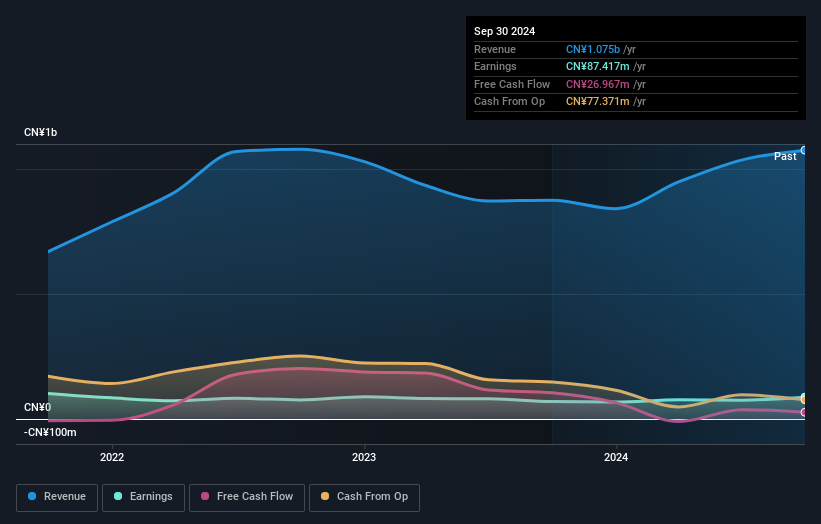

Anhui Tongfeng Electronics, a promising player in the electronics sector, has shown robust earnings growth of 18.1% over the past year, outpacing the industry's 1.8%. The company's debt-to-equity ratio has impressively decreased from 16.9% to 3.1% in five years, indicating prudent financial management. Despite not being free cash flow positive recently, it boasts high-quality earnings and more cash than its total debt. Recent reports highlight sales reaching ¥962 million for nine months ending September 2024 compared to ¥799 million last year, with net income at ¥62 million up from ¥56 million previously—signifying solid operational performance amidst industry challenges.

Hubei W-olf Photoelectric Technology (SZSE:002962)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hubei W-olf Photoelectric Technology Co., Ltd. operates in the optics and optoelectronics industry, with a market capitalization of CN¥5.13 billion.

Operations: The company generates revenue of CN¥1.08 billion from its optics and optoelectronics industry segment.

Hubei W-olf Photoelectric Technology has shown promising growth, with earnings up 25.2% over the past year, outpacing the industry average. Despite a challenging five-year period where earnings fell by an average of 18.7% annually, recent results indicate a turnaround with sales reaching CNY 868.43 million for the first nine months of 2024 compared to CNY 634.04 million last year and net income rising to CNY 64.26 million from CNY 44.63 million previously. The company completed a share buyback of 450,000 shares worth CNY 5.59 million in late September, reflecting confidence in its financial position and high-quality earnings supported by more cash than debt on hand.

Shandong Sanyuan BiotechnologyLtd (SZSE:301206)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Sanyuan Biotechnology Co., Ltd. focuses on the research, development, production, and sale of erythritol and compound sugar products in China with a market capitalization of CN¥5.74 billion.

Operations: The company's primary revenue stream is from its food additives business, generating CN¥663.23 million.

Shandong Sanyuan Biotech, a nimble player in the biotechnology sector, has shown impressive financial strides with its earnings surging by 81.2% over the past year, outpacing the broader food industry which saw a -5.8% change. The company reported sales of CNY 514.92 million for nine months ending September 2024 compared to CNY 351.19 million previously, while net income jumped to CNY 81.01 million from CNY 41.67 million a year earlier. Despite not being free cash flow positive recently, it remains debt-free and boasts high-quality earnings, indicating robust operational health and potential for future growth in its niche market segment.

Summing It All Up

- Gain an insight into the universe of 4644 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301206

Shandong Sanyuan BiotechnologyLtd

Engages in the research and development, production, and sale of erythritol and compound sugar products in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives