As global markets react to the Federal Reserve's first rate cut in over four years, small-cap indexes like the Russell 2000 have shown notable performance, albeit still below their previous peaks. With this backdrop of renewed investor optimism and economic resilience, identifying high-growth tech stocks becomes crucial for capitalizing on market momentum. A good stock in this environment typically exhibits strong revenue growth potential, innovative product offerings, and a solid market position that can thrive amid changing economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 1302 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog active pharmaceutical ingredients (APIs) and injections in China, with a market cap of CN¥25.29 billion.

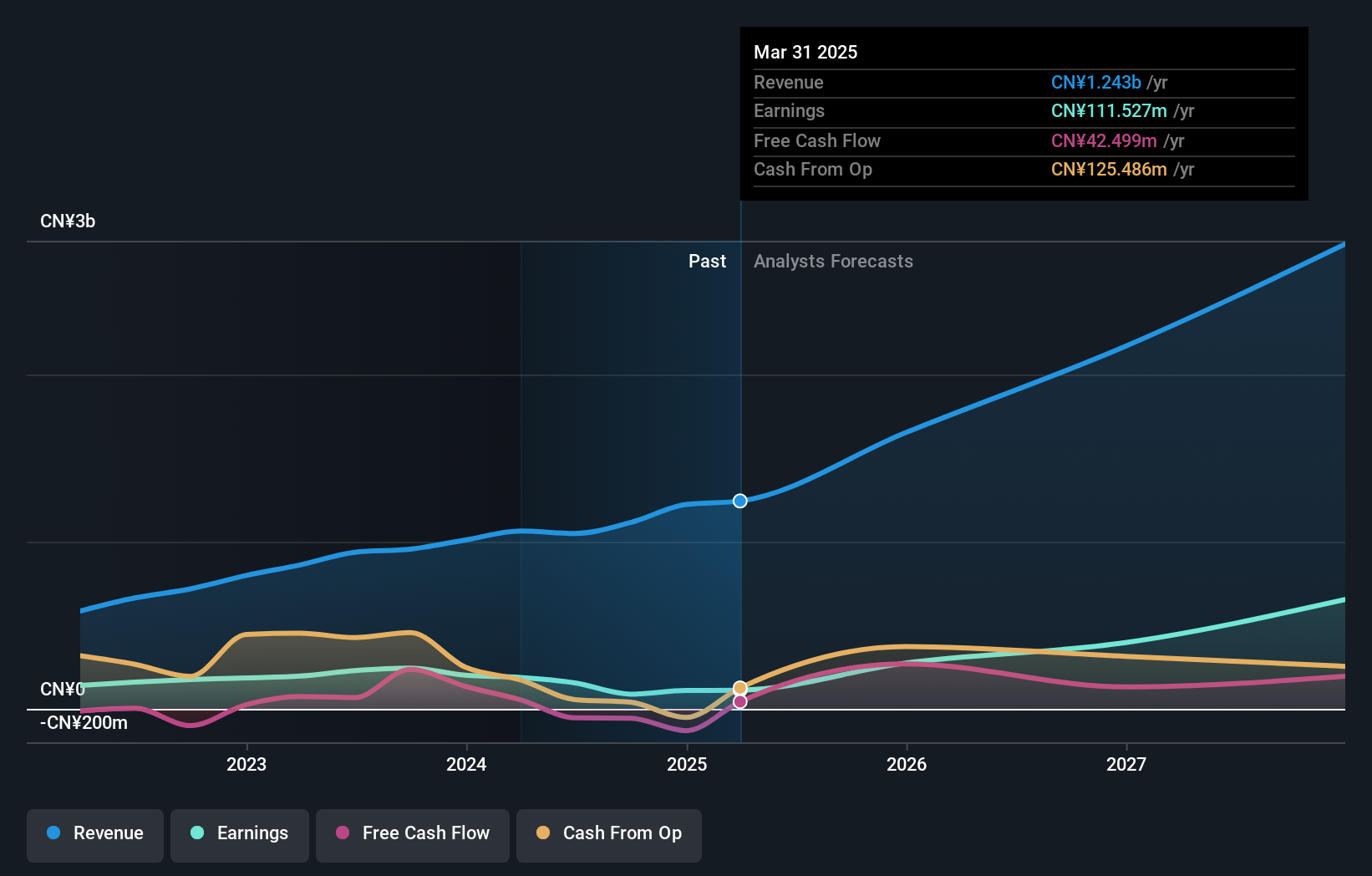

Operations: Gan & Lee Pharmaceuticals primarily generates revenue from the development, production, and sales of insulin and related products, amounting to CN¥2.69 billion. The company's operations are concentrated in China.

Gan & Lee Pharmaceuticals has demonstrated robust growth, with revenue and earnings forecast to outpace the Chinese market at 26.3% and 43.3% per year respectively. This performance is particularly notable given the company's recent transition to profitability, aligning it with high-growth trajectories in biotech sectors globally. The firm's commitment to innovation is underscored by a significant R&D investment, which has been crucial in driving these results. Moreover, Gan & Lee's strategic share repurchase program valued at CNY 300 million aims to bolster shareholder value through equity incentives, indicating a proactive approach in capital management and employee engagement. These factors collectively highlight Gan & Lee’s potential as a dynamic player within the biotech industry despite challenges like one-off financial impacts that have skewed recent earnings figures.

iFLYTEKLTD (SZSE:002230)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iFLYTEK CO., LTD. engages in artificial intelligence (AI) technology services in China and has a market cap of CN¥86.15 billion.

Operations: iFLYTEK CO., LTD. primarily generates revenue from its Software and Information Technology Services Industry segment, contributing CN¥20.77 billion, with additional income from the Education and Teaching sector at CN¥303.66 million.

