- China

- /

- Electronic Equipment and Components

- /

- SHSE:600207

Henan Ancai Hi-TechLtd (SHSE:600207 shareholders incur further losses as stock declines 11% this week, taking three-year losses to 38%

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Henan Ancai Hi-Tech Co.,Ltd (SHSE:600207) shareholders have had that experience, with the share price dropping 38% in three years, versus a market decline of about 19%. Unfortunately the share price momentum is still quite negative, with prices down 21% in thirty days.

If the past week is anything to go by, investor sentiment for Henan Ancai Hi-TechLtd isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Henan Ancai Hi-TechLtd

Given that Henan Ancai Hi-TechLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Henan Ancai Hi-TechLtd saw its revenue grow by 18% per year, compound. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 11% per year, for three years. This implies the market had higher expectations of Henan Ancai Hi-TechLtd. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

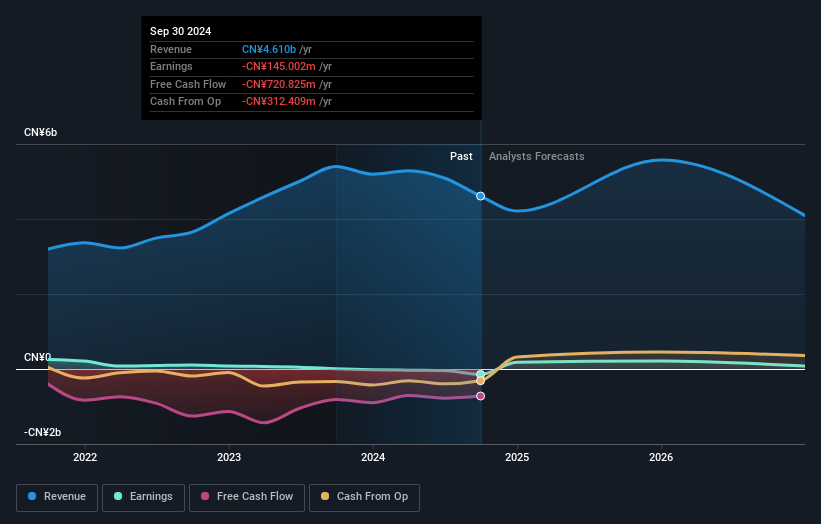

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Henan Ancai Hi-TechLtd had a tough year, with a total loss of 11%, against a market gain of about 6.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Henan Ancai Hi-TechLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600207

Henan Ancai Hi-TechLtd

Engages in the research, development, production, and sale of photovoltaic module packaging glass products in China and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026