- China

- /

- Tech Hardware

- /

- SHSE:600100

Tsinghua Tongfang Co., Ltd. (SHSE:600100) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Despite an already strong run, Tsinghua Tongfang Co., Ltd. (SHSE:600100) shares have been powering on, with a gain of 28% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

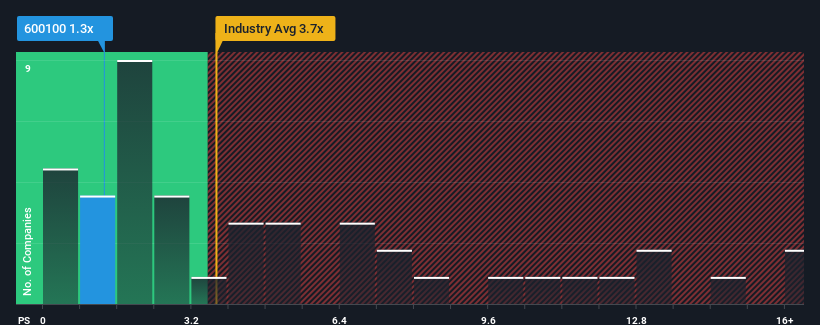

Even after such a large jump in price, Tsinghua Tongfang may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.3x, considering almost half of all companies in the Tech industry in China have P/S ratios greater than 3.7x and even P/S higher than 9x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Tsinghua Tongfang

What Does Tsinghua Tongfang's P/S Mean For Shareholders?

Tsinghua Tongfang hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Tsinghua Tongfang's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Tsinghua Tongfang?

In order to justify its P/S ratio, Tsinghua Tongfang would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 32% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 5.0% as estimated by the one analyst watching the company. That's not great when the rest of the industry is expected to grow by 17%.

In light of this, it's understandable that Tsinghua Tongfang's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Tsinghua Tongfang's P/S Mean For Investors?

Even after such a strong price move, Tsinghua Tongfang's P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Tsinghua Tongfang maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Tsinghua Tongfang with six simple checks.

If these risks are making you reconsider your opinion on Tsinghua Tongfang, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tsinghua Tongfang might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600100

Tsinghua Tongfang

Engages in nuclear technology application, smart energy, and digital information businesses.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success