iFLYTEK's recent developments underscore its strategic focus on AI and software innovation, despite facing a challenging financial period with a net loss reported in the first half of 2024. The company's commitment to R&D is evident as it continues to lead in AI advancements, demonstrated by the launch of Spark V4.0, which has set new benchmarks internationally. This focus on cutting-edge technology and the application of AI solutions across various business processes positions iFLYTEK distinctively within the tech landscape. However, with revenue growth at 14.7% per year, slightly above China's market average but below high-growth thresholds, and earnings expected to surge by 60% annually, careful navigation will be crucial for sustaining its competitive edge amidst financial recuperation efforts.

- Get an in-depth perspective on iFLYTEKLTD's performance by reading our health report here.

Gain insights into iFLYTEKLTD's past trends and performance with our Past report.

Empyrean Technology (SZSE:301269)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Empyrean Technology Co., Ltd. develops, sells, and services electronic design automation (EDA) software with a market cap of CN¥42.02 billion.

Operations: Empyrean Technology Co., Ltd. focuses on the development, sale, and servicing of electronic design automation (EDA) software. The company operates within a market cap of CN¥42.02 billion.

Empyrean Technology's recent performance and strategic initiatives offer a mixed yet intriguing picture. Despite a dip in net income to CNY 37.87 million from CNY 83.81 million year-over-year, the firm demonstrated resilience with a revenue increase to CNY 443.79 million, up from CNY 404.83 million, reflecting a growth rate of 30.8%. This positions Empyrean notably above the Chinese market average growth of 13.1%. At the Design Automation Conference, their presentations likely bolstered industry connections, potentially enhancing future prospects despite current earnings challenges marked by significant one-off costs of CN¥186.4M last year and lower profit margins at 14.8%, down from the previous year's 24.4%. With earnings expected to surge by an impressive annual rate of 47.3%, Empyrean is navigating its path forward amidst these fluctuations.

- Delve into the full analysis health report here for a deeper understanding of Empyrean Technology.

Understand Empyrean Technology's track record by examining our Past report.

Next Steps

- Reveal the 1302 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iFLYTEKLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002230

iFLYTEKLTD

Engages artificial intelligence (AI) technologies services in China.

Undervalued with reasonable growth potential.